This update is several days behind because I literally jetted out of town for several days the morning of the 1st (to attend Cents Positive, the first ever women’s financial independence retreat!). Then I came back to a busy work schedule that someone (read: me) also tried to pack with doctor and dentist appointments for myself and my fam. And I’ve been working on my brand-spanking-new website, The Middletons, the whole time. Oh, and my favorite yearly round-the-clock week-long charity fundraiser, Desert Bus for Hope, started the other day, too.

So lest you thought I had up and disappeared because I didn’t want to write a definitely bad news bears net worth update, nope, that’s not it at all. (I’m just way overbooked this month.) But, you would have been right about the bad news. Because people, it is baaaad:

Change: -$6,155 or -6.20%

October Net Worth TOTAL: $93,122

Oh how the mildly mighty have fallen!! From a high of $99,824 just two months ago, down to $93,122 now. Alright, let’s talk this through:

Cash: +$353

Not amazing, but at least it wasn’t down again this month. Medical costs have continued to pile on, because of my brilliant idea of “schedule ALL the doctors’ appointments now that we’ve hit our deductible!” Not that I was wrong to do that, mind you, it’s just that hitting our deductible doesn’t mean everything is free now. We’ve still got copays on the medical stuff, and the dental and vision stuff is unaffected by the medical deductible.

Now, this warrants a bit of an aside to talk about, because going to all these appointments has already shown that it will have far-reaching effects on my net worth updates. My husband and I both got prescriptions for glasses (my first! I’ll have glasses now! this is a new thing for me!), and both were told by the dentist that we’ll need braces. In my case, I need them very badly, very urgently, and I won’t be able to do Invisalign or anything, I need the funtimes metal ones. The good news is that our trips to the dermatologist revealed no issues, so we’ve got that going for us.

All told, the estimates for everything that’s coming out of these visits will be… somewhere in the region of $6,000 – $10,000 worth of work we need (not including the copays!). That number will ultimately depend on whether we can use something like Invisalign for my husband’s needs and whether we can negotiate down the costs of my dental work. It’s still a lot of money even if we can keep it down on the $6,000 end, though.

Now, perhaps “Cash” is not the right place to talk about this. Yes, for now we’re cash-flowing (paying out of pocket) the expenses as they come. But in reality, these are more like debts that we’ve been carrying around and not acknowledging here. Especially my dental work: it’s like a debt that I’ve been carrying around in my mouth knowingly, and yet ostriching my head in the sand about it at the same time.

We’ll see how it goes, but really… chickens have just come home to roost, and it is what it is. Hopefully taking care of all this ASAP will save us money on health care over the long run, so maybe this actually belongs in “Retirement,” where the bulk of our Health Savings Account savings are.

No matter where in this update I should have talked about it, it’s happening. Yay? At least glasses will help me to further look like a total nerd, so that people will stop mistaking me for anything but. (Seriously, that’s a real problem I have in my life. Perhaps this way, no one will ever ask me about a sportball again.)

Retirement: -$6,692

It’s the markets. I made my regular contributions, and the markets just went nuts. It doesn’t bother me—other than in the AW DANG YOU COULDN’T HAVE WAITED UNTIL *AFTER* I HIT $100K?!? sense.

As always, the markets taking a little dip actually works in my favor, since I’m buying stocks right now and this just means they are on sale. It’s annoying when tallying up the numbers, but it’s ultimately better than paying the peak price. *shrug*

Cars: -$107

Aw, come on car, why couldn’t you have an up month with your nonsensical value changes? Why you gotta pile on with the downward trend? If all the other categories jumped off a bridge, would you do it too? Actually, don’t answer that, car. You’re the only car we’ve got, please don’t get any bridge jumping ideas.

Other Assets: -$44

I cashed a $50 birthday check, and then my Lending Club balance… went up by $6? Alright. Cool.

Student Loans: -$150

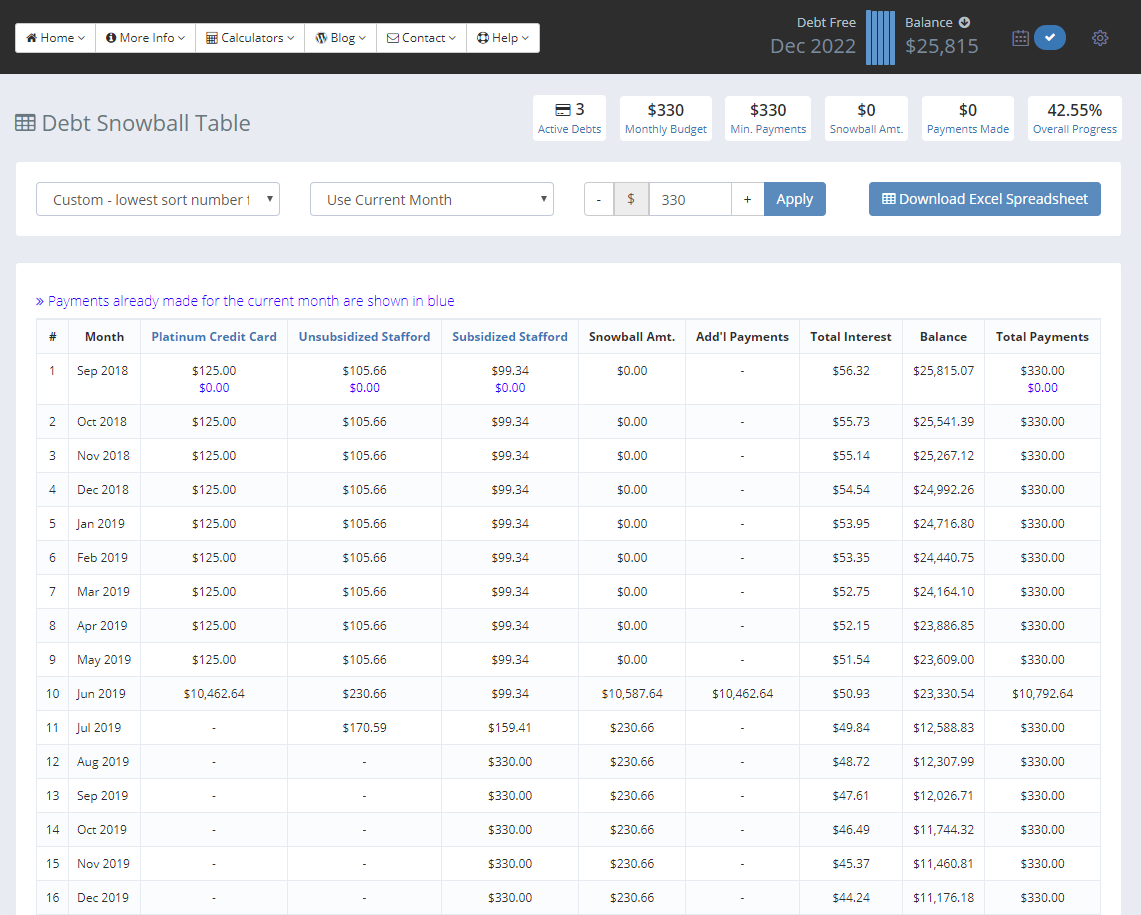

Oh! Here’s a thing I did. I was playing around with my debt payoff table on Undebt.it, and I noticed that there was an extra $170.59 payment to be made to my unsubsidized student loan after my 0% credit card is paid off. You can see it in this screenshot that I shared in the August net worth update:

See how there’s a weird extra payment on the unsubsidized (middle) loan after the credit card (first) is paid off? The asymmetry of that was bothering me. So, I divided that $170.59 by the remaining months (result: $21.16), and upped my student loan payment by that amount. Because I know I can probably come up with another ~$20/month, and the awesomeness of paying off the entire unsubsidized student loan in one month (because remember, that’s where the credit card debt came from!) is going to feel amazing. I’m not going to want to wait an extra month to really pay that sucker off, so… I won’t.

Bonus: by adding that $21.16/month to my debt payoff plan, my ultimate debt free date moved up by 3 months—it’s now predicted for September 2022. Which I think is super fitting, since September is the anniversary month of when I got into debt (wee student loans!), and September 2009 was my lowest net worth ever, and generally, stuff tends to just happen in September. So why not get debt free in a September?

Credit Card: -$125

Nothing new to report.

Other Debts: -$60

So, the good news about spending a bunch of money on attending conferences and launching a new website is… your business tax burden goes down!

That’s it for the category-by-category breakdown. TL;DR – the markets were bad and I need thousands of dollars of dental work. Yay!

Milestone Progress

The Milestone: $100,000 net worth. Only 3 months left to get there by the end of the year, but I’m further away from it now than I was last month or the month before. If I can manage $2292.67 of growth each month, I can get there… which isn’t impossible. But it may largely depend on what the markets do, which is entirely out of my control. Oh well. I will get there eventually.

The Milestone: Paid off Unsubsidized Stafford student loan. I talked about this above in the “student loan” section, but in case you skipped past that, I’m sending an extra $21.16/month to this as of this month, and that will accelerate my payoff of this loan by one month, and my eventual total debt freedom by three months. Wee!

No bonus celebrating someone else’s net worth milestone this month… I honestly didn’t see anyone celebrating, since the markets hit everyone pretty hard, and I was traveling. If you did celebrate a milestone this month or last, let me know in the comments below!

Don’t know where you’re at with your money to be able to tell me? Tracking your net worth month to month is the best way to find out! You can do it by hand with a spreadsheet like I do, or you can check out Personal Capital for some automagical tracking. You and I each get a $20 gift card if you sign up through me and then link at least one valid investment account.

Gulp. Those dental bills are scary numbers. Maybe time to look into medical tourism? Ha. Yeah I’m not sure if I would go that route or not… I did have $3500 in dental work done at 23 soon after we moved home from South Carolina and I was still paying off my student loans. They did give me a 10% cash discount, but man did that hurt…

I’ve heard that medical tourism doesn’t work for braces because they require regular maintenance and checkups (not a “one and done” type thing), but a good idea for other things. Also, traveling is more expensive for us since we don’t get paid time off — it may actually be cheaper overall for us to stick with an orthodontist in walking distance, since it will mean the least amount of missed work.

Definitely going to talk to them about cash discounts, family discounts… Pretty much every way of doing it, I want to know about! Haha! I know they do interest-free financing, and a credit card churn wouldn’t be out of the question, either. In the end, we can pay for it out of the HSA, so it’s really one of those “first world FI” problems of how we pay for it to minimize derailment of our financial independence date.

For the glasses, we’ve done one pair each of the pricey ones at the doctor’s office, and we’ll get sunglasses and copious backup pairs from Zenni Optical, because toddler parents! XD

Braces – right before I retired, I bit this bullet with my daughter. And I definitely wouldn’t recommend medical tourism for that since it is quite a bit of work and in the beginning when they are starting to get the teeth moving, they use lighter duty wires and every 2 weeks, my daughter was breaking the wire so we were right back in that office getting it fixed.

I took a somewhat strategic approach, however. Switched from a dental plan at my company to one at my husband’s company which had *some* ortho coverage for the new plan year (dentist had been telling me since kiddo was in 1st grade that braces were imminent). Got the bid from the ortho, negotiated and also took a cash discount for paying all at once while at the same time using the opportunity to churn a couple of travel hacking credit cards by hitting the minimum spend with one and getting close on the other. I imagine you could do a 0% credit card for it to self finance it for 12 months if you didn’t want to eat up all the cash at once. The good part is that once I took the pain and paid for it, it doesn’t hurt anymore and I think she will be good to go in another two years besides retainers (already 2 years into the process, lol).

Like I mentioned on the IG, you have made some impressive progress and once you hit that $150,000 the compounding effects start to take over and things will grow in a much quicker fashion. I appreciated getting to know you at the retreat and especially enjoyed your thoughtful commentary. Cheers!