Those of you who have been following the site for a long time will remember that I used to be a member of (and cheerleader for) the peer-to-peer (p2p) lending service Prosper. A little while ago, Prosper voluntarily halted its operation while it seeks to become registered with the SEC. I never got around to lending or borrowing with Prosper before this happened.

Lending Club, a similar company, is registered with the SEC, and things are chugging along just fine. But I didn’t pay too much attention to Lending Club, because I didn’t need a loan and had no money to become a lender myself.

Well, today, I decided to try it out anyway. And I was able to do that because someone sent me a referral link to Lending Club, which gave me a $50 bonus to start out with. Now, perhaps the smart thing to do in my situation would have been to take the money and run, but I decided to lend it out. I like the idea of having $50 in “fun money,” to see if I can grow it.

This is the beginning of the Lending Club Experiment. If you’re curious about LC but don’t want to dip your toes in yet, you can just watch me do it! Or, if you’d like to try it yourself, contact me and I’ll send you a referral link, so that you can get your own $50 bonus. Or become a borrower – it might be the way to go, if you can get a good interest rate on the site.

Signing Up and Getting Started

After following the referral link to LC, things went really smoothly. I just made a username and password, and gave them my email address. After verifying my email address, I was back at the site, where I could choose between becoming a borrower or a lender.

After selecting “lender,” I had to give some identifying information: name, address, phone number, Social Security number, and date of birth. I then had the option to link up my LC account to a bank account, so that I could transfer in money to lend. I decided to skip this step, because you can also fund your account via PayPal, which I like. I’m not sure if you lose some money in PayPal fees doing that, though. But since I’m only lending out my bonus money (for now), I skipped the bank information.

The last step to becoming a borrower is to choose your “affiliations,” such as your hometown, where you went to college, where you work, and any organizations you belong to. This is so that you can find people who share something in common with you, when you’re looking for people to lend to. For example, wouldn’t you rather lend to someone who went to your college? Or is involved with the same charity as you? I put in my college, and continued on.

Now, I got to the point where I could browse “notes,” which are the loans you can lend to. Each note is $25, so I could invest in two notes. I decided to pick two different loans to invest in: one person doing a kitchen remodel, and one guy paying for his daughter’s college tuition.

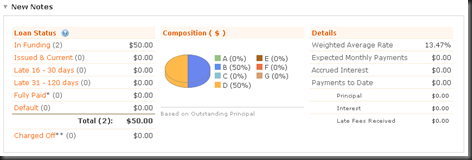

My weighted interest rate for the two loans is 13.47%, and both have three-year repayment terms. I’m sure that somewhere in my finance classes I learned how to calculate what the payments will be: $1.70/month according to my financial calculator, but I could be doing that wrong.

My little Lending Club portfolio

Is it Risky?

Well, yes, a little. One of my borrowers could decide to cut and run with the money, and just stop making payments. Or be unable to make the payments, for whatever reason. That’s why I’m using the referral bonus for now, and not my own money. When I have some disposable income, I may contribute some of my own money to the account. Because risk is relative. And I could invest in corporate bonds… but those have default risk, as well!

Or maybe I’ll just keep reinvesting the money I get in payments, indefinitely. That could be fun, too! And that’s really my goal here: have a little fun with some money that I can stand to lose, learn a bit about p2p lending, maybe earn a nice return, and help some people get the loans they need.

????

I was looking into one of these sites, until I saw this from their description:

Specifically, lender members who are residents in states other than California must either:

* have an annual gross income of at least $70,000 and a net worth (exclusive of home, home furnishings and automobile) of at least $70,000; or

* have a net worth (determined with the same exclusions) of at least $250,000.

taken from:

https://www.lendingclub.com/info/how-to-invest-money.action

any comments?

Good find, David. I wonder if those numbers are personal income/net worth, or household income/net worth, because that makes a big difference!

This is great! I cannot wait to sign up!

Thank you!

Nate

Hm, I could take the fifty and run you say? Sounds like a good idea to me. I wonder if they have some sort of small-print rule against doing that or something.

@Jamie – in an interview at My Money Blog, Lending Club Director of Product Strategy, Rob Garcia, said people are free to take the bonus and run, “although we’d love you to try Lending Club.”

Thanks for sharing this! I’m intrigued to try it myself. What a fun experiment. Are you paying the loan of the $50? or is that simply gratis – and please loan it?

@Kaye – the money just exists in your account if you open it up using a referral bonus. Then you can lend it out without having to deposit anything yourself – like I said, I didn’t even bother hooking up a bank account (yet). It’s kinda fun that way – you get to just try it out without feeling like you’re taking too big of a risk!

I’m with David. I was going to take advantage of this $50 referral that’s floating around, but you’re required to have the income and net worth David stated. I was also wondering if it’s household or individual based. As far as I can discover, these limits were required by the SEC.

David: I think those rules are there for the same reasons why there are rules for people investing in hedge funds, they don’t want someone duped into a get rich quick scheme.

As for LC, i wanted to try it out but you can’t do it in Maryland! Boo…

This program is generating quite a net buzz. I am planning an article about my experience with it as well. I wish you the best of luck.

Hunh, interesting offer. I’ve been considering P2P lending for a while now, but with my recent job loss and other issues, I haven’t been able to try it out. I’ll have to drop you a line and get an extra $50 to try it out (although, I’ll likely put up some money of my own, as well).

Great Blog 🙂

I hate places like these. They have a set credit limit policy that makes it impossible for people who actually NEED the loan to post. I realize it’s to protect people from deadbeat borrowers, but if the point of getting a loan is to help you get out of debt, of course your credit score is going to be less than perfect. The only reason to go to a personal lender site is if the bank won’t lend you the money, but apparently neither will the personal lenders.

@Maveth Actually no, not quite. Lending Club is a money marketplace for people who are actually responsible with their credit. If you’re not responsible then you can’t play in it – simple as that. Lending money isn’t a charitable duty by any means and shouldn’t be looked on in that way.

I only make this rant because my credit score is 10 points under their minimum, even though I never make a late payment and I need the loan to fix my car to earn money to pay my credit cards so that I won’t miss any payments. Double edged irony stabs me in the ass every time.

Interesting thing I’ve learned: apparently, Lending Club has a policy of not allowing Pennsylvania residents (as well as residents of more than half the States in the US) to buy notes directly. But, it seems there’s no restrictions on buying resold notes (weird, hunh?) So, I’m currently trying to figure out the note trading system, which looks rather more complicated than the direct purchase system. So, yeah.

@Roger – I think that’s because it hasn’t yet been approved to operate in those states by the SEC. You may want to continue checking back to see if that changes.

I’m just annoyed with the net worth/income limits that prevent me from trying it out. From what I’ve seen you can go ahead and ignore them, but you’re pretty much screwed if anything ever goes wrong because you haven’t followed the terms of the agreement.