Buzz kill time! After five on-time payments, one of my Lending Club loan borrowers has just stopped paying the bill. I’d hoped this wouldn’t happen (of course I hoped this wouldn’t happen!), but it is sort of interesting to see how Lending Club handles it when someone stops returning their phone calls (literally).

When I logged into my account, I noticed it no longer listed my loans as “Issued and Current (2),” but rather “Issued and Current (1)” and below that, “Late 31 – 120 days (1).” Uh oh! So I checked in on it – August’s payment hadn’t gone through, and the one at the end of September had just “failed” as well. I’m not exactly sure what it means for a payment to “fail,” though. I suspect it might mean that my borrower had their payments set up as automatic withdrawals from a checking account, and when Lending Club went to take the money, there just wasn’t enough in the account.

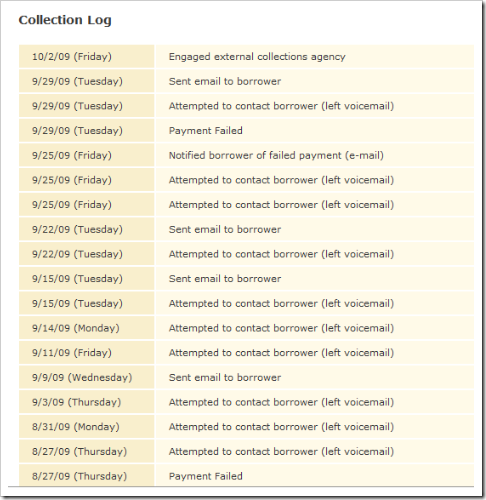

At the bottom of the loan page, Lending Club helpfully listed the actions they had taken, in reverse chronological order. Here’s a screenshot (if it’s too small to read, click on the image to view it full-size):

Of course, that “Engaged external collections agency” at the top doesn’t thrill me one bit. But it’s really nice to see that Lending Club has been doing a lot to try and get payments out of my defaulted borrower. It’ll be interesting to see what happens from here. If a collections agency buys the debt, will I get a portion of my money back? Or will the collection agency try to collect without buying the debt, and so maybe I’ll have to wait?

If the collection agency buys the debt for pennies on the dollar, I could be out 22 bucks in free Lending Club opening-bonus money. I guess I can’t feel too bad about it, especially when I know people not paying their bills is simply a part of life. But… dangit!

Defaults happen.

I’ve got a little more ‘skin in the game’ at Lending Club, and I’m nervously waiting to see what happens with 2 of my loans that are late – but they’re still in the ‘Late 16-30 days’ category. Hoping that they can get it together before it goes to collections, of course.

Regarding your questions, I got an email from Lending Club about a free online roundtable discussion about Credit and Collections at Lending Club that is occurring tomorrow evening at 7 – if you didn’t get that email and are interested, shout at me.

Thank Adam, I did get that email, but I have work right at that time. Maybe someone will go in my absence and take notes? 😀

I’ve yet to have a missed payment on any of my 5 loans but I hope I never have to experience it. Keep us posted Stephanie

That sucks.. but I guess that’s part of the game we play. I use Zopa (The UK version of TLC). If the debt collection agent buys my defaulter, I get about 20% of the outstanding amount if I recall. Not great, but better than a total wipe-out.

What were the specs on that note… A grade? I’m going out on a limb and will say C or less. Sorry about your loss. Glad you understand it WILL happen from time to time but that LC at least gave the borrower many opportunities to get back on track, come up with a payment plan, etc.

Great question – it was actually a “B” grade loan. When I signed up with my $50 bonus, I put $25 into this B-grade loan, and the other $25 into a D-grade loan. I was quite surprised when it was the B-grade one that stopped making payments!

B-grades seem to be a problem for me too. Of the 5 loans that have defaulted on me (out of 52 total) 3 were B-grade, 1 was C and 1 was D.

They do not give you an opportunity to get on track – they sent my 75% payment back to me.

That is a shame to hear. At least you know that persons credit score is going to tank because of this. But none the less it is a total bummer.

Yes, in fact, Lending Club has already reported a decrease in the person’s credit score. I don’t know if it is because of the default, or if there are a lot of things going on in the person’s life and they’re not paying several bills right now. Hard to say, but their score has indeed gone down.

Stephanie:

I’m happy you took the time to write about this topic. The reality is that, as you said it, “defaults happen”. It’s a natural and normal part of the concept and that’s why we put so much emphasis on diversification.

At Lending Club, we are really methodical (and effective I must say) about collections.

In fact, we are about to talk about Collections tomorrow on our weekly webinar that I recommend you attend:

http://www.instantpresenter.com/AccountManager/RegEv.aspx?PIID=E957DF8685

Check it out.

Rob Garcia from LendingClub

Thanks Rob, and thanks for stopping by! Like I said to another commenter, I can’t attend tomorrow’s webinar because I have a conflict with work. Will there be some way to view it after the fact?

So far only one of my Lending Club loans has defaulted, my Prosper loans are performing worse. Eh. I think I’m probably done with P2P lending, too many defaults. But I’ll leave the $1000 or so I have invested and see how it performs over the long run.

@Stephanie:

Indeed, we’ll post a recap within 24 hours of it happening for all to access.

Rob Garcia from LendingClub

That sucks! I’ve only been with Lending Club a few months and have about 25 loans right now, so far all are current but I know it’s just a matter of time before someone defaults. Had they made many payments before defaulting?

There were five on-time payments before they just stopped paying. It came as quite a shock!

I was afraid that this might happen. Are there repercussions in place that punish the non-payer?

Hey Stephanie – Sorry to hear about this. Given your experience, would you recommend a potential new lender like me lend?

Your deadbeat borrower could still decide to pay, so don’t give up hope!

It depends on what you want to give out of it, and how much money you want to put into it. Lending Club is one of those “I’ve maxed out my retirement plans, my emergency fund is in place, and I’m on track with my savings goals… now what?” things. No matter what, I’d say “diversify!” There’s a reason I picked one B-grade and one D-grade loan, instead of just finding one loan to put all $50 into.

I still think it’s a great service and that they run it very well. Obviously there’s risk, but that’s how investing works.

Hi Steph – Thanks for your thoughts. What about more money, such as $20-$50,000? Is this just too much to risk, if all your savings retirement etc stuff is in place?

I would love to get 10%/annum returns, but I also don’t want a binary goose egg!

I’ll be honest – I’m really not at liberty to make that call. The problem with peer-to-peer lending is that it’s just too new – we don’t have “historical data” on it. That’s not a knock against the idea or against Lending Club, that’s just the way it is. So, there’s no way for me to say “You’ll be fine as long as you put X percent in grade-A loans, Y-percent in grade-B…” or something like that.

But if really is just like any other investment – if it were me, I’d do some heavy research along with some soul-searching. I can’t even say off the bat whether I would personally put my money into it if I have $20k-$50k to do it. It would take some time for me to make that decision.

Sounds good Stephanie. I feel that there are a lot of other blogs out there pushing Lending Club… and I am very wary that Lending Club has gone out and decided to pay publishers money to hock their site and victimizing some folks.

Perhaps in 1 year, I’ll revisit and see how things go.

I hope you get your money back soon.

The screen shot is actually helpful. Lets others know good steps to follow in recovering money.

Then again, someone who has defaulted for so long is unlikely to just show up and say,”Sorry, here’s your money”.

I cant may a payments anymore to lending I just waiting for them to call me, do you think I can work whit them for a Settlement??? Or its better just not pay and go to collection?? No idea what to do my financials are bad.

Marc

Hi Marco,

I can only speak as a LendingClub lender and as a member of the general public, but if you are having any problems making a payment to any lender, you should call them and start working with them as soon as possible. They can’t help you if you don’t talk to them!

I have called lending club numerous times and have been told they won’t work with me. I am sure the actual person who loaned me the money would be more than willing to take something over nothing….what can I do to get them to re-vamp or lower my payments and help us both out?

Hi Heather. Sorry to hear they didn’t agree to work with you. I would keep trying to call them if I were you – you never know if a different rep might be able or willing to do something different for you.

And if you’re still not getting anywhere with other reps, you may want to ask them why they won’t accept a payment plan. Is it because they’ve already engaged a third party collection agency, and you’re talking to the wrong person/company now? That’s really the only reason I can think of off hand for why they would be completely unable to accept a payment plan from you, if they’ve already passed on the debt collecting to someone else.

Hello,

I am a borrower, I honestly never took out a loan before but me back was against the wall. So I just went for it now I’m in bigger debt then before. I’m literally paying $79 on my loan and almost $100 in interest. Sooooo not fair! Is there anyway I can contact my actual lender to see if I can continue making pays strictly to them only because I can not afford 2 more years of paying almost $200 a month. LendingClub wa complete rip off! Wish I did my homework and wasn’t so pressed for cash. Life is hard a I truly thank my lender but %65 of my monthly payments is going straight to LendingClub not my lender.

Hi Cindy, thanks for telling your story. I’m not sure what’s going on with your loan, but I can say that both principal AND interest go to the people holding your loan segments, and Lending Club only collects a small fee (from the lenders) from each payment. On any loan, you’d be paying much more interest than principal at the start, because of the way interest amortization works. The lenders who hold your loan are collecting that interest as payment for having given the money to you, and would probably not want an arrangement where you paid only the principal back to them, as that would be an interest-free loan, meaning they wouldn’t make anything at all.

I can appreciate that life is hard (believe me, I’ve been there, and a lot of what’s happened to me was chronicled in the early days of this very blog if you want to check it out). Right now, your best option would be to contact Lending Club to let them know that you are having trouble making the payments, and see if they can arrange a different payment plan for you. Not sure if they can do this, but since many other creditors can, it’s always worth asking. If not, you probably need to look into refinancing the loan to someplace else where you can afford the payments. The only way out of the debt without completely trashing your credit and having debt collectors come after you is to find a way to pay it off, either through keeping up with the Lending Club payments, or refinancing it elsewhere with a smaller payment and eventually paying it off there. If at all possible, if you can keep it at Lending Club and find some way to throw extra money at it each month above the $200 payments, that’s really the best way, but it sounds like that might not be feasible for you right now. And that, I do understand.