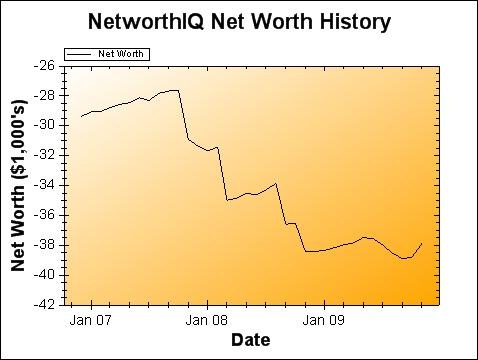

It’s time to put a cap on November and start in on all the joys and pains of December! But before we move on completely, let’s have a looksie at the progress I made in November:

Change: $920 or 2.37 %

Hot.

A lot of this month was about playing catch-up. I stopped contributing to several of my savings goals because for a few months, I was living out of one of my savings accounts! Now, granted, it was my “Getting Established” savings account, and that’s what it was meant for. But it didn’t make any sense to me to move money from that savings account into other savings accounts — robbing Peter to pay Paul. So I socked away as much as possible this month in an effort to get back on track.

So are we finally seeing the climb up out of the “valley” in my net worth? Possibly. My student loan progress is slow, taking a back burner to my savings goals. The interest rate on my loans is so low that they just don’t earn priority over saving for retirement, growing my emergency fund, putting money away for weddings I’ve been asked to participate in, saving up for an eventual new-to-me car… yeah, other things demanding my moneys. Even though I get flak for it from time to time, when it comes to my student loans, I’m on the 10-25 year payoff plans.

If you have any questions about my net worth or how it is calculated, feel free to ask them in the comments. Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Wealthy Blogger List. (Spoiler alert: the name of my site is highly accurate.)

Great job! Yes, keep contributing to retirement and emergency savings. You can increase your payments to student loans as your income increases, even making one double payment a year will help when you can. You’re right to prioritize saving for emergencies over aggressive repayment of student loans; loans like mortgages don’t look at student loans in the same way as other unsecured debt like credit cards, but without an emergency fund, if you lose employment in future, you can’t pay your mortgage or rent by showing the bank or your landlord your progress on your student loans….

Keep up the GREAT work!

Thanks! You’ve pretty much hit the nail on the head there – once you put money into your student loans, you can’t get it back out again to retire on or pay for an emergency. Yes, there’s deferrals and forbearance if times get tough, but if you need more help than that… you can end up screwed. Thanks for the encouragement 🙂

I like the uptick Steph! Sweet! Whooo hooo!

Good to see your net worth is headed in the right direction: up. Putting off the student loans to stack up emergency cash is a good move. When deciding to choose paying off student loan debt over saving for retirement, I strongly consider two things: 1) the employer match, if any and 2) the interest rate on the loans.

Certain student loan interest is pretty much fixed. You know your rate of return. Even if it’s negative. When it comes to investments, “prior performance is no indication of future performance.”

Since my employer didn’t provide a match, I took practically every cent I could’ve invested and put it towards my student loans. Mathematically, it may not make since over the long run. But it’s comforting not owing anyone anything.

I don’t knock people for holding on to low interest rate student loan debt as long as they’re actually saving, investing, etc. the money they could use to pay it off.

I’m sure you don’t have this problem.