I like the end of August. It means the oppressive heat of summer is about to go BUH-BYE, which is great for a delicate northern-born flower like myself (I’m basically like a Stark IRL. Winter is coming and all that.). It’s also my wedding anniversary, which is a lovely celebration of my love, and generally means there’s a steak dinner for me. And it means my birthday is right around the corner, which means CAKE IS COMING. Which is what my house words would actually be, of course.

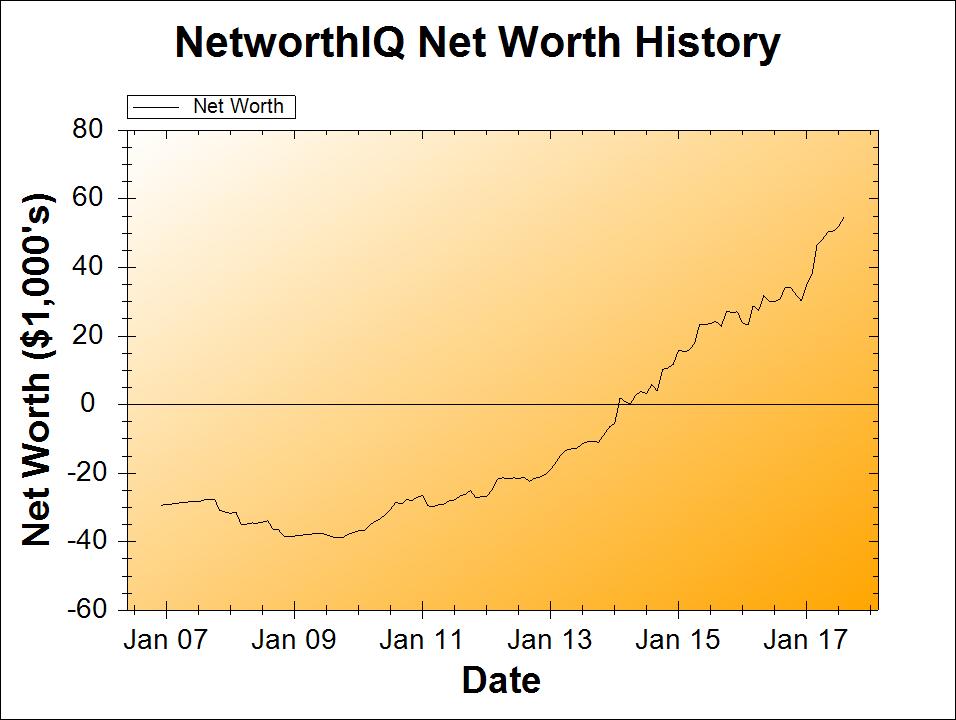

So do the net worth numbers for the end of August live up to the general awesomeness that is the conclusion of this month? Let’s have a little look-see:

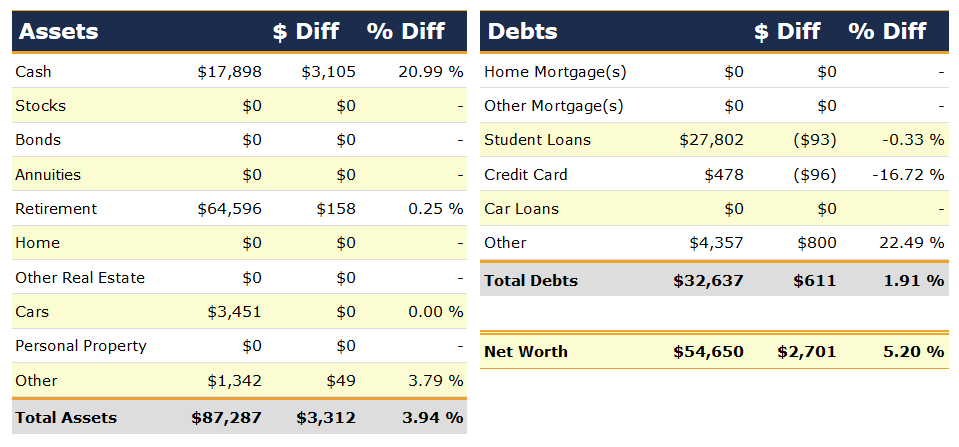

Change: +$2,701 (+5.20%)

August Net Worth TOTAL: $54,650

Cash

Cash is up this month, and that’s just darned surprising. When last we spoke, I mentioned that July’s vacation would not be fully felt until this month, since it fell in the last pay period of July and we didn’t actually get our paychecks for that time until, well, August. So despite taking a week off almost completely unpaid (other than the freelance writing I did from the beach because I am a BEAST), cash is up up up.

As best I can tell, that’s because my freelance writing has been hovering at just-below-maximum every week continuously. We are starting to get into my client’s busy season, which is good news for my bottom line. (But bad news for me writing other things. Like blog posts. Like for this blog. Oops. So that’s why it’s been nothing but net worth reports for a while. Sorry about that.)

Retirement

Up by $158, but that’s just the market. Last month, my gains were all market gains as well, because we were focusing on my husband’s retirement accounts for the time being. But in August, we decided to make the switch to my retirement accounts, so that we can focus on a Solo 401(k) for my business (freelance writing and this here blog, not that this blog is a real money-maker or anything, but I do get a little kickback if you buy anything on Amazon through my link, for example).

So if we’re focusing on my Solo 401(k) now, why was there no contribution in August? *cough* Because I didn’t get around to setting it up. *cough*

OKAY, yes, I know. Putting off financial tasks is soooooo not like me. But I’ve been all frazzle-dazzled for the past year because of this whole “baby” thing. So I’m just not as on the ball as I might have been in years past. It’s alright though – with the exception of the time I lose not being invested in the market, there isn’t much of a downside, as long as I open the Solo 401(k) before December 31st, I can still contribute for 2017.

I’m not sure if there’s a critical mass of readers that would be interested in the details of a Solo 401(k) (which is a retirement account for a self-employed person, btw). But if the details of how I decided on a Solo 401(k) (vs. other options such as a SIMPLE IRA or SEP IRA or whatever else might be out there), and where I’m opening it interest you, shout out in the comments of this post. If enough people are interested, I’ll write a post.

But yes, so, I haven’t opened the Solo 401(k) yet, so our retirement contributions for this month are just sitting in my husband’s saving account. Which means they’re not even in this net worth update at all. So this could have been an even more impressive net worth update, if I had gotten my ducks in a row earlier in the month. Alas, I did not, so September will get to be the cool kid, instead. Ah, well.

“Other”

The “Other” category includes my business’ tax liability, so really, pay that no mind. I’m hoping to pretty much wipe it out (other than the self-employment tax portion) by contributing as much as possible to a Solo 401(k). But until I confirm how much I actually owe (when I do my taxes), I keep a high estimate of the taxes on the books.

Milestone Progress

$54,650, out of $61,099 by January 2018 – only $6,449 to go! That’s $1289.80 needed per month to get there. Looking more doable every month!

How do you think I should celebrate when I get there? Reminder: this number, $61,099, represents $100,000 in progress from my all-time net worth low back in September of 2009. They say the first $100,000 is the hardest! So how does one celebrate their first $100,000? Hmm… (Obviously I’m looking to you guys for a bunch of fun, fabulous, frugal ideas. Go go Gadget Crowdsourcing Celebration Ideas!)

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

I think you’d surely meet your goal of $61k by Jan 2018.

Considering you still had a positive month in terms of Net Worth, you should be good :)!

Excuse my ignorance as I haven’t followed all of your post but how old is the baby..?

I think you’re right! Getting so close I can almost taste it. 🙂

The baby is about 10 months old. Starting to show some real signs of independence, now!

That is an awesome chart to see, and no sign of slowing down!

And you’re still richer than me!

Hahaha, well, maybe. Isn’t there some way to count the value of your law degree on the balance sheet? It almost certainly beats my B.S. degree! 😛

Really nice to see the slope of your NW! Fantastic work. I also love the Will Ferrell gif 🙂