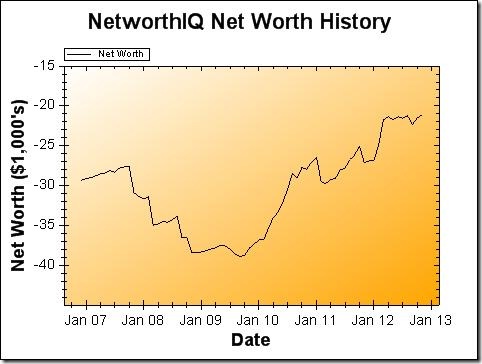

I’ve been testing out some new money tactics, with the goal of getting my net worth up to $0 by September 2014. But November, the month of a big charity event and the lead-up to Christmas, is a tough place to start. How am I doing?

Change: +$379 or +1.76%

Upwards! But not upwards “enough” for my taste. To hit $0 in net worth by September 2012, I need to average $1,000/month in gains. And I came up more than $600 short of that this month — meaning I’ll have to make up that $600 along the way, in addition to hitting $1,000 or so in gains every month going forward.

Upwards! But not upwards “enough” for my taste. To hit $0 in net worth by September 2012, I need to average $1,000/month in gains. And I came up more than $600 short of that this month — meaning I’ll have to make up that $600 along the way, in addition to hitting $1,000 or so in gains every month going forward.

But of course, I’m just starting out on this new goal, so it doesn’t help to be too hard on myself. I’m still laying the ground work for two years of steady gains.

End of the Year = Charity Time!

I dipped into my Charity savings account in order to donate to Desert Bus, the largest of the charity events that I participate in each year. Desert Bus is actually the reason I started keeping a Charity savings account (with $30/month automatic deposits).

Speaking of charity fundraisers, I’ll be running one in the month of December! You can check out my new charity blog, the fundraiser’s Facebook page, or the direct donation page of the U-Pick Video Game Marathon for Charity for details.

Getting Better Returns

One of the things I’m working on is getting more bang for my buck (aka better returns on my investments). Previously, the best return I could hope to get over a 2 year period was in debt payoff — specifically, my student loans, which all carry 5% interest rates. That rate is actually a tab bit lower if you take into account the tax deduction I get on student loan interest, but that’s negligible enough to ignore.

Those student loans are certainly a good place to start — certainly better than dumping extra cash into my sub-1% savings accounts, anyway. And while I will still be contributing my planned $5,000/year into my retirement accounts, the market is too volatile over just a two year period to consider it a higher yield than my student loans.

Pumping Up my Peer-to-Peer Lending

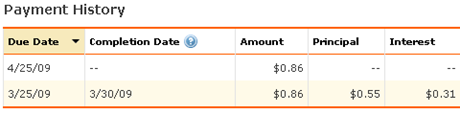

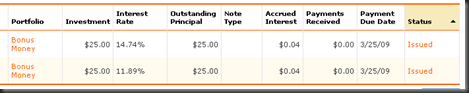

The option I decided to pursue in November was Lending Club. You may remember my peer-to-peer lending experiment with Lending Club in the past, where I lent out $50 in bonus money, but never put in any money of my own. After getting some encouragement from reading Lazy Man and Money’s update on his own Lending Club experiment, I decided to take the plunge in putting my own cash in. Seeing his net annualized return of 7.63%, and Lending Club’s own statistics on average net annualized return made the decision pretty easy for me.

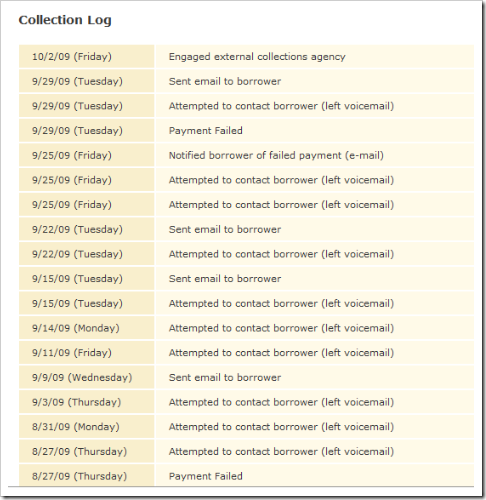

Is there a chance that some of money I lend out will disappear through default? Of course — I’ve already seen a default on one of the three loans I’ve invested my initial $50 bonus with. It happens. It’s not pretty, but it happens. And by diversifying the loans I invest in (I’m not putting more than $25 into any one loan), I’m mitigating that risk as much as it can be mitigated.

We’ll see how that pans out — at this time, my Lending Club portfolio is now worth $249. I’ll give updates on the return I get periodically on this blog.

Looking Forward at December

I can already see that December will be much like November. More charity donations, and a lot more Christmas presents — it’s not going to be a cheap month. But hopefully I can also find some money to put into more Lending Club loans, after meeting all the savings minimums that I’m working on, as well.

25 months remain until my $0 Net Worth deadline.