I’m officially declaring this “The Most Topsy-Turvy Month Ever.” Why? Because even though the worth of my assets went down in several key categories, the reasons those decreased were not bad; and even though my total net worth increased this month, the reason it did so is bad. Welcome to Bizarro World, folks!

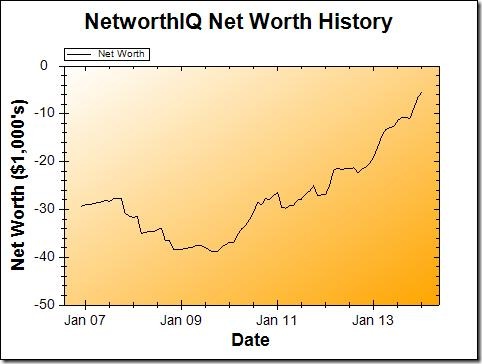

Change: +$1,117 or +16.96%

January Net Worth: -$5,469

The Good-Bad (Where I Lost Money)

My cash reserves went down by a staggering $3150 dollars in January. That’s because I finally paid out money for two things I’ve been saving up for: my upcoming vacation in Ireland (now paid in full!) and some wedding expenses. So no big deal there — I saved up the money, then used the saved money to pay for these things. Awesome.

My retirement accounts also lost just north of $500 over the month, but that really doesn’t bother me. The markets are down as a whole, so it’s not surprising. I’m in it for the long-haul when it comes to retirement, anyway, so a one month swing is not really a problem.

The Bad-Good (Where I Made Money)

It makes me extremely nervous and anxious to even write about this. It’s not that I did anything wrong — it’s just because it’s a very uncomfortable situation.

The “Other” line of my assets on my net worth balance sheet is now sitting at $4,465. Some of it is my Lending Club account, which grew a little over the month. Some of it is my fiancé’s half of the rent money, which I forgot to collect from him in January. Those things are fine — good, even.

But the rest of that money is an uncashed check for my accrued PTO (Paid Time Off) from my job, because I was laid off at the end of the day this past Friday.

It’s tough. Obviously, I can’t say much about what happened, but I can say that I am still very emotionally raw. And being unemployed affects everything in my financial world: the wedding, my upcoming trip to Ireland, my Emergency Fund, my retirement savings, my “positive net worth by September” goal, my ability to make payment on my debts (student loans and car payment), my ability to make rent… it’s all in varying amounts of jeopardy in the foreseeable future.

But I’m trying to stay positive and, most of all, proactive. Here’s my current Emergency “I’ve Been Laid Off” Money Plan:

- Halt all wedding plans that include an outlay of money. I have some DIY projects I can work on that we already own the materials for, but anything that involves spending money? That’ll have to wait. I was about one day away from ordering my dress, even. The only thing I will make an exception for is anything surrounding the “legal” parts of the wedding — the marriage license/officiant — because the marriage is happening no matter what our money situation is!

- Halt all retirement savings (outside of a savings account). I have a high-yield online savings account specifically to catch money before depositing it into my Roth IRA. But putting money into the IRA itself would freeze up that cash, which I can’t risk right now. Still, I can put some money aside in the savings account, where it’s still perfectly “liquid.” When I get a new job, then I can make the transfer from the savings account to the actual IRA, if I haven’t used up that savings.

- No eating out, unless it’s a networking meal. Gonna have to cancel some dinner plans this week, because I need to stretch the money I have for an indefinite amount of time. But I will absolutely make an exception to take someone out for lunch or coffee to discuss my job hunt.

- Apply for Unemployment Insurance payments. I’m actually half done with this step — I started the application the day after I was let go. Just need to update my résumé and upload it.

- Make job-hunting my new full-time job. Not only does the Commonwealth of Virginia require that I do this to qualify for unemployment; it’s just common sense. My job right now is to find a new job.

Needless to say, if you know of a company looking for a spunky, energetic spreadsheet wizard with strong merchandise planning, company culture, and customer service experience, contact me.

Man, sorry to hear about the layoff.

My wife was laid off in 2009. That is rough.

My wife and I got married in the middle of a short-sale on our home. So, I am with you in that regard. Stay positive.

Thanks for posting. Good luck to you!

-Derek

Thank you for dropping by, and for your kind words, Derek! 😀