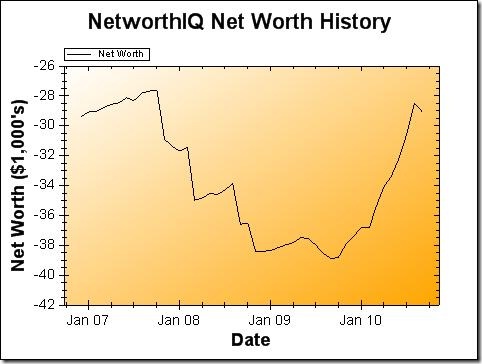

Last month, I predicted that September’s net worth chart had nowhere to go but down. How did that pan out?

Change: -$523 or -1.83 %

Down she goes! It’s not really surprising, although I wasn’t quite prepared for the extent to which it went down. Here are the factors that played into this (temporary!) downfall:

Income: My previous job ended at the very end of August, and I went into job hunting mode. Which was also vacation mode — I decided to do my job hunt during the day while visiting family in Upstate New York. My previous job was understaffed and I was not able to take much time off, so it was my first extended visit up there since I moved down to Virginia a year ago. While I did manage to get the job I really wanted (huzzah!), I didn’t start that one until the 22nd, and so, no paycheck yet.

I did go and conduct a training seminar for my previous job, which brought in something to cushion this month, but not enough to offset the fact that…

My car is expensive: And not in a cool way, but more of a “1996 Oldsmobile granny-car needs repairs” way. First, September is the month my insurance comes due. No biggie, because I put aside money for it monthly in my “Occasionals” savings account and then pay it every six months. But that does eat a chunk out of my net worth every six months, regardless. Of course, my car wasn’t happy with just that: aside from also needing its yearly inspection, it decided it deserved new tires and new turn signal bulbs. And an air freshener. (Oh, and now? Water is leaking into the backseat when it rains.) Apparently, my car is a gold digger.

All the usual expenses still apply: Okay, technically, I could have applied for a forbearance on my student loans while I was looking for a job. But it probably would have taken me about as much time to fill out that paperwork as it did to find a new job. In general, the world doesn’t stop turning just because you don’t have a job any more — and that means everyone still wants money from you. I know I was very lucky that my “unemployment” was extremely short-lived…

But also, a big part of why I was able to handle not having a job is that I prepared for it. I knew it was coming and stocked up my emergency fund for months ahead of time. Again, I know that I’m lucky that I didn’t have to dip into it. But it was there, just in case. So this temporary slide down on the net worth graph? It really doesn’t bother me one bit.

Next month? WIll be up.

If you have any questions about my net worth or how it is calculated, feel free to ask them in the comments. Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Wealthy Blogger List. (Spoiler alert: the name of my site is highly accurate.)

I don’t post mine, but Ad Rev was up, direct sales down. I’m glad you feel comfortable sharing.

Overall Net worth still declining when you take our mortgage into account. Actually, a little bummed, we looked at refinancing, but the price of the home has dropped too much. That will teach me for being on time with my payments. They gave me some things to try, but I think the home value will drop even further, thus putting it out of reach. Oh well.

Hi, It’s been quite a while since I checked out your site. So encouraging to see that steady upward trend!

How does new pay compare to old? Is that line going up even faster from here on in? I’ve not plotted a nice graph as you have, but recently had a triple whammy which is moving things up nicely.

Paid of Student Loans – An extra £400 per month which was going to pay of debts

Promotion at work – £5000 a year more 😀

Free Housing/meals – the job is residential so my expenses have plummetted.

We had a little celebration when I reached “debt free day”

Stephanie, in reference to the student loan forbearance. Assuming they are serviced by Direct Loan Servicing, you do not need to fill out any paper work. I thought the same thing but all you have to do is call and tell them when you can start paying them again, seriously.

I was amazed when I called and they told me that, no paper work, no approval process, just done. Now I must state this was a deferment and not a forbearance, so interest still accrues. That said, it’s great move for anyone who has additional debt with higher interest rates.

I’m the same, not posting mine, but my net worth is pretty much a carbon copy of yours. Around 2008 work dried up and down she goes!!

Its tough to be going in the wrong direction but you will be back on tare now that things are settling down. I really like your site. My wife and I are in our mid twenties and have six figure debt from student loans so you are better off than us, if that makes you feel better. I think 2011 is going to be a good year for finance/economics. Best of luck in 2011.

I’m impressed by how cool you are in the face of this (temporary) downfall. I hope your granny car holds up!

Yeah sometimes it is tuff to keep up with your finances. The best thing to do is make a plan and then follow it.

Cars… you can’t win! 😉 A nice one is expensive, and a beater ends up being expensive when it lets you down! The best tactic as far as I can tell is when people buy one that is 2-3 years old, not so new as to have ‘newness’ price, but not so old as to have problems. Then the trick is to sell it before it gets old and things start going wrong.

I would never buy a new car unless I had tons of spare money, which I never have. Otherwise, you lose money as soon as you drive it away.

what is your best items you want to get in your lift?

All cars are gold diggers. Next car I buy, I am going for reliability over everything. The old toyotas are known for going on forever, also German stuff like BMW and Mercedes, not that I will probably be in the market for something like that.

I would love to know what your car insurance is every six month if it takes a big chunk out of your net worth. It must be chunky !? I don’t think I will be buying an Oldsmobile any time soon!

It was about $240 every six months with the Oldsmobile. Not high, really, just seems so in comparison to my net worth and usual net worth changes!