Is retirement the last thing on your mind right now? Fair enough! With textbooks, professors, and homework assignments taking up all of your brain power, it’s hard to think about starting your career, let alone ending it! But hear me out:

Did you ever have a math teacher ask you which you would rather have, $100 now, or a penny that doubles every day for a month? Did you take the $100?

Silly you. If you’ve got a penny that grows at 100% interest (which is what doubling is) per day, you’ll have $5,368,709.12 at the end of the month. That is the awesome power of compound interest.

Of course, if you can find an investment that truly returns 100% per day for 30 days, I’ll hire you as my financial advisor and we’ll start building our Scrooge McDuck money bin! But even 8% or 10% growth per year can net you a sweet future, especially if you let the money sit around for say, 40 years. Try playing around with this retirement calculator, keeping in mind that the stock market (as a whole) generally returns between 8 and 10%.

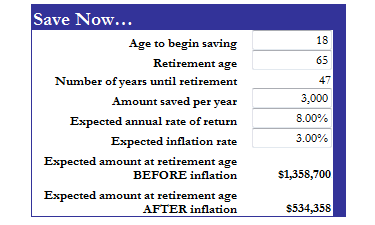

So if you start investing $3,000 per year at age 18 as a freshman, you’ll have $1,358,700 at age 65. After inflation, that works out to $534,358 in spending power (in today’s dollars). Not bad for $250 per month! But what if you wait? Wait until you’ve graduated from school and had a few years to establish yourself?

So if you start investing $3,000 per year at age 18 as a freshman, you’ll have $1,358,700 at age 65. After inflation, that works out to $534,358 in spending power (in today’s dollars). Not bad for $250 per month! But what if you wait? Wait until you’ve graduated from school and had a few years to establish yourself?

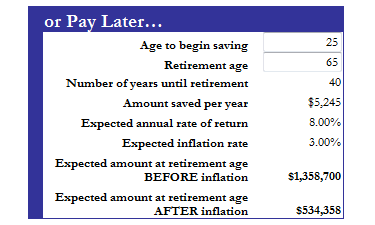

To get that same $1,358,700, you have to contribute $5,245 per year if you wait until age 25 to start investing. That’s $437 per month, or nearly twice as much just for waiting seven years!

Are you ready to get this show on the road and see big returns on your money? If you’ve followed all of the previous college money tips, you are. Because you’ll have a reasonable level of student loan debt (or none!), no credit card debt, and you’ll already be saving for your short and medium term goals. Which means if you’ve still got money left over, it’s time to think long term and open a retirement account.

For a college student, a Roth IRA is the type of retirement account you want to get. To learn what you need to do, I recommend the Get Rich Slowly Guide to Roth IRAs. Written by J.D. Roth (no relation to “Roth IRA”) of Get Rich Slowly, it covers everything you need to know to get started. It’s a really easy read at only 31 pages, but it packs a lot of punch.

The ebook costs only $7 — the cost of a combo meal at a fast food place. And if spending that $7 gets you investing now instead of waiting until after graduation… well, you do the math.

Check out all of the College Money Tips!

useful tips and forthose people who wants to make their life comfortable and attractive whole life

thanksl

Great information, but don’t you have to have earned income to qualify to put money into an IRA? As a college student, my grandson does not have real earned income.

Thanks,

Jim Lewis

@James: Yes – so if your grandson truly doesn’t have earned income, he won’t qualify. That’s something that’s explained in the ebook. 86% of college students work while in school, so I didn’t mention that fact as it applies to less than 15% of college students.

well if he isnt making money then how would he put any in anyway?

I’ve been looking at retirement options and this information is really useful – I wish I had put more money away when I was younger and didnt have to rush to do it now…but its better later than never

My son opened a Roth IRA at troweprice when he turned 18. He picked them because they allow monthly contributions of as little as $50, with no initial investment required if you set up automatic transfers.

$3000 a year seems like a lot, even for working college students (considering all of their other expenses)! I think he has managed about $1000 per year for the last 2 years.

$3000 might be a lot, depending on your situation. It was really just an example I used, but it can be possible in some cases. I went to a college that heavily emphasized paid internships (“co-ops”), and for some majors even required them! A lot of people I know made way more than $3000 during their co-ops, and could have done well by sticking that money in a Roth IRA.

Looking at this only makes me a stronger advocate for schools to teach money management and finance classes at a much younger level. I’ve found ways to bring in income for myself starting at a very young age and if I’d know then what I know now, I’d already be set for life. I say financial education should start in middle school.

i second what ashley said, i also feel that emphasis on financial education should start earlier in schools.. i bet people will be in a much better place (financially) if they were taught how to handle their finances wisely at an earlier age, much better if education begins at home..

Being economical and saving wisely is something ive always valued

These are fantastic tips! Starting to work with a financial advisor at a younger age rather than waiting can also help secure your financial future. You can talk about long term and short term goals – but be sure to meet often to change these goals along with major changes in your life and lifestyle. And like anything else, shop around until you find an advisor you are comfortable with!

Is this info current?

All of the info in the post is still current (because math… math never changes), but unfortunately JD Roth’s $7 ebook about Roth IRAs is no longer available. However, there is now a pretty good guide for free on his website, Get Rich Slowly: http://www.getrichslowly.org/blog/2012/03/27/what-is-a-roth-ira-a-short-and-simple-guide/