Hope you’re not in a sugar coma from all the Halloween candy, because I’ve got a bunch of numbers to throw at ya! We can only find out if this month was a trick or a treat, if we come out of the shadows (and maybe do the Time Warp again…)

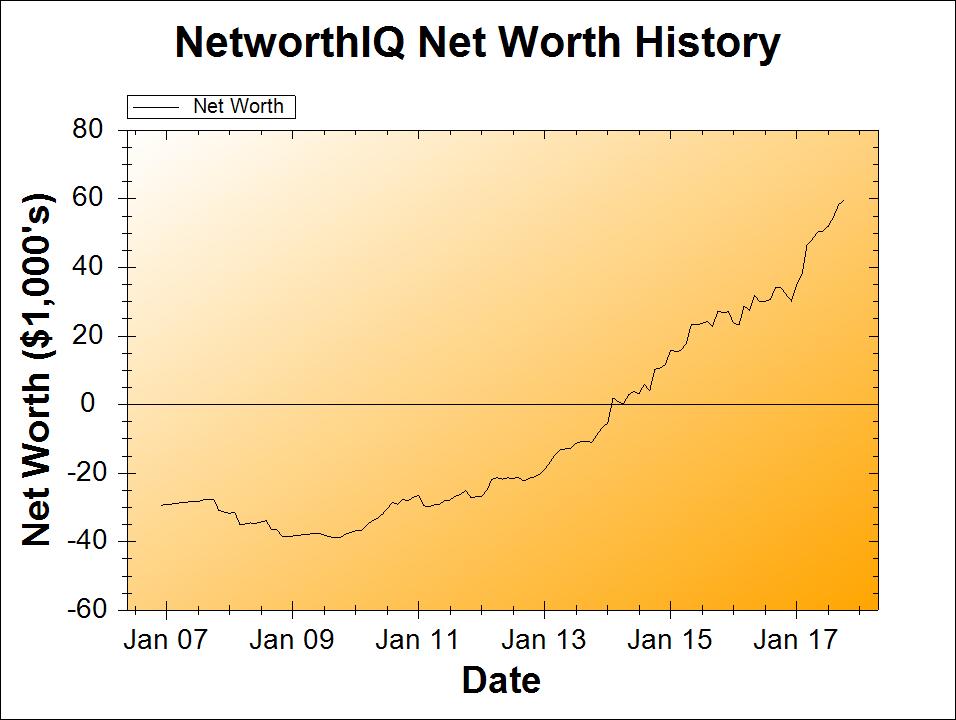

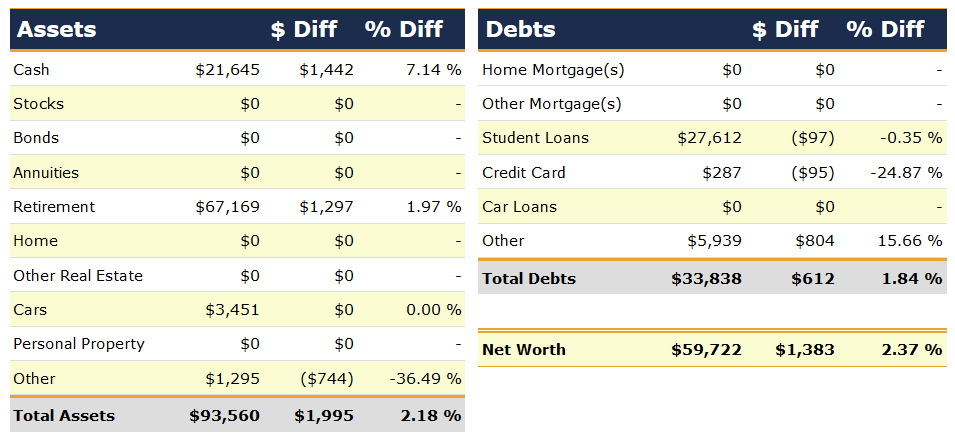

Change: +$1,383 or +2.37%

October Net Worth TOTAL: $59,722

Before we do a deep dive into the numbers here… can we celebrate something else? For just a moment?

THIS IS THE 500TH POST ON POORER THAN YOU!

I know, Egon. I’m as shocked as you are! (And yes, I totally had this action figure when I was a kid. Of course I did.)

That’s all. Here’s to another 500! (Maybe it won’t take 11 years this time.)

Retirement

Let’s rip the band-aid right off this one: no, I didn’t finish opening up my Solo 401(k) this month. That’s three solid months of not accomplishing the thing.

In my defense… progress was made this month! Remember how last month I pointed out that before I can open a Solo 401(k), I really ought to open up a SEP-IRA? Well, I did that! And it was easy-peasy, actually. I simply opened one up with Vanguard, and because I already have my regular IRAs with them (they already have most of my info), it took maybe 2 minutes. Tops.

I threw $140 into the SEP-IRA and bought a single share of VTI, the Vanguard Total Stock Market Index ETF. Now, I can ignore it until someday when for some reason, putting money into a SEP-IRA makes more sense than a Solo 401(k). Not sure when that would ever be, but now I have the option. And I luuuuuuurve having options. Especially when it costs literally nothing, like this!

I also made quite a bit of progress on the Solo 401(k) paperwork, thankyouverymuch. I filled out as much of it as I could on my own, but was left scratching my head on good portions of it. I’ll need to call E*Trade’s customer service line to fill in the gaps in my understanding. Which will require, you know, using a phone. Blaaaaaaargh.

“Other” Assets

I’ve long listed my Lending Club investment under “Other” in my assets column. In it’s heyday (like, June of last year), I had a whole $443 invested in that account.

I know, right?

Well, I’ve decided to divest, aka get the hell out there. I know I only had a small amount in there, so true diversification was pretty much impossible, but I wasn’t getting great returns due to hella lots of defaults. People just straight up taking my money and not repaying it. We call that welching back where I come from. (Which is, I guess, small town drama club that did Guys & Dolls in 11th grade.)

Maybe if I’d had more money in the account to spread around, the story would have been different. But instead of putting more money into it, I decided to start getting out. Not by selling or anything as effort intensive as that – just by withdrawing cash whenever I remember to, instead of reinvesting in new loans.

Where’s that cash going now, hookers and blow? Pssh. No. How much hookers and blow can you even buy with like $350? Also, what are the units that hookers and blow are measured in, anyway? Yes, obviously I know what I’m talking about right now. I’m just asking to make sure you know.

I’m not specifically putting the former Lending Club money anywhere (which is maybe a mistake), but rather just rolling it into my Savings Snowball, which means it pretty much gets throw at retirement after the “minimums” on all my short and medium-term goals are fulfilled. Or, at least, it would if I actually opened up that Solo 401(k). But it’s sitting with the other cash that’s waiting to go into the 401(k), so… it’s sorta like I did the right thing with it. I did not purchase any grams of hookers or furlongs of blow with it, at least!

Obamacare Open Enrollment

This isn’t strictly a net worth or October thing, but it’s pretty much taking over all of my brainspace, so I might as well mention it. Open enrollment started today, and holy hell wtf.

Our choices are not looking good for 2018. Our current plan is ending, so we’ll have to hop on a new plan, and there are only two insurers left on the Marketplace for our area. Neither of those insurers has our family doctor in their network. All of the plans are significantly more expensive than our current plan. Only one plan is HSA (Health Savings Account)-compatible, and it’s a plan that’s nearly double the cost of our current plan.

I’ve tried looking for private plans, but every website I’ve checked just shows me those same Obamacare plans. It could be that this is it. These are our options. [In before someone says the words “Christian Health Share” or “Health Sharing Ministry” – nope, no, not going there. Just drop that one and leave it where it is, cause that’s not on the table.]

So… I don’t know what we’ll do. There’s a lot of tricky math, and it’s made even more tricksy because of our variable income. I’m still trying to wrap my brainmeats around all of it. Before the day is through, there will be spreadsheets. Spreadsheets of terrible options where we pay more and lose our doctor. >_<

Let’s just tuck this terribleness away for the moment, and talk about more pleasant things…

Milestone Progress

$59,722 out of $61,099 by January 2018 – omg almost there. $459/month needed to get there now. CAN WE DO IT?

I went looking for “Bob the Builder” gifs and it gave me Titus Andromedon. That’s fine with me.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

Congrats on 500 posts!!!

Saw you notes on Obamacare. I’ve seen so many comments like that, you’re right – its tricky math. I know it causes a lot of stress. OMG. Good luck, keep us posted. Cheers. Tom