Happy Holidays! I’m in full-on holiday-crazy mode at work, my Christmas tree is up and decorated at home, and I’ve got an 18-pound turkey in my freezer (hey, it was $0.59/pound!), so we’re definitely due for an update on how my Net Worth came out in November.

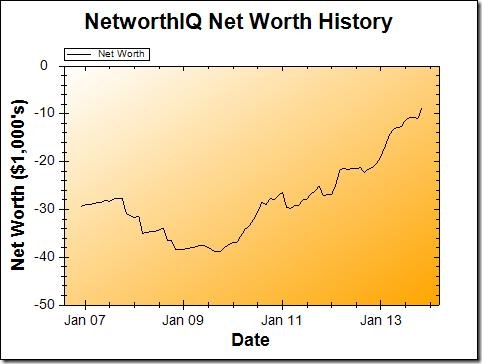

Change: +$2,288 or +20.77%

November Net Worth: -$8,728

Well, well, well! Would you look at that? The number might still be negative, but it’s up to four digits! We’re in the home stretch of my goal to get my net worth in the positive numbers by September 2014. Which is good news, since that’s only 9 months away!

Well, well, well! Would you look at that? The number might still be negative, but it’s up to four digits! We’re in the home stretch of my goal to get my net worth in the positive numbers by September 2014. Which is good news, since that’s only 9 months away!

Still, there are some things going on here that will affect my net worth in the coming months:

Retirement Savings

I’m happy to report the value of my retirement accounts came within $25 of $20,000 in November! That’s obviously subject to the whims of the stock market, so I can only be proud of those gains up to a point.

Still, it means it took me a year and two months to get my retirement funds from $10,000 to $20,000 — so now the goal will be to get to $30,000 within one year from now. Totally do-able, I think. Though it does mean I’ll be working on two challenges at once: Positive Net Worth by September, and $30,000 in Retirement by November. Thankfully, those two goals go hand-in-hand!

Cash Savings

The other large gain I made this month was in my cash accounts — so, savings for goals that are less than five years away. The largest gains were in the Wedding fund and my Travel fund. This is both good and bad, in a way: The reason I’m focusing on these two is that each has a large expenditure planned for 2014.

By January I will have to hand over all of my Travel savings for my upcoming international trip in March (care to guess where I’m headed?) and the Wedding savings will be drained pretty consistently as we approach the big day in August.

So my net worth gains in these categories are only temporary — but that’s okay. The whole point of saving up for travel and the wedding is so that I can spend on these things. It’ll just be a little psychologically painful to see the numbers go down.

I’m also draining my Charity savings account entirely in the month of December, as I do most years. I run a video game marathon fundraiser at the end of December, so whatever’s left in the account will be donated to that and to other causes I support. I don’t do all this donating in December for tax reasons (I do not have enough deductions to itemize my taxes, you see) — I just do it because that’s how I roll.

Basically, between paying for my trip, wedding expenses, the charity drive, and Christmas, I expect December to be a down month, net-worth-wise. Still, it’s exciting to see that I did manage to get it up above negative $10,000 this year!

Questions? Critiques? Words of encouragement? Leave them in the comments!

This update give me hope for my financial future.

Keep up the good work. Thanks!