Just a quick update this month because my brain is just a goo mush right now. We started potty training our kiddo the other day and I’m seriously questioning the nature of my reality. I know this is off-topic but, seriously? Is this how we learn to handle our bodily functions? I’m honestly surprised that anyone is capable of learning how to use the toilet. This process is bananas.

So, rather than talking about urine at all (because that’s the only topic of conversation in my home right now), LET’S TALK ABOUT ANYTHING ELSE, OH HEY NUMBERS ARE A THING, LET’S DO THOSE:

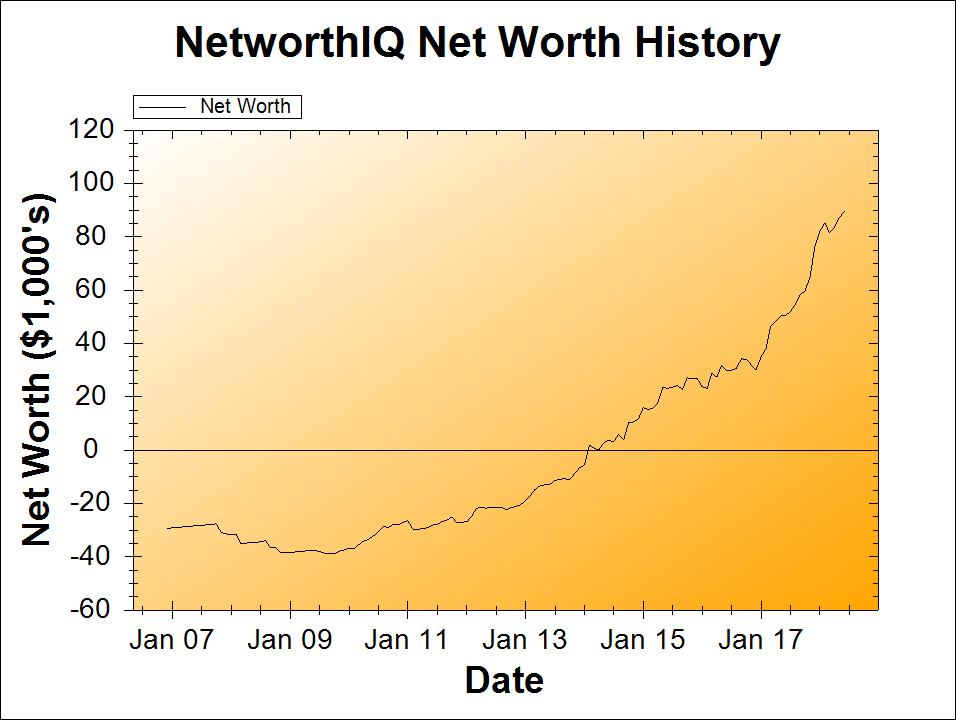

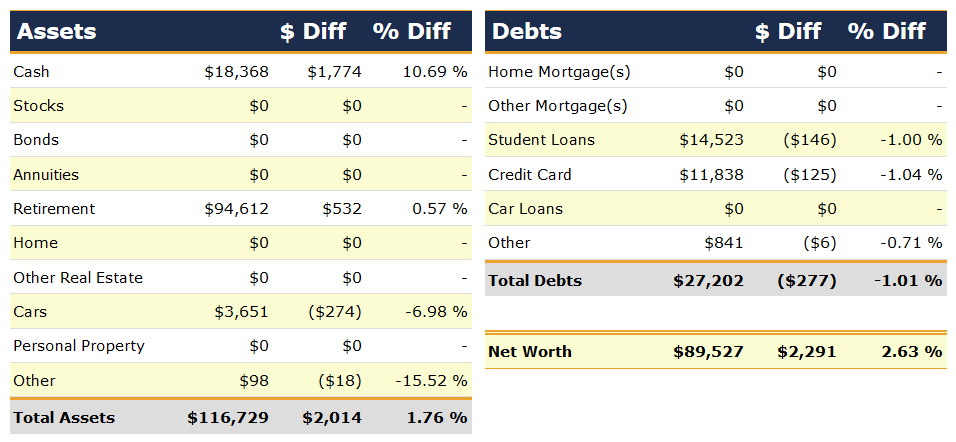

Change: +$2,291 or +2.63%

June Net Worth TOTAL: $89,527

Not amazing, but not too shabby, either! Let’s dig a bit deeper into the numbers.

Cash: +$1,774

Still hoarding cash, begrudgingly. Unfortunately, as of yesterday, one of the two 5% interest savings accounts I was using no longer exists (the other one still does, though!). So I’ve got to figure out a new place to keep the majority of my cash savings and still get a higher-than-inflation return. I wanted to get that taken care of this month, but, well, it ended up being a busier month than I anticipated.

Not too many large, unexpected expenses this month. Two medium-sized ones, though. The first one was for new rear brakes on my trusty Camry. I took the car in for the yearly inspection and it failed thanks to brakes that were worn down almost to the metal. Uh, thanks car. Thankfully, they were having a special on brakes at my mechanic, and I do have my generously-funded Car Maintenance Fund, so it was fine.

The other medium-sized expense this month that popped up were tickets to the Cents Positive Retreat this November! Cents Positive is a short retreat happening in Denver this November, and it’s “A Safe Space for Women to Talk Money & Financial Independence.” This will be the first ever Cents Positive Retreat, and my first trip to Colorado, so I’m pretty pumped about it. Also, there’s going to be a fascinator/onesie party, so the only question I really have is should I get a new fascinator to go with my Stay Puft Mashmallow Man onesie, or is it cool to wear my Star Wars fascinator with it?

At the time of this writing, tickets are still available for the Cents Positive Retreat. If you are a woman over the age of 18 (including trans women and nonbinary people who relate more to the female experience), check it out and maybe I’ll see you there!

Retirement: +$532

The markets must be holding pretty steady, because this is pretty much exactly the amount I put into retirement this month. Nothing special this month (as I continue to hoard cash), just the regular automatic HSA contributions from my paychecks.

I did send my HSA administrator an email asking for the “trustee-to-trustee transfer form” (ooo, fancy) to transfer my old HSA account into the current one offered by my employer. When I finally get this transferred, I’ll be saving ~$6/month in fees. The only downside is that I have to wait for that email with the form, because they took the form off the website recently for some reason.

Cars: -$274

Mysterious are the movements of the Kelly Blue Book value of my car! It hardly matters since I’m not planning to sell it anytime soon (ever?), but of course it’s funny to have put hundreds of dollars of maintenance into the car, and have it lose hundreds of dollars of value at the same time. Thanks car. You’re really helping me out here.

Student Loans: – $146

Still nothing special going on, just the minimum payment. It is really nice how much more of my payment goes to principal now thanks to my “credit card refinance.” I do enjoy seeing the larger principal payoff each and every month!

Credit Card: -$125

Also nothing special, just the minimum payment again. Well, technically, it’s a bit more than the minimum payment, because for some reason, I can’t get ebills for this card in my checking account. Just this card in particular. I have other Bank of America credit cards (which I pay off in full every month, if I use them), and those have no trouble delivering ebills to my checking account. Harrumph.

Hardly matters because the card will be paid off in a year anyway, but it means I can’t set the checking account autopay based on the actual minimum payment. So right now I have it set to do another year of straight $125 payments, even though the minimum payment will go down each month. Whatever, this is some serious in the weeds minutia. But it bugs me!

Milestone Progress

The Milestone: $100,000 net worth. Less than six months left to achieve this one! Thankfully, I made more than enough progress this month. I just need $1,745.50 in net worth growth every month to get there by the end of the year. Can we do it? YES WE CAN PROBABLY. DON’T OVERTHINK IT.

Other Milestone: $100,000 in retirement accounts. Ugh, it’s sooooo close that all I want to do is post a bunch of “give it to me” gifs. But the rule around these parts is that I can only post gifs when we hit a milestone. I will need a little help from the markets, or a big push into retirement account contributions, to get there by the end of the year. Thankfully, the latter is within my control and is, of course, the plan.

Hooray! And how will you ever decide about the fascinator? I think you could totally make what you have work, but… 😉

Isn’t KBB weird? I used to look fairly regularly but then I decided I’m driving my Camry until the wheels fall off. So I pretty much ignore it. Ditto with our house.

So excited that you’re going to the Cents Positive retreat. I will be living through everyone on social media and in posts!

I found this post very informative and interesting! It’s fascinating the different ways people manage their finances! And it looks like you’ve got a great system for getting on top of debts and getting ahead in the long run 🙂

And for the credit card, celebrate the fact that you are paying it off quicker without having to change the amount you pay, rather than being frustrated by the slight inaccuracy 😉

Oh, and as for the potty training (from a non parent who has worked with a lot of kids, so feel free to take it or leave it!) don’t rush it. If you try to make it happen before they are physically and emotionally ready there will be a lot of tears (from everyone!) but when they’re ready, it tends to just happen! That’s not to say don’t try, just don’t push it if it’s not happening yet 🙂

Thanks! That’s the thing though, about the credit card: I don’t wantto pay it off quicker, because it’s at 0% interest! I know it’s only a few pennies probably, but I’m losing interest in my savings accounts by sending that money to the 0% interest credit card early. Not enough money to get me to manually fix it each month, but enough for me to go “curses! I wish this were automated correctly!”

And the potty training thing, well, I’m taking a different approach to it than that, but thank you for the advice anyway. If you’re curious, I learned about this method of early potty training from the Mama Fish Saves blog, from her post The Economics of American Potty Training. Long story short, I think most Americans wait too long to start potty training, compared to how much of the rest of the world does it. But different strokes for different folks.

If it’s not obvious, I mirror my site after yours, and I think that’s for good reason: your writing is clear and sharp yet full of personality. It isn’t bogged down by data — but doesn’t shy away from it either. It’s quality stuff, and I think you deserve WAY more readers than you have.

But, as you probably know by now, people reading financial blogs only care about a few things: How much money does he/she have? Is he/she FIRE? Am I better than him/her?

Those readers are on their way when the answer is “HOLY SHIT SO MUCH MONEY.” It’s been fun to watch you dig your way out of debt. Soon you’ll be in the six-figure club and soon after that you’ll be in the seven-figure club (if that’s your ambition).

I’ll be here. Silently lurking, comparing myself to you, and, of course, occasionally commenting. Good luck!

Also I made a Personal Capital account. When do we get our $20?

Nvm, got it