The end of June marks the halfway point of the year, so it’s a really good time to look everything over and assess progress for the year. It also helps that there’s a big holiday weekend right after the end of June, so there’s even a time baked in to do a little evaluation. So let’s see what we’re working with at this particular end-of-June milestone:

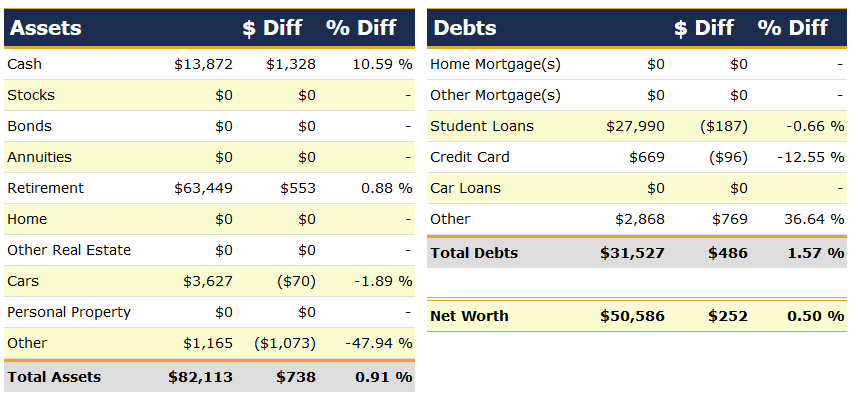

Change: +$252 or +0.50%

June Net Worth TOTAL: $50,586

Well, $252 isn’t a super exciting gain, but it is still a gain and that’s not nothing. It does fall short of the $1,346/month that I need to hit my goal of $61,099 by January, though. So now it’s $1502/month to hit that goal on time, which feels a little daunting, but I still think I can make it, and here’s why:

No Retirement Savings This Month

The $553 gain in my “Retirement” assets was all growth, as I did not make any contributions this month. (We focused on my husband’s retirement accounts instead this month.) That means of the $10,513 until my milestone goal, $5,500 of it can reasonably be expected to be covered by my IRA contributions alone, once we max out my husband’s IRA and switch to contributing to mine.

Work Should Remain Busy Through November

Work picked up about 2 months ago and pretty much hasn’t slowed down, and I don’t expect it to. At least, not until after the end of November, which is a really large chunk of the time until my goal deadline. There may be some weeks that are a little slower, but between my job and my freelance work, I’m finding plenty of work to keep me busy in the evenings after my baby has fallen asleep. So here’s hoping the kiddo keeps up this 6:30pm bedtime through then!

Big(ish) Travel Expenditure This Month

I put down the money to split a vacation house with my extended family, so that took a chunk out of what would have been a bigger gain this month. But, this is also our only planned travel this year (because no one is especially keen to travel too much with a baby), so that spending is already behind me. There will be another burst of spending for it in July – lost wages for taking the time off, and food & sundries during the trip, but the big housing expense is already done for, and we’ve saved up the money for the other things already.

So while this month may not be super impressive, it’s not really indicative of the months to come – after July, anyway. I’m still pretty bullish on this goal overall. Just gotta stay on track, and like the Little Engine That Could… I think I can I think I can I think I can.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

You must be a good financial planner. I am happy to see that the chunk of your networth is in retirement and not in wasting asset. You are making progress indeed.

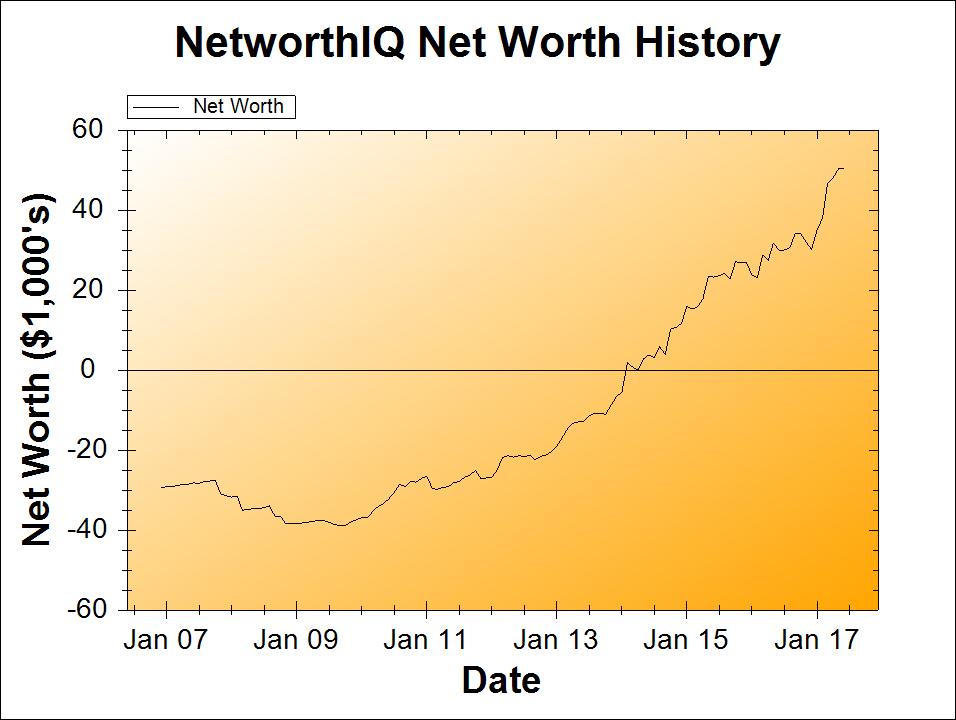

Wow, loving that exponential looking curve. You’re doing great! It’s great to take a break especially to spend time with family!

Looks like you’ve got some great months ahead after knocking out your travel costs for the year. Good luck!