I sincerely hope you enjoyed yesterday’s April Fool’s Day prank, and that if you did fall for it, you’re not pissed at me! Yesterday’s post was a heart-wrenching goodbye that was 99.9999% true. That’s the key to a good April Fool’s joke: plausibility. Everything in yesterday’s post was true… except for the conclusion that I’ll stop writing.

Because honestly, I’m not smart enough to know when to quit. Lucky for you, I suppose 😉

Plus, I have some truly HOT news to share in this month’s Net Worth Update, so it’s no time to quit writing now!

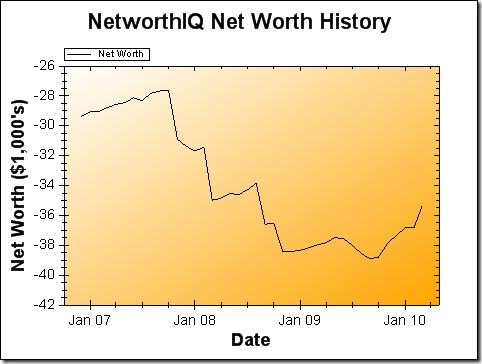

Change: $1,427 or 3.87 %

Booyah, buckaroos! Look at that little line on the end of the graph there, trying to shoot straight up toward the sky! Do you know what that means? I worked a ton of hours in March and didn’t buy much. But, it gets even more exciting because…

I opened a retirement account last night! Okay, that was supposed to be a lot more dramatic than it looks typed out. Only big money-nerd types like me will be wetting their pants at that statement. But I’m ready to declare it a big F’n deal, myself. I’ve been stating my desire to open a Roth IRA since the earliest posts on this blog and, three years later, I’ve finally done it.

And, because I did it before April 15th, I opened the account for 2009, which means I can still contribute up to $5,000 for 2010 this year (on top of the $3,000 I opened the account with last night). Those of you curious-cat types will be interested to know that after years of research and careful consideration, I decided to open my Roth IRA with Vanguard. Low expense ratios and tasty tasty index funds? Yes please!

Things are not perfect (see yesterday’s post re: work/life balance), but they are starting to come together. I still have to rebuild my emergency fund following my last car repair. I also give some consideration to how aggressive I want to be with my retirement fund now that I’ve passed the first hurdle (the $3,000 minimum to buy into the index fund I wanted).

But I crossed a major checkpoint last night, so for a few days, I’m just going to bask in that.

If you have any questions about my net worth or how it is calculated, feel free to ask them in the comments. Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Wealthy Blogger List. (Spoiler alert: the name of my site is highly accurate.)

I like it! Great job turning the corner and shooting for the sky!

I fell for it! I almost took you off my rss list! 🙂

Great April fool, as you said the key is plausibility.

Good job!

Glad to hear it, way ahead of me! But I’m still learning. One day I’ll shoot for the sky, just building my rocket. 🙂

Have a great weekend!

Matt

Nice move on the Roth IRA with vanguard funds 🙂

Hey,

Sounds like you really got a few people on the 1st. I’m sorry I hadn’t seen the post and been one of those duped so that \I could have had a good laugh about it afterward. I think I might of been upset if you left as well, judging from your sense of humor. I wish we’d thought to do an April Fool’s day joke on our readers mixed in with some tips on budgeting which could have been, as you say, 99.99999% true.

Thanks for the levity,

Guy

Keeping up a blog is a lot of work. It’s difficult to keep up with interesting, well researched posts each day. I’ve just subscribed to your RSS feed so keep the info coming!

as we like to say, You are in a V shaped recovery. Keep up the good work

awesome prank that!

I didn’t know that Vanguard had low expense ratios and “tasty tasty index funds”. I am thinking of opening a retirement fund myself, now, because the words “low expense” and “tasty”, repeated, made me dream of a better world. Thank you for the useful information and especially for the way you’ve described it.