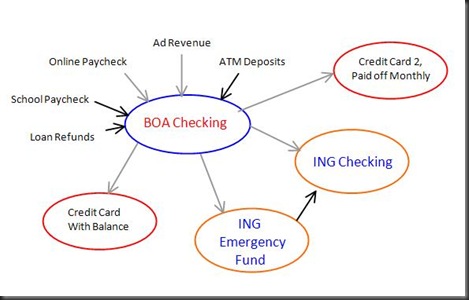

With the addition of an ING Checking account and a free and clear credit card to my banking arsenal, it became clear to me that I needed a different plan of attack for how I’m doing my banking. To show you what I mean, here’s a diagram of how I was doing things:

The black arrows represent near-immediate deposits or transfers, which take only a day or so. The gray arrows are slower deposits or transfers, which typically take three days or more.

So, if you look at the diagram that I crudely constructed, you’ll see that all of my income and deposits came into my Bank of America checking account, and then largely sat there, until either being moved to one of ING accounts, or used to pay one of my two credit cards.

Note: nearly all of my purchases are made using Credit Card 2, to earn rewards points and offset my purchases by one month before I pay the bill in full.

So what’s the problem with this? Convenience-wise, not a whole lot, except that the Bank of America checking account doesn’t earn me any interest, and that’s where most of my money was sitting most of the time. So I decided to entirely rework things, and came up with this new setup:

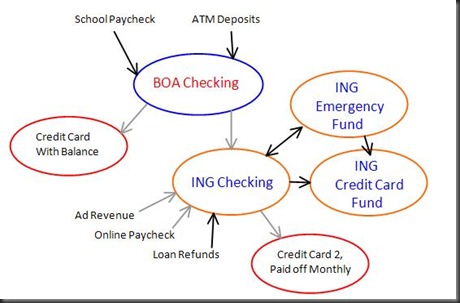

Ok, so, the paycheck from my on-campus job still direct deposits into my BoA account, and it’s still the convenient account for depositing checks at the ATM. But I’m quickly moving that money from BoA to my ING Checking account, so that it can earn interest, leaving only enough in my BoA account to pay the minimum payment on the credit card with the balance.

“Only the minimum payment?!?” you cry out, in shock and alarm. But, you will see that I’ve also got a new ING account in this setup. ING allows you to set up multiple savings accounts with minimal work and as quickly as humanly possible – I timed how long it took me to setup my new Credit Card Fund savings account, and it came out to 42 seconds!

Instead of making payments to the card itself, I’m now putting aside $140 of my monthly $160 payment (the other $20 is the minimum payment I make directly to the card) in the new savings account to earn interest. Then, the month before my 0% APR period ends, I will take all of the money in the account and pay off the credit card in full.

NOTE: This “paying your card off in your savings account” only works if you meet two conditions:

A) Your credit card interest rate has to be lower than your savings account interest rate. My savings account earns nearly 4%, and my credit card is at 0% for now, so it works. If your credit card interest rate is MORE than the card, then you should just pay off the card directly.

B) You treat payments into the savings account just like any other bill. You make the payments regularly, on time, and in the full amount. More importantly, do not take the money out of the account for any other purpose! Although it can technically serve as a second emergency fund, taking money out of the account is just the same as putting purchases on your credit card – it will completely counteract your credit card payoff efforts.

So, what are the advantages to my new setup, over the old one?

- Interest, interest, interest. I’ve got much higher balance in my ING checking this way, so that’s earning much more interest. And I’m earning interest on the credit card payoff account, as well. Altogether, I’ve calculated this setup will earn me an extra $60 in interest this year. Which may not seem like a lot to some of you, but to me? A poor college student? That’s some serious gains just for rearranging my accounts!

- Faster transfers. If it looks like there are more black lines in the second diagram, that’s because there are. Using mainly only ING accounts means instant transfers between three of my accounts – not even 1 day transfers, but instant!

- Shows my undying adoration for ING. Sure, they don’t have the best interest rates around, but they’re still competitive, and I love them to pieces. Plus, I made as much money from their referral program last year as I did working my on-campus job for the fall! Out of the four high-yield accounts I have (the others being E*TRADE, Emigrant, and Citibank), I like ING’s interface and usability the best.

All in all, it might seem like I’m a little crazy to obsess over such minute details, but I figure it probably only took me a half an hour of work, and netted me $60, so that’s an hourly rate of $120! Not bad at all!

Anyone else have any little “bank life hacks” like this?

Tax time is in full swing, and as usual, I’m sitting around waiting for my last few pieces of paperwork to come in so that I can do my taxes. Every year, I strive to get my own taxes, and my mother’s, done as quickly as possible so that I can fill out the Free Application for Federal Student Aid (FAFSA), a bane of my existence, in hopes of getting as much aid as possible (not that it has really helped in any of the previous years).

Tax time is in full swing, and as usual, I’m sitting around waiting for my last few pieces of paperwork to come in so that I can do my taxes. Every year, I strive to get my own taxes, and my mother’s, done as quickly as possible so that I can fill out the Free Application for Federal Student Aid (FAFSA), a bane of my existence, in hopes of getting as much aid as possible (not that it has really helped in any of the previous years).