Those of you who have been following the site for a long time will remember that I used to be a member of (and cheerleader for) the peer-to-peer (p2p) lending service Prosper. A little while ago, Prosper voluntarily halted its operation while it seeks to become registered with the SEC. I never got around to lending or borrowing with Prosper before this happened.

Lending Club, a similar company, is registered with the SEC, and things are chugging along just fine. But I didn’t pay too much attention to Lending Club, because I didn’t need a loan and had no money to become a lender myself.

Well, today, I decided to try it out anyway. And I was able to do that because someone sent me a referral link to Lending Club, which gave me a $50 bonus to start out with. Now, perhaps the smart thing to do in my situation would have been to take the money and run, but I decided to lend it out. I like the idea of having $50 in “fun money,” to see if I can grow it.

This is the beginning of the Lending Club Experiment. If you’re curious about LC but don’t want to dip your toes in yet, you can just watch me do it! Or, if you’d like to try it yourself, contact me and I’ll send you a referral link, so that you can get your own $50 bonus. Or become a borrower – it might be the way to go, if you can get a good interest rate on the site.

Signing Up and Getting Started

After following the referral link to LC, things went really smoothly. I just made a username and password, and gave them my email address. After verifying my email address, I was back at the site, where I could choose between becoming a borrower or a lender.

After selecting “lender,” I had to give some identifying information: name, address, phone number, Social Security number, and date of birth. I then had the option to link up my LC account to a bank account, so that I could transfer in money to lend. I decided to skip this step, because you can also fund your account via PayPal, which I like. I’m not sure if you lose some money in PayPal fees doing that, though. But since I’m only lending out my bonus money (for now), I skipped the bank information.

The last step to becoming a borrower is to choose your “affiliations,” such as your hometown, where you went to college, where you work, and any organizations you belong to. This is so that you can find people who share something in common with you, when you’re looking for people to lend to. For example, wouldn’t you rather lend to someone who went to your college? Or is involved with the same charity as you? I put in my college, and continued on.

Now, I got to the point where I could browse “notes,” which are the loans you can lend to. Each note is $25, so I could invest in two notes. I decided to pick two different loans to invest in: one person doing a kitchen remodel, and one guy paying for his daughter’s college tuition.

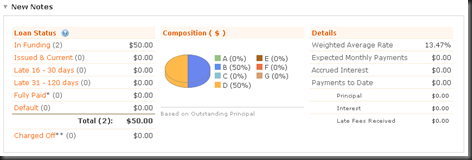

My weighted interest rate for the two loans is 13.47%, and both have three-year repayment terms. I’m sure that somewhere in my finance classes I learned how to calculate what the payments will be: $1.70/month according to my financial calculator, but I could be doing that wrong.

My little Lending Club portfolio

Is it Risky?

Well, yes, a little. One of my borrowers could decide to cut and run with the money, and just stop making payments. Or be unable to make the payments, for whatever reason. That’s why I’m using the referral bonus for now, and not my own money. When I have some disposable income, I may contribute some of my own money to the account. Because risk is relative. And I could invest in corporate bonds… but those have default risk, as well!

Or maybe I’ll just keep reinvesting the money I get in payments, indefinitely. That could be fun, too! And that’s really my goal here: have a little fun with some money that I can stand to lose, learn a bit about p2p lending, maybe earn a nice return, and help some people get the loans they need.