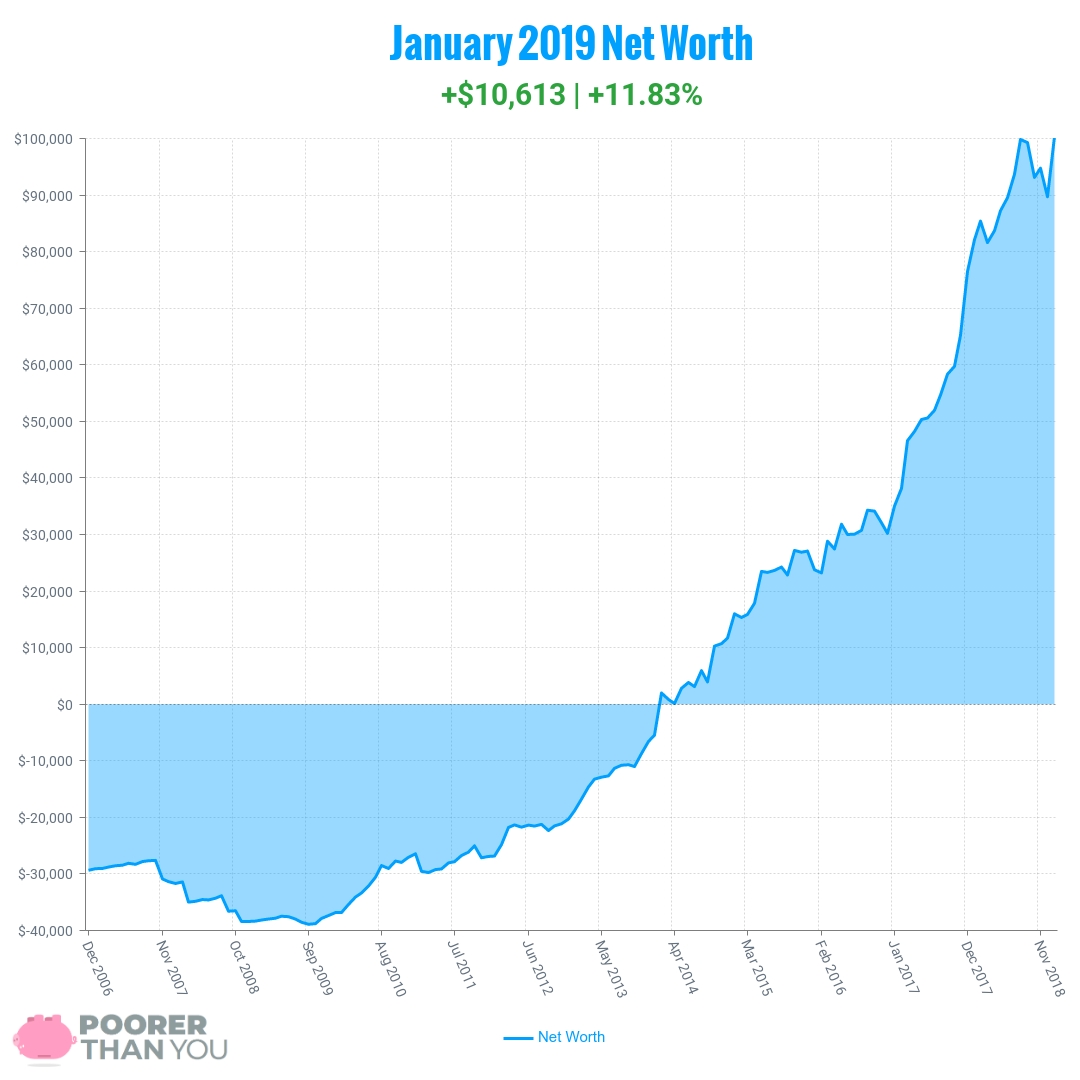

One of the things that’s clear to me from tracking my net worth over the years is that most of the time, growth is pretty slow-going. Sometimes, there are setbacks and the growth feels even slower. Then, you’re just trying to claw back to where you were a few months ago. Last month, when I slid back to more than $10k away from the coveted $100k milestone, I steeled myself for months of slow growth to get there.

But then I was like, NAH WHATEVER LET’S JUST DO IT RIGHT NOW.

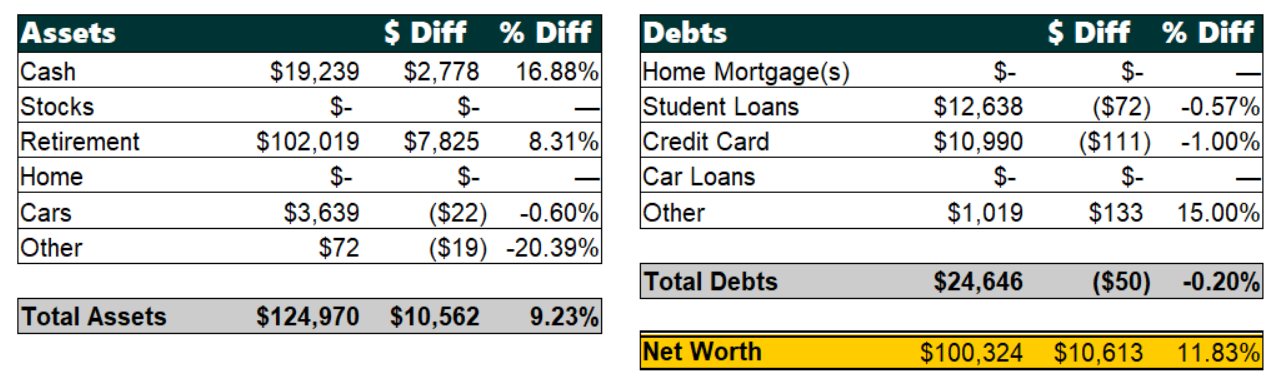

Change: $10,613 or +11.83%

January Net Worth TOTAL: $100,324

I did it! So we get gifs!

Well, more gifs to come. Let’s just get started with talking about how I pulled off this momentous feat:

Cash: +$2,778

I mentioned last month that my final paycheck of 2018 (with the gobs of overtime from the holiday) hadn’t hit my account yet, and now it has! Plus an unexpected bonus. And, we’ve been selling lots of video games on eBay this past month (trying to list about 10 a week, if we can), so that’s a good chunk of the cash, too. A $300 bonus for opening a Chase checking account certainly didn’t hurt, either! (I’ve been keeping track of potential cash bonuses for bank accounts and credit cards in this document, if you want to have a look.) Cash hoarding to pay for dental work continues!

Part of the reason cash is doing so well this month is that the actual dental work has been delayed, again. This time, I came down with a cold right when my wisdom teeth were scheduled to be removed. So we’ve pushed that expense (and all the ones that will follow, like a possible root canal and then the braces) into February and beyond.

Retirement: +$7,825

Made back all of last month’s “losses” and then some! A lot of it was just simply the market recovering. But, also, I increased my HSA contributions (the new limit for 2019 is $7,000 for a family plan!), and was able to put aside a bit to go into my IRA, even. (On top of putting aside the rest we needed to max out a 2018 IRA for my husband, but that doesn’t show up in these numbers as I keep his net worth off the blog. But he’s taken care of as of this month, too.)

Cars: -$22

Other Assets: -$19

Lending Club not doing so hot, as usual. Been continuing to pull my money out, as I remember to.

And now, the debts!

Student Loans: -$72

Okay, I have a bone to pick with this one. Some of you may remember that just last month, I sent off a $1,000 payment to my loans in order to knock one of them out, and thus free up its payment to pay for my orthodontia financing. Well, color me surprised when my student loan servicer decided to step in and ruin that plan.

For whatever fun reason, they decided that if I paid off one of the loans, then the repayment plan on the remaining loan would need to be recalculated. And, because my original repayment plan is no longer an option… they put me on a new one that has the loan paid off sooner, increasing my minimum monthly payment for the remaining student loan.

Technically, this will have the loan paid off sooner and I will pay less in interest. But, it does somewhat defeat the purpose of why I paid off the other loan. So I’ll need to find somewhere else to free up more than $20/month in cash flow. I’ve already cut Netflix and Hulu, and there isn’t much left to cut. Le sigh.

Credit Card: -$111

Now here’s a place where the above missing cash flow could come from. The last payment before the 0% promo is up is June, and then this payment will go away when I pay it all off in one fell swoop. I could pay it off a bit sooner, but I’m using the cash to earn bonuses which are helping to pay for the orthodontia, as well.

For now, since I’m not yet making payments on the braces (since they’re not on my teeth yet), the cash in the bank earning bonuses is much more valuable than the cash flow from paying off the card. (Again, because the card is at 0% interest.) It’s a delicate balancing act, but for now, I’ll just keep making the minimum payments.

Other Debts: +$133

Eh, it’s just the ol’ life insurance / car insurance 1-2 punch, as my obligation to pay each grows each month. Car insurance is due next month, so this will drop a bit then.

Milestone Progress

The Milestone: $100,000 net worth. FINALLY DID IT!

It feels like it’s taken forever to get here. Especially after brushing so close—within $200!—back in August.

And yet, here we are. And in reality, it’s been just shy of 5 years since I crossed the $0 net worth line. $100,000 in net worth growth in 5 years is a pretty good clip, I suppose. Zach over at Four Pillar Freedom explains why this whole $100,000 thing is a big deal. I’m just glad to keep moving on up from here!

New Milestones! Since I keep blowing past milestones here, it’s time to set some new ones to look forward to:

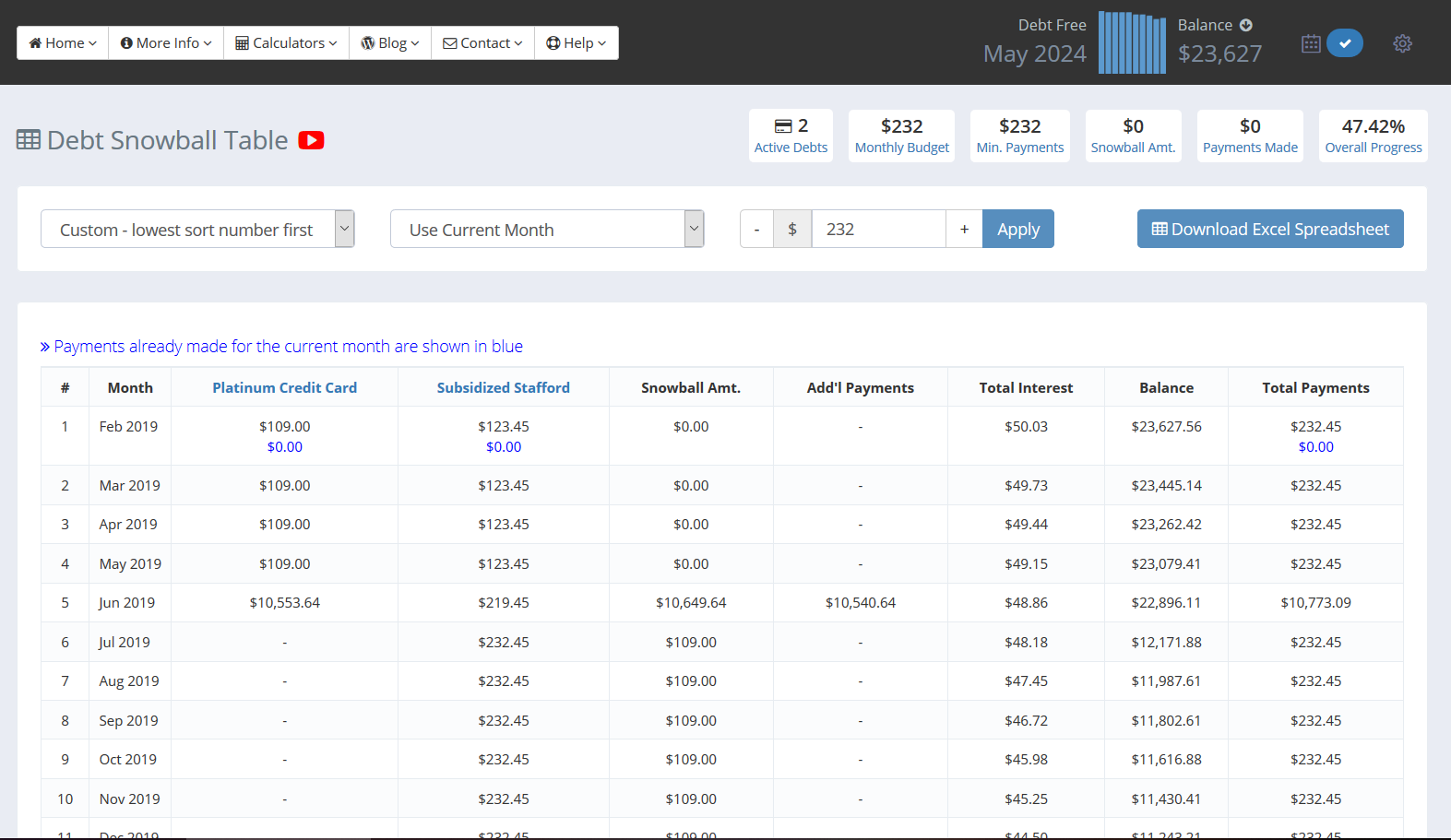

Debt Freedom: This has never really been a goal of mine (I prefer to let my low-interest debt ride while I work on investing goals/milestones), but it is coming onto the horizon anyway. At points in the past, this has been projected at happening in 2019 (this year!), or by the end of 2022. But the news of how much our dental work is going to cost has pushed that back to 2024, or maybe even beyond.

So debt freedom is on the horizon… somewhere. We’ll have to wait until all this oral surgery and such is done to see where it will really shake out.

$200,000 in Retirement Accounts: This one is a ways off, as well, but worth mentioning as the next goal. The first $100,000 in retirement accounts took me 9 years and 5 months (from the time I opened my first Roth IRA. I won’t bother to count the extra year and a half before that where I was saving $5/month in a savings account to open that IRA!). The next $100k shouldn’t take nearly that long, thanks to compound interest. I’d love to hit it in just a few years, but realistically, I’d be happy hitting it within 5 years, given how long the first $100k took. So, by 2024 as well, for this one?

Ugh, 2024 is so friggin far off. I need some milestones that are closer to now.

Bonus! Celebrating Other People’s Milestones

Let’s share the wealth, somewhat-literally! Some other people in the personal finance internet-o-sphere are celebrating milestones, as well:

Rich from PF Geeks: Broke $75k net worth! At the time he set the goal for himself, it was a “reach” goal, so congrats to Rich for making it before the end of 2018!

Chad Methner of Little Brother Life Coach: He’s got only $350 left on his very first, 10-year-old student loan to pay off! And he’s moving closer to a positive net worth—he’s now within about $20k of moving into the black!

Annie from Champagne & Capital Gains: She had some milestones to share with us on Twitter:

I hit my $50,000 investment goal in 2018 and got my student loans under $300k! A long way from $100k net worth but trending up for sure ?

— Champagne & Capital Gains (@champgains) February 5, 2019

A Purple Life: Celebrating a new all-time net worth high! (I’m not jealous, I’m not jealous…)

https://www.instagram.com/p/BtUSaynjqfx/

Awesome job, everyone!

Congrats on passing the 100K mark, keep up the good work, was curious if you have 20K in cash why you haven’t paid off your credit card?

Because the credit card is at 0% interest, and the cash can earn me $300+ in bonuses every few months. More on that within the Cash and Credit Card portions of this very post.

Congratulations!

Thank you!

You go, girl! *throws confetti*

Yay! *dances in confetti shower*

Hey Stephanie, this is really fantastic work and a great milestone! Six figures in five years is not easy. Best to you!

Thank you, John! I’m really glad you stopped by – I appreciate having friends from “the olden days of blogging” here in the comments. You’ve been around for this whole journey, pretty much! 😀

Congrats!!! This is awesome!

Thank you!!

Gahhh how frustrating about the student loan recalc!! But CONGRATULATIONS on that $100k!!!!!!!

I know, right!?! I don’t know if I would have paid that extra amount to them (as opposed to keeping that $1000 in cash) if I had known that they were going to demand like an extra $25/month in minimum payment on the remaining loan. Harrumph!

And also, thank you!

Nicely done! Breaking $100,000 in net worth is no small goal! I think it’s awesome that you are paying down debt in a responsible way while keeping your eye on the prize. Thanks for featuring some other bloggers too. I generally think I’m informed on things through twitter (ha), but there are people here I’ve never heard of and now I’ll go check them out. Best of luck with the wisdom teeth!

Thank you! I love featuring other people’s milestones, and I’m glad I could introduce you to some new people! (Funnily enough, I got these milestones to share from asking on Twitter… maybe I need to be retweeting more? 😀 )

This is the most exciting of things!! So happy for you!

Thank you, Moriah!