IT’S BABY TIME! This November saw the birth of my first child (and of course, only child at this point!), and during the whole pregnancy I’ve been anxiously wondering what would happen – with the baby, and with my finances. Between being self-employed (so no paid maternity leave), being on “Obamacare” health insurance, and knowing that kids cost an average of $13,000 per year on top of such things… it’s been a bit daunting just to get to this point. But, here we are, and we can now mark the official beginning of the kid’s effects on my net worth.

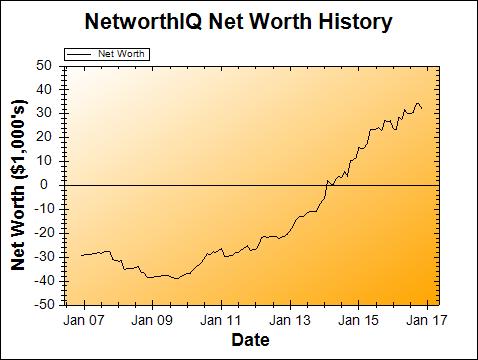

Change: -$2,058 or -6.03 %

November Net Worth TOTAL: $32,075

You know what? That’s not too bad! Now, this is just the beginning – not all of the hospital/doctor bills came in by the end of November, and we’ve got years of diapering, feeding, schooling, and affected income to look forward to. But encouragingly, the biggest portion of the drop this month was due to me not working – meaning that even though my net worth went down, I didn’t have to dip into my savings (yet) or take on any new debt.

December will be a different story on that front – I’m still not able to work (as previously mentioned, because the newborn requires constant care, daycare prices in my area are sky-high, and I would not have a place to pump breast milk if I did work outside the home right now), so I’ll be tapping some savings (that were put aside specifically for this time period) to pay the bills. I’ll also be taking a big chunk of money out of my HSA to pay all the hospital/doctor bills from the birth, which have started to really pile up in December. All things that I knew were coming… but still, they’ll hit hard in December.

I was also buffeted somewhat by what appears to have been a rally in the stock market. This is actually the first time I’ll be recognizing such gains more than just on paper – by taking money out of my HSA to pay the hospital bills, I’m “selling high.” Though, it’s not intentional: the market just happens to be up at the very time I’m selling and taking the money out. But I won’t be taking everything out – I’m still leaving as much as possible in the HSA investments, and I’ll even be trying to contribute more when I get back to working.

Fittingly, that’s all there really is to say about this month: I had a baby. My net worth went down. Those two things are very much related.

And now, I think I hear a baby starting to wake up in the other room… so we’re out of time, anyways. 😉

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!

Your employer has to provide you with a place to breastfeed or express milk during your working hours.

https://www.dol.gov/whd/nursingmothers/

Hi Jennie! Thanks for the comment, but unfortunately, that does not apply to my situation. I’m an independent contractor, so I have a client, not an employer; and my “place of work” is a one-room workshop where it would not be food-safe to pump, and there is no privacy or ability to create a private area.