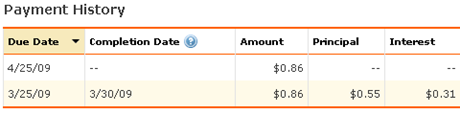

Late in February, I decided to start experimenting with Lending Club by investing the $50 bonus that was deposited into my account when I signed up (using a referral link). I chose two loans, which were issued and entered repayment. Last week, I received the first payment from each loan! You can see a snapshot of the payment I received from one loan below:

The “completion date” is the day which the payment hit my account. It takes a few days, because the borrowers pay through an electronic transfer, which takes a few days to go between banks.

So now there’s $1.66 in my account – one payment of $0.86 and another of $0.82, minus the $0.02 “cut” that Lending Club took. I could leave the money there and reinvest it once my account balance reaches $25, or I could transfer the money into my savings account and let it earn interest for a while.

If I just leave the money in my Lending Club account, it will be 16 months (15 months from now) before there’s enough money in the account to invest in a new loan. There would be $26.56 in the account at that point. If I move the money to my bank account, which earns 1.50% interest per year, I would have $26.81 by that time. Not a huge difference – I’m not sure that $0.25 is worth the effort of transferring the money every month. It wouldn’t even allow me to invest a month earlier! So I’m just going to let it sit there, for the time being.

All I have to do now is sit back and watch the payments come in each month (hopefully). So far the experience has been simple, easy, and kinda fun. Grow, money, grow!

I’ll continue to give little updates on my Lending Club account here, but there probably won’t be much else interesting to say, unless one of my borrowers decides not to pay, or pays late. However I would love to get the perspective of a Lending Club borrower! If you’ve borrowed money from Lending Club, contact me about the possibility of writing a guest post for Poorer Than You.

Have you connected your bank to Lending Club? If you didn’t have any problems getting the money then I will try it too.

I’ll be interested to see how it plays out from here. I would like to think that it’s a relatively safe investment and that the borrowers make good on their obligations, but it’s somewhat hard not to feel skeptical about p2p lending.

Maybe I’ll give er a try with $100 or so…

Thanks for keeping us updated on this process. I, too, am interested in the possibility of Lending Club, but am nervous about it’s true investment potential.

This way I can live vicariously through you!

I forgot to say thank you for the referral for lending club you sent me a few weeks back! Only problem is, the service isn’t supported in my state!!! When I checked it out I was sent to a page with a bunch of legal mumbo jumbo, not entirely sure what it was about, but they are making an effort to expand I guess. So just a word to anyone else about to try this out, check and make sure it is allowed in your state. I believe the info can be found somewhere on their FAQ page.

@MK – although you can’t use the main features of Lending Club, the “FOLIOfn” trading platform to buy notes. Once you buy a note on the trading platform, you own it and (from what I can tell), it’s the same as if you had been the original lender. Perhaps my readers would like me to experiment with this platform in a future post, so that we can see exactly how it works?

You wouldn’t happen to have any more referrals, would you? 🙂

@Regina – check your email! I just sent a referral link to you.

Hi Stephanie. I usually withdraw my earnings. I transfer back any new funds I want to reinvest in $25 increments. It keeps my accounting cleaner. I can see earnings and contributions easier.

Thanks again, but apparently Lending Club can’t let you invest in notes if you live in Texas. 🙁

I chose Alaska just to see if I could fake the state and it didn’t even check it against the city and let me proceed through the process to register as a lender, but I probably shouldn’t misrepresent my residency like that. Maybe they’d ruin all the fun and seize my account if they found out.

@Regina – yeah, I would not advise that you misrepresent your state. Again, have a look at the FOLIOfn Trading Platform on Lending Club – it’s slightly different, but from what I can tell, the end result is the same.

Awesome to hear it’s going well.

I’m trying it to, and I think this is rad! What I recommend to do is to set up a monthly or weekly deposit of $24 or $24.25, that way when you log into your account, you can lend to another person and keep growing your account. It’s almost like a side savings for me.

@Regina: The real concern is whether your state and the feds will consider it tax/investment fraud. Lending Club is registered with the SEC. The reason Lending Club isn’t available in all states is because not all states have agreed LC complies with their state laws.

There’s really no buyer for your notes, unless you sell for a loss. Recently, the number of people lending money have dropped off drastically. As for you paypal deposit, you have to use it all with LendingClub or they’ll lock your account out. Imagine that, having your account locked out when it’s not even in the contract.

A company that makes up new unadvertised rules with your money. You decide.

Is there any way to get a referral still? I am intrigued by the simplicity….

@Cody: Yep! Check your email. 😉