This month, I pulled my credit report to review it. You know, from AnnualCreditReport.com (the only free authorized source), like you’re supposed to do every four months or so. I’m happy to report there are no issues, but it started the ball rolling on something for me. A challenge, you might say.

But first, the numbers:

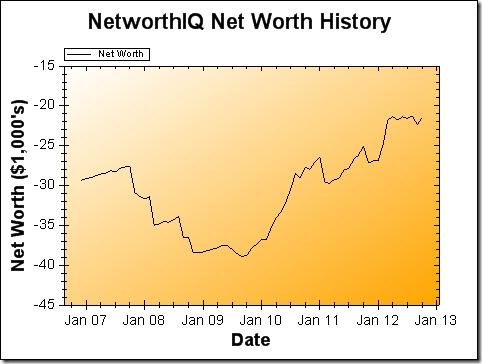

Change: +$818 or +3.66%

Preparing for September 16th, 2014

As I finished up my tally of October’s net worth number, something just clicked. I had a thought: that my net worth is currently hovering around “the highest it has ever been.”

Except that’s not even true. Which is why I had to put “air quotes” around “the highest it has ever been.” Because it’s not the highest my net worth has ever been. The actual highest would have been in high school, when I had money in my pocket (and savings account), and no debts whatsoever.

September 16th, 2004. That’s the date, according to my Experian credit report anyways, when my net worth took its first of many nosedives. When my very first student loan went into effect and suddenly I owed a lot of money to the US Department of Education. For the next four years, my net worth took a tumble every few months as I added on quarterly loan disbursements to fund my Bachelors of Science degree.

(Don’t you just love the fact that Bachelors of Science is abbreviated to BS? I know I giggle every time I think of that!)

It finally, finally ended in November of 2008 when I took out my last student loan, and my loan balances hit their all-time high of $43,667. It was basically all I could talk about in that November 2008 net worth update — I was so excited to finally be at the bottom of the student loan ravine, even though I knew it meant I would have to start the many-years journey up out of that. At least I had hit the bottom, finally.

Amazingly, it’s been four more years now. Since hitting an all-time low net worth of negative $38,901 in September of 2009, things are looking way, way up. I’ve steadily improved my situation to the tune of a $17,385 gain over three years. That’s pretty good progress, but I like more of a challenge.

September 16th, 2014 will be ten years since that first loan, which started my long windy path of debt (and my credit history!). By that date, I’d like to be in the black, as they say — in other words, to have a positive net worth. That’s doesn’t necessarily mean paying off the student loans themselves — after all, at 4.75%-5% interest rates, they’re not the biggest bang I can get for my spare buck. But however I get there, a positive number is the goal.

22 months to squirrel away $21,516. That’s $978 per month. The only way to get there? I have to spend $978 less than whatever I earn each month. That’s it. Simple! Just have to earn more, or spend less (or, most likely, a combination of the two).

Simple, but difficult. As any good challenge should be.

And hey, that magical day, September 16th 2014? It’s 10 days before my 28th birthday. So, I figure nothing will help me deal with the fact that I have been an adult for an entire decade like a positive net worth.

Hopefully.

Good luck! I have enjoyed reading your updates for the past few years. As I approach graduation, I will owe much less in student loans than you, but I still face an uncertain job market… and am considering graduate school, after a bit of a break. After finally getting my credit rating back up to “fair” after medical bills stomped it into nothingness, I am already trying to figure out how to maintain it when loan payments start being due… fingers crossed for a job that’s NOT in the service industry after I graduate!

I look forward to hearing details about how you meet your personal challenge!

I read the update posted from you regularly, please keep posting. It helps me a lot ….

I’ve genuinely enjoyed reading your website posts. Thankyou!

This is a great goal to have and I hope you achieve it. I graduated with my MBA when I was 24 and didn’t pay off my student loans until I was 42!!! Yes, I stretched it out as long as possible to take advantage of the very low interest rates and the monthly amount started off really low and slowly grew as it approached the final pay off. The day I sent in the last payment was a very very happy day for me. Good luck and being “in the black” is a wonderful thing.

this is the first time that i read your site. Thank for the advices. i graduated 15 years ago and i finished my last loans at last month. Good luck to you

Good Luck!!All the best!!