The Making Do project pays low income, unemployed, or underemployed writers and artists to contribute personal money stories to Poorer Than You. But what do we mean by “low income, unemployed, or underemployed?” Before this, it didn’t feel necessary to completely define these terms, and in truth we don’t hold a strict definition but rather let people self-identify when submitting to the project.

Still, many people want a way to gut-check that they “fit” our definitions of these terms, so on this page we’ll attempt to set up a framework for determining if you are low income, unemployed, or underemployed:

Unemployed

Probably the easiest one to define: if you’ve lost your job or are unable to find one in the first place (after finishing or leaving school, or trying to go back to work after taking time off to care for children or other dependents), then you definitely meet the definition of “unemployed.”

Underemployed

Underemployed is the weird murky area between unemployment and being employed. If you have a job but can’t get full-time hours even though you need them, you’re underemployed. If you have a job but it pays so poorly that you have to supplement it with side work just to meet basic expenses, then you are underemployed. If you are only doing gig work and struggling to make ends meet because you can’t find full-time employment that pays enough, you are underemployed. Any situation where you cannot get the amount of work needed to cover your expenses with some wiggle room – that’s underemployed!

Low Income

There are lots of ways to define low income, and it can get a little tricky! There are some obvious metrics: if you are at or under the poverty level, you’re definitely low income. Many government and private programs use 200% of the poverty level for your household size to define “low income” for subsidies and assistance, which certainly qualifies as well.

| 2021 POVERTY GUIDELINES FOR THE 48 CONTIGUOUS STATES AND THE DISTRICT OF COLUMBIA | ||

|---|---|---|

| Persons in family/household | Poverty line | 200% of Poverty line |

| 1 | $12,880 | $25,760 |

| 2 | $17,420 | $34,840 |

| 3 | $21,960 | $43,920 |

| 4 | $26,500 | $53,000 |

| 5 | $31,040 | $62,080 |

| 6 | $35,580 | $71,160 |

| 7 | $40,120 | $80,240 |

| 8 | $44,660 | $89,320 |

Source: Poverty Guidelines, U.S. Department of Health & Human Services

While folks with income within 200% of the poverty line are certainly all low income, I still feel this is an insufficient place to put a “cutoff,” as it doesn’t capture nearly everyone who I believe qualifies as low income.

When I asked around on social media for other people’s definition of a “low income,” I got a lot of answers that boiled down to “unable or barely able to pay for needs.” Family/household size came up a lot as well – whether you are supporting just yourself, a part of a working couple, and/or supporting dependents makes a big difference as to how far an income has to stretch, and therefore what should be considered “low.” There was also a lot of feedback that location matters heavily – which I agree with wholeheartedly. The same income that wouldn’t be “low” in a small town in the Midwest might be extremely low in New York City.

My definitions of “low income” attempt to take all three of these into account:

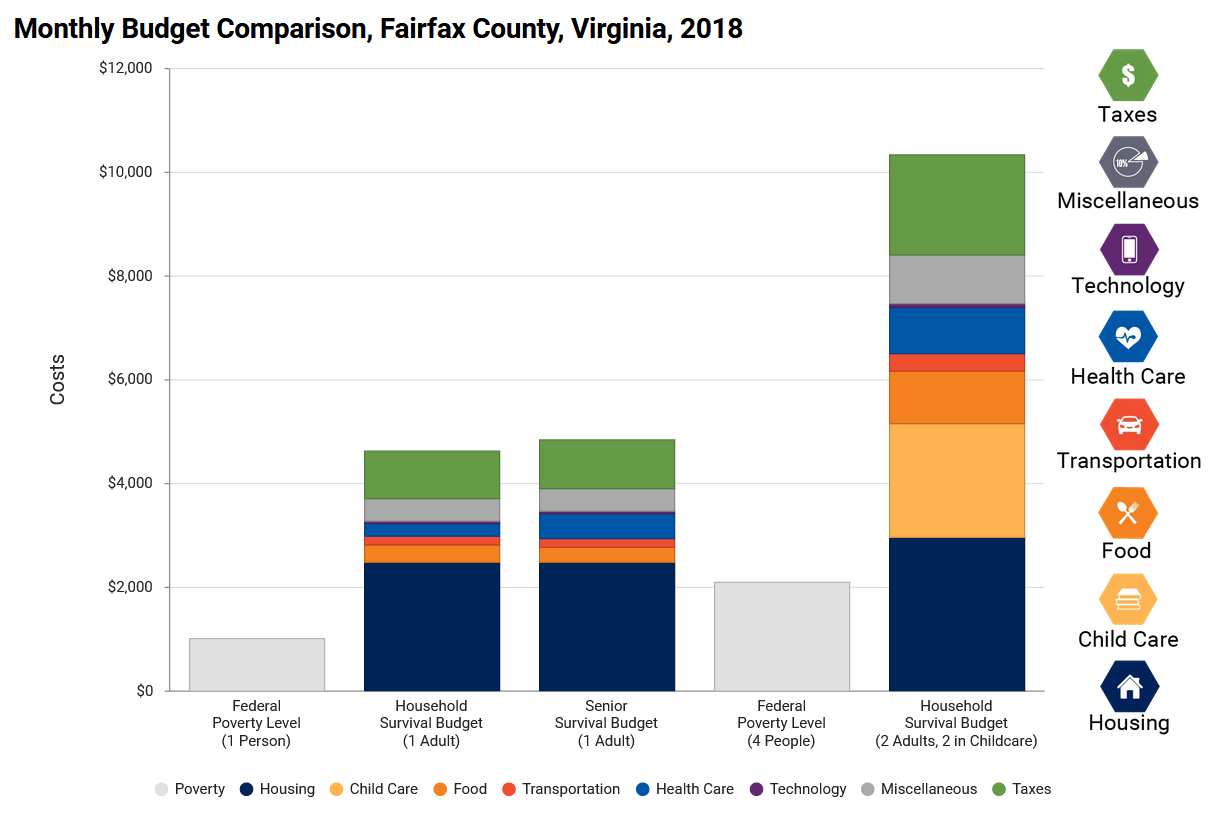

United Way’s ALICE Report Numbers

The United Way’s ALICE (Asset Limited, Income Constrained, Employed) reports give “Survival Budgets” for local areas across the United States based on the ages and situations of household members. The idea is that they’re coming up with a number for what basic needs (no savings) actually cost in each county. So if you are making less than the ALICE Survival Budget number for your location and household makeup, you’re struggling to (or unable) to pay for basic needs, which gives us an actual number for “struggling to make ends meet.”

To see your county’s ALICE Survival Budget number (if available – unfortunately, they don’t have numbers for every state), go to the ALICE website’s National Overview page. There, find your state in the “Select State” drop-down, click the “Household Budgets” button, scroll down a bit to select your county (or your county and the surrounding counties if that makes sense for your situation, such as you could be living in a county nearby with a longer commute).

I don’t agree with all the calculations that go into the ALICE Survival Budget, but I still feel like it’s the best number because it takes local costs, and household composition (not just household size, ie. “a family of four” but rather “one adult, one senior, one child in school, one infant in daycare”) into account. It also gives a framework for you to add or subtract things that don’t apply to you, such as additional household members, or in my case, altering the child care costs number to reflect that we’ve chosen to work fewer hours to forgo most child care costs.

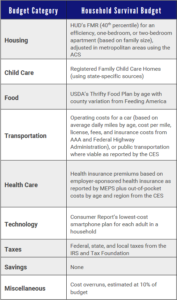

If the United Way doesn’t have an ALICE Survival Budget number for your location, you can approximate it yourself (though this is more work, of course!) by finding the reasonable basic costs of their categories for your situation and adding them up:

- Housing

- Child Care

- Food

- Transportation

- Health Care

- Technology

- Miscellaneous (10% of the household budget)

- Taxes

The ALICE Reports Methodology documents provide a chart for how they arrived at the numbers for each of these categories.

Another similar resource is MIT’s Living Wage tables, which seems to be more extensive in that they have all 50 states listed plus the District of Columbia. Their method uses likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities (e.g. clothing, personal care items, etc.) costs.

They give two income numbers: Living Wage, and Poverty Wage (and compare those to the minimum wage in that location). For the Living Wage, they define it as “the hourly rate that an individual in a household must earn to support his or herself and their family.” Once again, this is a pretty good working definition of the line where one would be struggling to make ends meet, so earning less than this can be considered low income.

If You Receive Support

Support can come in lots of forms – straight money, a free place to stay, free access to groceries paid for by someone else, schooling paid for, etc. If you are receiving any of this sort of support from a government or charity because of your income, it’s pretty safe to say you are low income!

But what if it’s coming from family or friends? In that case, we ask that you figure out the “market value” (how much you would have to pay to buy what you’re being given for free) of the support you’re receiving and add that to your income when evaluating your situation. So for example, if you are staying in a bedroom that your parents could be renting out for $400/month, you would add $4,800 ($400 x 12 months) to your yearly income for your new “total” income.

What If You’re NOT Low Income Like You Thought?

It really doesn’t say anything about you as a person, either way. But, one thing it does mean is that you would not be a good fit for contributing to the Making Do project. That’s okay! And of course everyone has something valuable to share with the world—we’d love to support you sharing your voice with the world even if you don’t currently fit the definitions for this particular project. There are other ways to contribute to Poorer Than You, as well! We accept guest posts for the site from those who do not (or no longer) fit the definition of “low income” so long as the writing is a good fit for the low income, unemployed, and underemployed audience.