Today is my last day of college… assuming my presentation tonight goes well (which it will!). You would think I would feel… elated? Scared? Hopeful? Hopeless? Helpless?

I don’t feel much of anything, really. Maybe I’ve become jaded by years of final exams – being on the “quarter system” instead of the semester system means I had 50% more “finals weeks” than my friends from high school. You get pretty used to the drill – presentations and multiple choice exams, or, as it was when I was in film school, endless screenings of films.

Tomorrow is supposed to be a brand new day! My first day as a graduate! Except I don’t walk the stage to get my diploma until May, and job applications and cover letters just feel like more homework. Nothing feels like it’s changing, because changes are more gradual than that. Like graduating from high school: nothing really changed then until my mom and my sister put the last box in my dorm room at the end of the summer, and said “See ya!”

So maybe it won’t feel different until I start a job, or move. But regardless of what it feels like, things are different. My student loans have come due, and I can only be a mooch for housing for so much longer (Thanks Mom! Please don’t kick me out yet.). And my savings goals? Those have to change with me.

The Old Savings Snowball

Here’s what my savings snowball looked like the last time we checked in:

| Name | Goal Total | Progress | Monthly Payment |

| Getting Established | $2,000 | $1066 | All extra $$ |

| Emergency Fund | $10,000 | $425 | $10 |

| Future Car Fund | $10,000 | $55 | $10 |

| Retirement | Infinite | $36 | $5 |

| Student Loan Interest | $500 | $68 | $60 |

Remember, the idea is that I pay the monthly payment on every goal except the top one. For the top one, I throw as much money at it as I can, so that I can achieve it as soon as possible.

What’s Gotta Change?

Getting Established Fund: It doesn’t make any sense to contribute to this anymore, because it’s time to start drawing from it. I’ve officially entered the Getting Established period. I don’t intend to spend the money all willy-nilly, but it’s there to get me on my feet now. Basically, I’ll pay for what I can out of pocket, and if I need more money each month, I’ll draw it from this fund, first.

Emergency Fund: It’s a little bigger now! Is $10,000 an insane goal for this? Kinda – but it’s a long term goal. Right now I’m just happy that there’s anything in there at all!

Future Car Fund: My current car is still running fine, thank you very much. Although it seems like I’ll be needing new tires in the near future, the rest of the car is just dandy. Passed inspection not too long ago, actually.

Retirement: Ah yes, my teeny tiny fund. No plans to up the contribution to this until I, you know, get a job.

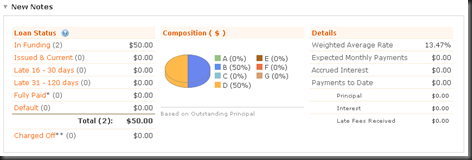

Student Loan Interest: Dead! I’ve paid everything in the fund to my loans, again. Now some of my loans are going to enter repayment, so I won’t be saving money up for them anymore, I’ll just be, you know, paying them.

So, two categories gone off the list – is it time to add a new goal?

Yes! Last week, I was asked to be a part of my brother’s wedding party, and it’s probably going to cost me more than a pretty penny. I don’t have solid numbers yet, but I do know the wedding will be around October of 2010 and it’s a destination wedding. So, it will be my Bro’s Wedding/Travel Fund all wrapped up in one. I’m estimating I’ll need to save at least $150/month for that. I’ll adjust that number as plans become more solid.

New Snowball!

| Name | Goal Total | Progress | Monthly Payment |

| Bro’s Wedding | ? | $0 | All extra $$ |

| Emergency Fund | $10,000 | $514 | $10 |

| Future Car Fund | $10,000 | $76 | $10 |

| Retirement | Infinite | $47 | $5 |

I considered “upping” my contributions to my Emergency Fund, but that doesn’t make much sense if I’m drawing money out of my GE fund, now does it? It’s just shifting money around at that point, and may cause me to have to draw from my Emergency Fund, as well. I’ll reevaluate contributions when I have… that thing… what’s it called again? Oh, a “job.”

Mmm… tasty, tasty credit. We’ve talked about

Mmm… tasty, tasty credit. We’ve talked about