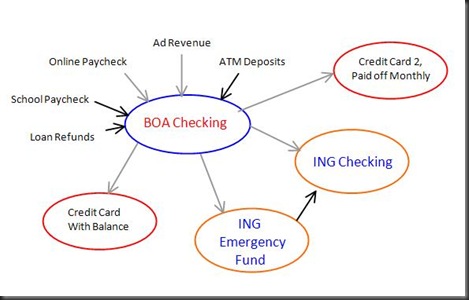

With the addition of an ING Checking account and a free and clear credit card to my banking arsenal, it became clear to me that I needed a different plan of attack for how I’m doing my banking. To show you what I mean, here’s a diagram of how I was doing things:

The black arrows represent near-immediate deposits or transfers, which take only a day or so. The gray arrows are slower deposits or transfers, which typically take three days or more.

So, if you look at the diagram that I crudely constructed, you’ll see that all of my income and deposits came into my Bank of America checking account, and then largely sat there, until either being moved to one of ING accounts, or used to pay one of my two credit cards.

Note: nearly all of my purchases are made using Credit Card 2, to earn rewards points and offset my purchases by one month before I pay the bill in full.

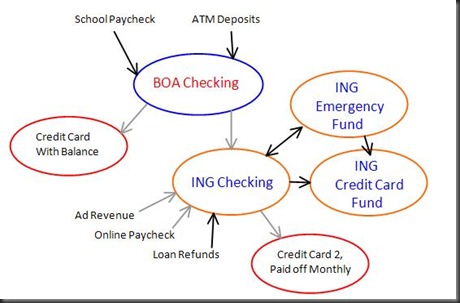

So what’s the problem with this? Convenience-wise, not a whole lot, except that the Bank of America checking account doesn’t earn me any interest, and that’s where most of my money was sitting most of the time. So I decided to entirely rework things, and came up with this new setup:

Ok, so, the paycheck from my on-campus job still direct deposits into my BoA account, and it’s still the convenient account for depositing checks at the ATM. But I’m quickly moving that money from BoA to my ING Checking account, so that it can earn interest, leaving only enough in my BoA account to pay the minimum payment on the credit card with the balance.

“Only the minimum payment?!?” you cry out, in shock and alarm. But, you will see that I’ve also got a new ING account in this setup. ING allows you to set up multiple savings accounts with minimal work and as quickly as humanly possible – I timed how long it took me to setup my new Credit Card Fund savings account, and it came out to 42 seconds!

Instead of making payments to the card itself, I’m now putting aside $140 of my monthly $160 payment (the other $20 is the minimum payment I make directly to the card) in the new savings account to earn interest. Then, the month before my 0% APR period ends, I will take all of the money in the account and pay off the credit card in full.

NOTE: This “paying your card off in your savings account” only works if you meet two conditions:

A) Your credit card interest rate has to be lower than your savings account interest rate. My savings account earns nearly 4%, and my credit card is at 0% for now, so it works. If your credit card interest rate is MORE than the card, then you should just pay off the card directly.

B) You treat payments into the savings account just like any other bill. You make the payments regularly, on time, and in the full amount. More importantly, do not take the money out of the account for any other purpose! Although it can technically serve as a second emergency fund, taking money out of the account is just the same as putting purchases on your credit card – it will completely counteract your credit card payoff efforts.

So, what are the advantages to my new setup, over the old one?

- Interest, interest, interest. I’ve got much higher balance in my ING checking this way, so that’s earning much more interest. And I’m earning interest on the credit card payoff account, as well. Altogether, I’ve calculated this setup will earn me an extra $60 in interest this year. Which may not seem like a lot to some of you, but to me? A poor college student? That’s some serious gains just for rearranging my accounts!

- Faster transfers. If it looks like there are more black lines in the second diagram, that’s because there are. Using mainly only ING accounts means instant transfers between three of my accounts – not even 1 day transfers, but instant!

- Shows my undying adoration for ING. Sure, they don’t have the best interest rates around, but they’re still competitive, and I love them to pieces. Plus, I made as much money from their referral program last year as I did working my on-campus job for the fall! Out of the four high-yield accounts I have (the others being E*TRADE, Emigrant, and Citibank), I like ING’s interface and usability the best.

All in all, it might seem like I’m a little crazy to obsess over such minute details, but I figure it probably only took me a half an hour of work, and netted me $60, so that’s an hourly rate of $120! Not bad at all!

Anyone else have any little “bank life hacks” like this?

We seem to have similar banking habits. Or we had similar banking habits. I find it easiest to put everything into one account and devide it regularly, but that’s what has been and is working for me.

Also, knitting damn it! I demand knitting!

You say $60 in 30 minutes but you’re not including the time it takes to execute your plan. I’ve been leveraging 0% APR credit cards to make money for some time now, and I must say that the process of transferring the initial money to my checking account, moving money back and forth between checking and savings, making sure that all of my credit cards (6 or 7 of them) get paid each month and that they get paid off before the 0% APR expires ends up taking up a decent amount of time.

@lc –

That would certainly be true, if I had more credit cards. As it stands, nothing has really changed in the execution of my banking, just in the setup. In fact, I’m saving time, because I was moving money from my BoA to my ING checking all the time, to take advantage of the higher rate. Now most of my income goes directly there.

Also, I’m paying the same number of “bills,” just as frequently – I often made multiple payments to my credit card per month, now I just pay most of them into the savings account instead.

GE INTEREST PLUS – great interest rates. Check it out.

Your strategy will help instill the discipline needed to build valuable assets in the long term. Your 0% credit card interest must be on a new card? That sounds real good.

OMG i cannot stop laughing at how awesomely cool those charts are! hahah…. I don’t know what it is about them, but they make me want to read (which is tough w/ A.D.D. & the web as you know).

Congrats on saving the $60 though, and here’s to saving more in the future!

Q. Can a Credit Card company pull more money than the purchase for a period of time?

Ex. I had 80.00 charged to my account for gasoline and when questioned the Amx guy said they always did that.

I can’t find anything to back this up other than my statement. If true could the companies be making money by holding my money for a period of time. Thanks for any comments.

Michael

You can get a nice bump on interest to a little over 2% at Smartypig. Their system is a little weird (you can’t just deposit money and leave it there, you have to have ongoing deposits of some amount, but it’s easy to adjust them up and down)

Moving some of that money to Smartypig might give you a bump to $80 or $100 per year in interest gains from the 60 you are getting.