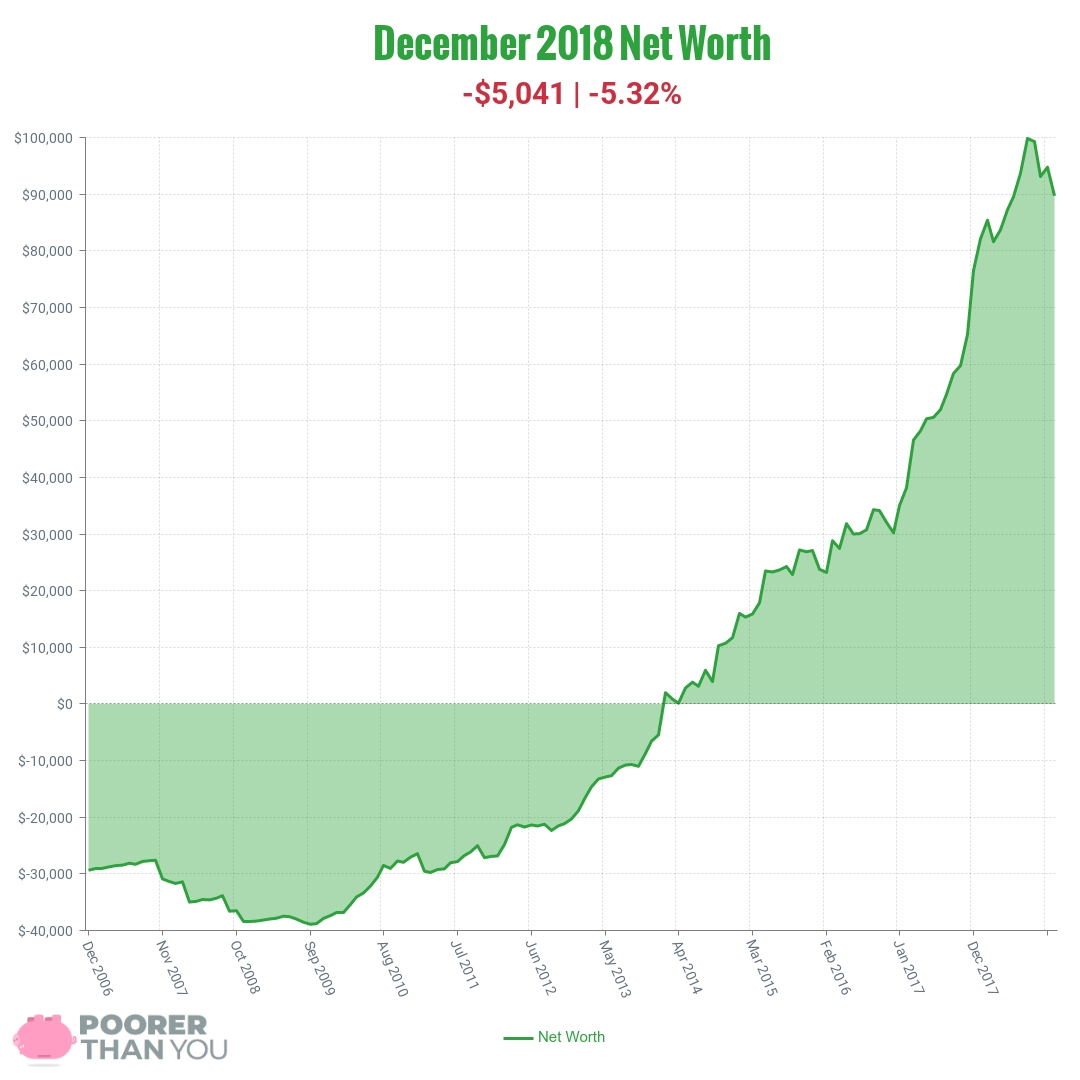

Happy New Year! The December net worth update is usually my favorite of the year, since it concludes not just another month, but of course the calendar year, as well. But, um, well… have you heard about the stock market this month? I had heard rumblings that things were down by quite a bit, but I don’t check my investments more often than once a month. So, I’m just seeing what all the fuss was about right now…

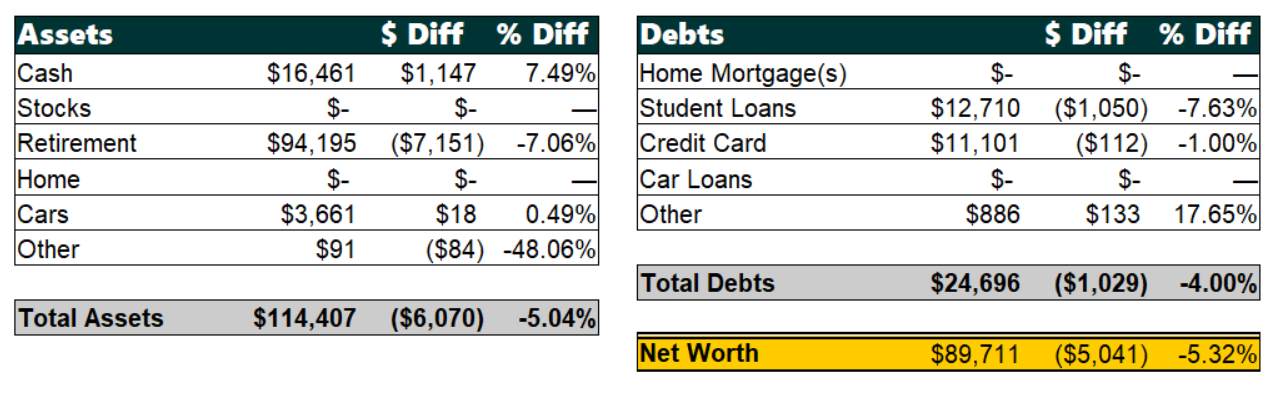

Change: ($5,041) or -5.32%

December Net Worth TOTAL: $89,711

Ugggggggggh! It really is that bad, isn’t it?

Ah, well. It truly doesn’t bother me that much.

After all, the market is out of my control. It’s not like I did anything wrong to tank my net worth by over $5k in one month. It just is what it is. And besides, we’ll be making our yearly retirement account contributions into our IRAs soon (would have liked to have done it sooner, but it’s, well, been quite a year). That means buying at this lower price, which isn’t a bad thing at all. Stock sale!

To the nitty gritty!

Cash: +$1,147

Nice. Worked a lot of overtime this month, though a big chunk of that won’t show up until next month, because it was in the last paycheck that hasn’t hit yet. But still, able to beef up cash a bit by working pretty much around the clock.

Cash will be the name of the game again as we continue to work on how we’re going to pay for $10,000 – $17,000 in dental work without raiding our savings. In that vein, a small amount of this cash increase is from selling some things on eBay. It’s sad to purge old video games in particular (especially the ones that used to help us raise money for charity), but we gotta do what we gotta do.

Retirement: -$7,151

Down more than $7k, despite the fact that I was contributing. Despite the fact that I made an extra $50 contribution into the HSA, because the IRS jerked the limit around during the year. All a drop in the bucket compared to whatever the heckin happened this month.

I don’t actually know what’s going on with the stock market. Partially, because I’m disengaged from nearly all media while parenting a small child and working so much. But also, because no one ever really knows until they have the benefit of hindsight… any news right now would just be speculating. And, it doesn’t really effect me, personally. I will continue to contribute, and in doing so, purchasing stocks that are at a discount compared to a month earlier.

Cars: +$18

No explanation, but I like that it actually gained value this month. Good car!

Other Assets: -$84

Well, sort of. The return that was pending last month actually got credited to cash. So that blip is done now. Weee!

Student Loans: -$1,050

Woo! That $1,000 payment I sent to pay off my Unsubsidized student loan hit, and here we are. Well, that plus my regular payment to the other loan. But the Unsubsidized loan is goooooooone!

Credit Card: -$112

Okay, so the Unsubsidized student loan isn’t really dead. It lives on in this 0% interest credit card debt.

Other Debts: +$133

Taxes for self employment, as well as insurance premium future payments, continue to grow. As they do.

Milestone Progress

The Milestone: $100,000 net worth. I was hopeful, for a long while now, that I would hit this by, well, now.

Instead, I’ve been pushed back to right around where I was in June/July of this year. Which is not so bad, really. It’s not where I wanted to be, but I haven’t actually lost any ground. (Hint: you don’t actually lose money in the stock market unless you sell when you’re down, and I haven’t sold anything.) I still own the same number of shares that I bought, and things will just keep keeping on.

The Milestone: Paid off Unsubsidized Stafford student loan. ACCOMPLISHED!

And thus why we get gifs in this post!

Now, someone somewhere will have been paying enough attention to say that this doesn’t really count because the 0% interest credit card debt that I refinanced the loan to still exists. But, so does the cash to pay that off, all allocated to that very purpose. So, I’ll take the win in 2018, thank you very much.

Wooohooo! Congratulations on “knocking out that unsubsidized loan”!! 0% credit cards exist for a reason. here’s to a wonderful 2019!

True facts! 😀

Those dental bills… ?

But HOORAY for student loan payoff!!!

It’s like booooo…ray! XD

Congrats on your milestone! I like seeing all these numbers. Thank you for being so open and honest.

I too have used 0% interest deals to pay off debt faster. That’s the only way I know of to get rich quick..er. 😉

Thanks,

Miriam

I know some of the setbacks are frustrating, but way to go on making headway in the cash and student loan sections. Sometimes you can only celebrate the wins (and hope the stock market rights itself).

So true! I know things will bounce back eventually. And I’m all for celebrating the small wins!

That graph is priceless. Way to go! You are really spreading a great message and living what you preach. Keep it up!