Last week, I started up my Lending Club Experiment: to take the $50 bonus given to me for becoming a lender at Lending Club, and use it to test drive the service. It’s a hot topic – I can tell because I received a slew of emails asking me for referrals to get $50 bonuses. If you’re one of those that got a referral link from me, please feel free to share your experiences in the comments here.

It’s been a week, and a few things have happened. One of the loans I picked out last week fell through in the “review” phase, for whatever reason. My $25 was returned to my Lending Club account, and I chose to replace the first loan with a loan at a similar rate and risk level, so my estimated return is still around 13%. Now the two loans (or notes) that I’ve invested in have passed review, and are “issued and current.” They’re accumulating interest as we speak.

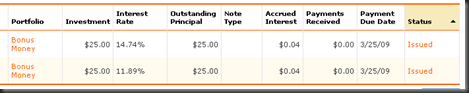

The above picture is a snapshot of my two loans, taken this morning (you can click the image to get a larger view if it’s hard to read). I cut off the identifying information that was on the left side, to protect my borrowers. But you can see that I’ve assigned these two loans to the portfolio “Bonus Money,” so that I can track them separately if I ever put money of my own in.

This is a wider view of my investments (again, you can click to view the full-size picture). You can see that my weighted interest rate is 13.32%, and my expected monthly payments are $1.68. I plan on leaving the payments in my Lending Club account, and when they add up to $25, possibly reinvesting in a new note.

There isn’t much for me to do for the rest of the month, except sit tight and wait for the 25th, when the first payments are due! We’ll check back in with things after that.

Well, I did take the fifty and run, and so far so good. I used it as a deposit after the consultation on my next tattoo (my reward for meeting a savings goal :P). Free money is awesome, really.

How did you pick your recipients? I am about to invest the $50 from your referral. I might try one high and one low interest loan.

I actually signed up without a bonus. I did not even realize there was a bonus until I looked in my account and it said, Invite others, they get 50$…

So I sent out a few invites but no one has signed up. Now that its 25-25 for referring I am hoping more of the invites I sent out will get cashed in 😉

Good luck on your return.

Mike, I personally just read through the info about each borrower, after sorting by lowest interest rate. I mean, being new to it you really have to just assess the risk and make a note of what you will be willing to lose. Once that is done, pick a recipient that falls in that category. With free money, losing it is not that big of a deal but I would be conservative, as it is still money 😉

@Mike – I looked for loans that were almost completely funded, because I wanted to get straight into it. That also provides a bit of “social proof” – if other people believe in this loan, than it’s already passed a gauntlet of sorts. Then I looked at each loan individually, to decide on the merits myself. I definitely went with loans where the borrowers had a clean credit history with no delinquencies.

@Jesse – Ah, too bad you didn’t see my referral offer from the last entry! Remember though, you only make money from referrals if someone you refer signs up as a borrower. So far I’ve referred dozens of people, but only lenders, so I haven’t made squat from it. But I don’t mind passing on my own referral money to give someone $50 to try it out. I don’t know how it works if you refer someone as a lender, and then they refer a borrower… I guess time will tell on that one.

I put my $50 into loans (thanks Stephanie). I pulled in skills from my time working in a bank. I used to look at credit reports and income making loan decisions and I followed similar logic today.

I looked at it more as a process of elimination strategy. If someone had high credit card debt (over $10k) or were using a large portion of revolving credit (over 10%) I took them off the list.

Next I looked at income compared to the loan payments. I looked at the type of person, why they wanted the money, and if they could afford to keep paying.

I ended up with 2 that I hope will keep on paying.

I was going to lend the $ but I cant do it in my state unless I go thru some stake trading site. I havent done anything else with it since then. I will likely cash out if i can and throw it toward my financial goals. I am interested to see how it works out for you though. 13% is a nice rate 😀

How could I go about getting a referral? I did see the previous post, and have done some thinking about it, and all in all it seems like a great idea! Like you said in your first post, you aren’t really losing anything with these loans since this was free money you received from a referral.

I got the referral bonus but had the same problem as MK (my state is not available). But you can invest in the notes (independent of the state) in the secondary market, which is a list of loans already bought by other lenders who want to cash out. i bought a couple at a slight discount. You should check it out.

So I signed up this morning with great ease. I selected two notes without a problem. The site is extremely user friendly.

The only problem I am having is after inviting friends to join the website, they become extremely suspious of the offer. Stating it is too good to be true, some even saying it is a pyramid scheme. No matter how I endorse the site, friends are just too scared. I even sent them copies of this blog to show them I’m not crazy.

Researched a little more for those who are on the tentative side and found a research report on the company.

http://www.thedigeratilife.com/images/javelin-2.pdf

Hope this people really look at the site a little better.

How are you able to do that when in the FAQ it says this about lenders:

“In addition, individual lenders who are residents of states other than California must (a) have an annual gross income of at least $70,000 and a net worth (exclusive of home, home furnishings and automobile) of at least $70,000; or (b) have a net worth (determined with the same exclusions) of at least $250,000. Individual lenders who are California residents must (a) have an annual gross income of at least $100,000 and a net worth (exclusive of home, home furnishings and automobile) of at least $100,000; or (b) have a net worth (determined with the same exclusions) of at least $250,000.”

I think this kind of loan process is somewhat helpful for those who needs money. But you have to recruit friends in order for the club gives you a loan am I right? That’s my understanding…Thanks for this.

@Phil low: No, you don’t have to recruit friends at all to use the service. You put up a loan listing, and people who are interested will contribute to it. Prosper (a similar service) had a feature where friends could give “endorsements” of you, which might help you loan get fully funded, but you don’t have to have any friends on the service in order to use it.