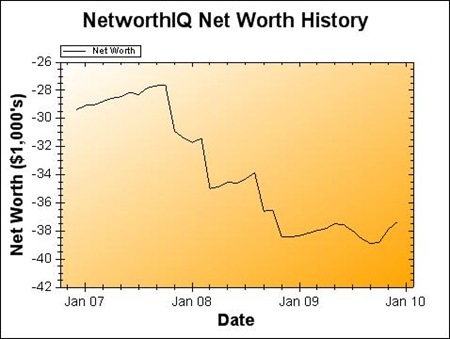

Happy New Year! The first of any month is an exciting time for me, because I’m a nerd and I love doing these net worth updates. (Data! Hurray!) But of course, the first of the year is always that much more exciting! This also marks a full three years of these updates — my first ever data point for this was December of 2006. On Monday we’ll do a walk down memory lane about how much has changed since then. But for now, let’s see what’s changed just since November:

Change: $511 or 1.35 %

Yay! Another upswing, thanks to my “big girl job” that I’ve been working since late October. My student loan debt is down, my savings accounts are up, and I even splurged on other people at Christmas. Well, splurged more than years past, anyway.

A few new things:

Occasionals Savings Account: I created another ING savings account for expenses that I don’t pay every month. My cell phone bill is only paid every six months, as is my car insurance. My renters insurance is paid once a year. So I’m putting aside a sixth or a twelfth of each of those every month into this savings account. I’m also putting a bit extra in there for a new cell phone when the time comes for that.

Lending club loan charged off: I’ll surely write a full post about this as a part of my Lending Club Experiment series, but the short version is that one of my borrowers declared bankruptcy and his loan has since been charged off. I’m down over $22 because of it. No big deal in the big picture, just worth noting.

2010? Oh, I really have no idea what will happen this year. No clue. Nothing is set in stone in my life right now, so 2010 will certainly be an adventure!

If you have any questions about my net worth or how it is calculated, feel free to ask them in the comments. Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Wealthy Blogger List. (Spoiler alert: the name of my site is highly accurate.)

You’re doing fine, Steph. The bleeding has stopped and that pesky line is heading back in the right direction. Yea! Keep it up!

Anyway, you’ve got plenty of years ahead of you to build that number up. 🙂

Personally, I evaluate my net worth only once per year (every January). For me, the month-to-month fluctuations are usually so small that it really doesn’t provide me with any real value added.

Then again, the nerd in me can also see why you like to look at the numbers from month to month. 🙂

Best,

Len

Len Penzo dot Com

For us chartists, looks like you found a bottom, hopefully you don’t re-test it. Great idea to take a notice of your networth and debt each year. Can’t dwell on the worth daily just take note of it here and there, great lil blog you have.

Congratulations, Stephanie; it’s always nice to have ready income. Before too long, you’ll have to change the name of your blog. Keep it up!