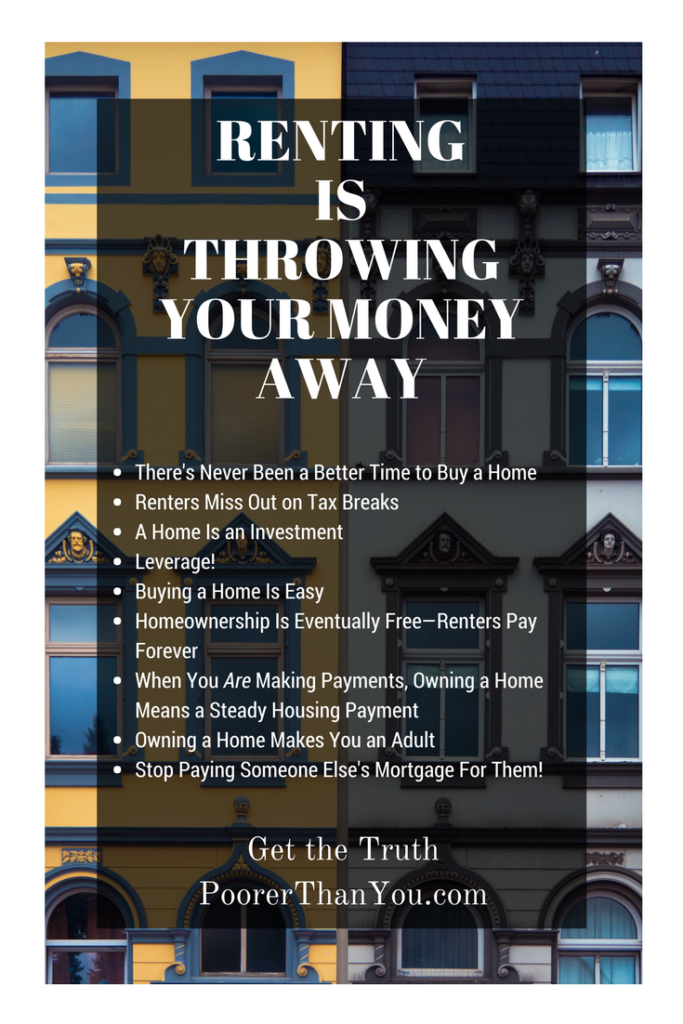

APRIL FOOLS! Thanks again to all of the good sports who played along this year. It was probably very obvious to many (I laid on the sarcasm pretty thick in the article below), but I don’t truly believe that renting is throwing your money away. In fact, my actual response to “renting is just throwing your money away” can be summed up in this one short tweet of mine:

But you're THROWING MONEY AWAY renting! Not like homeownership, where you only throw money away on interest, insurance, PMI probably, property taxes, maintenance, a longer commute to help you actually get a house in your price range… And you can build a tiny amount of equity!!!

— Stephonee | PoorerThanYou (@stephonee) March 23, 2018

(Okay, so that tweet was also me laying on the thick sarcasm. But I mean, with a blog named “Poorer Than You,” you had to know that’s what I do!)

Anyway, the article below is 100% pure unrefined sarcasm, and every single argument in it about why “renting is just throwing money away” crumbles like dry leaves under the smallest boot of logic.

I do think that homeownership can be a smart purchase under many circumstances, but the follow article is not about that. It’s about the phrase “renting is throwing money away” specifically. So without further ado, I present the original article as it appeared before noon on April Fools’ Day 2018:

I’ve been a long-time renter, and for years I kept hearing the phrase “renting is throwing your money away,” I resisted really hearing it. I didn’t want it to be true. I ran the numbers and some calculator told me that renting was a better deal than buying in my situation, so I felt pretty smug that renting couldn’t possibly be throwing money away if it was cheaper than owning… right?

But I always had this nagging feeling that maybe the people who told me I was throwing my money away were right.

And now, I’m going to admit it: they are right. And I can prove it. Here we go, with all the reasons why renting is truly just throwing your money into the void:

There’s Never Been a Better Time to Buy a Home

You know it’s true because my realtor told me this, and that’s someone who works in this field and completely understands the ins and outs of the housing market. Also, not to brag, but she is a little bit psychic. She has an uncanny ability to predict the future (for example, she knew when we were going to hit bad traffic or have weather issues while looking at condos), and that’s pretty much the reason we decided to go with her. We need someone who can predict the future of the housing market to get an edge on everyone else!

Renters Miss Out on Tax Breaks*

*Yes yes, I know, the tax laws just changed and this isn’t the same as it used to be. But stick with me, because there are still tax deductions homeowners get to take while sucka renters miss out:

Capital Gains Taxes on the Sale of Your Primary Residence (aka Your Home)

When you sell a stock that’s gained value, you have to pay capital gains taxes. But when you sell your primary residence and it’s gone up in value, you can exclude $250,000 ($500,000 for a married couple filing jointly) of that gain from capital gains taxes!

How much of a tax savings could that be? Well, for a single taxpayer earning up to $38,600 or a married couple earning up to $77,200, they have to pay 0% taxes on long-term capital gains (stocks they held for a year or more before selling). Should have put that money into your primary residence instead of investing it in stocks, sucka renters! Now you gotta pay taxes! And if you make more than $38,600 (or $77,200 for a couple) you have to pay 15% on the amount of capital gains above those income cutoffs. Or if you’re really super rolling in it making more than $400,000 per year, you gotta pay 20% to Uncle Sam on those capital gains!!!

The Mortgage Tax Deduction Still Exists

You can still take the mortgage tax deduction on your taxes – it didn’t go away! The cap did go down a bit to only include the first $750,000 of mortgage, but unless you live in an expensive housing market like the San Fransisco, Los Angeles, New York City, or Washington DC metro areas—hey wait a minute I live in one of those! Well, alright, as long as you’re not me or one of the millions of other people that live in these areas, that part won’t be a problem.

All you have to do is itemize your taxes, which is totally easy and you really should be doing it once you become a homeowner because it’s the only way to claim the deduction. The great thing about itemizing is that you get to claim deductions above and beyond the lazy-ass standard deduction. For the 2018 tax year, a married couple can only claim $24,000 if they can’t be bothered to itemize.

Let’s use the $750,000 cap as an example of how much $$$ you can save on taxes by taking on a mortgage:

- $750,000 mortgage x 4% interest rate = roughly $30,000 in the first year (it’s a little less than that, but amortization tables make me sleepy)

- $30,000 in interest minus the $24,000 you could deduct just for existing = an extra $6,000 you get to deduct!

- You’d have to be making at least $187,500 to afford a $750,000+ loan (based on the 4x gross salary rule-of-thumb I just found by Googling), so you’d be in the 24% tax bracket

- 24% of $6,000 = $1,440 saved on your taxes! Just by taking on a mortgage and paying $30,000 in interest that year (but you gotta spend money to make money). Oh, and itemizing, of course. See, itemizing is magic!

Property Tax Deduction

Everyone was all up in arms about the new tax law putting a cap on the so-called “SALT” (State and Local Tax) deduction. And with good reason—property taxes are included in that deduction! But the cap placed on the SALT deduction is only $10,000, so it’s really nothing to worry about, because your property tax bill (plus any other state and local tax) is probably not that high. Unless your property value is really high or you live in a high-tax state like California or New York or even Virginia which—why does the place I live keep coming up? I’m starting to feel personally victimized by the new tax law, folks.

A Home Is an Investment

And you all know how I feel about investing! Frankly, it’s been killing me for years that we couldn’t afford to get in on the real estate game. Your personal residence is the easiest way to add real estate to your investment portfolio (see below).

What makes a home such a great investment? Simple, common sense fact: you can’t build more land. (Until we colonize Mars, but come on, so far Mars is only inhabited by robots and those near-sighted scrap piles keep biting the Martian dust.) Since more land won’t be created until we get Mark Watney up to the red planet and making those pootatoes, the demand for land down here on Earth will only rise, bringing real estate prices up with it. It’s simple supply-and-demand, Earthling!

Not only do housing prices always go up, but the nature of your primary residence as an investment is pure genius. See, there are two very big problems with other types of investments (stocks, bonds, certificates of deposit, and even savings accounts):

- No one is forcing you to save with other types of investments. With your house, the equity you build up is like a forced savings account, which is great because America sucks at saving.

- Other forms of investment are “liquid” which means you can access them at any time. Which means you can panic and sell them at the wrong time. Or take that money out to buy a mint-condition Black Lotus. You can’t be trusted with your own money, so you really need to tie it up in your home equity so that you only get it when you sell your house. And when you do sell and get all those tax-free capital gains from the investment that always goes up? That Black Lotus will be yours.

Leverage!

Wouldn’t it be awesome if you could buy investments using other people’s money? Actually, you can. It’s called “buying on margin” when you do it with stocks. The upside is glorious – if the stock doubles, but you only had to put in a 10% down payment, then you are up 1900% on your initial investment! But stocks are super-duper risky – if the stock goes bankrupt and the bank issues a “margin call” (asks you for the money you borrowed back), you could be on the hook for everything you borrowed, with no asset to sell and make the payment. Yikes!

But with home-buying, you can invest in your home without any of that risky “margin” business. Instead of borrowing on margin, you borrow the bank’s money to buy the home, and therefore it’s totally different. Well, not totally different. After all, you still want (and get) that sweet, sweet upside: if your home skyrockets in value, you get to keep all that extra equity. And you only needed to put in a tiny down payment—and pay your monthly mortgage, of course, but since you’re building equity instead of throwing money away, that’s not a big deal.

As for downside risk? See above (There’s Never Been a Better Time to Buy a Home and A Home Is an Investment). In a booming real estate market—which you and your psychic real estate agent should easily be able to predict—this isn’t really something you need to worry about.

Buying a Home Is Easy

This is a major reason why it’s just “throwing your money away” to be renting – you could so easily just buy a home!

Don’t listen to know-it-alls who try to keep you a sucka renter by telling you that you need to save up 20% of the purchase price for a down payment before you buy. You can buy with as little as 3.5% down in most cases, and sometimes even 0% down! Will you have higher monthly payments, higher interest, forced private mortgage insurance, and the possibility of owing your lender a buttload of money if your local housing market declines and you have to sell? Yes. But that’s the price you pay for not saving up the 20% and becoming a homeboner homeowner the fast and easy way.

Similarly, don’t listen to people who whine about how stress-inducing the home-buying process is. There are 19 things more stressful than taking on a mortgage on the Holmes-Rahe Life Stress Rating Scale, so it’s pretty far down the list. Weird, though, that just below it is “foreclosure on a mortgage or loan.” Getting a mortgage more stressful than having one foreclosed on? Must be a typo.

And people love to whine about all the paperwork involved in getting a mortgage, but come on. You don’t read any EULAs when you agree to them, and you’re not gonna read any of that mortgage paperwork, either. Yes, you gotta spend a day or two signing your name over and over again until you’re not sure that’s really your name anymore and your signature starts to look like a Christian Rosa-Pappi Chulo painting. Better toughen up that signing hand, buttercup, if you don’t want to be throwing your money away as a renting sucka forever…

Homeownership Is Eventually Free—Renters Pay Forever

After 30 years of making mortgage payments (or fewer years if you’re a badass and pay it off quickly), you’re free! Your mortgage expense goes bye-bye while sucka renters are stuck still paying to have a roof over their heads. You have to live somewhere, so sucka renters will never escape their rent expense if they don’t eventually buy, and meanwhile you’ll be sitting pretty in a paid-off house! No payments ever again!

Debbie Downers will pop out to say that you still have to pay your property taxes and your homeowners insurance, and for any maintenance on the house. But those are small prices to pay for free housing!

And When You Are Making Payments, Owning a Home Means a Steady Housing Payment

Sucka renters are subject to their landlords raising the rent on them. Or getting kicked out and having to shop around for a new place at a potentially higher price. They can pretty much expect rent increases year over year, every year, forever. Sure, every once in a while you find that person who claims their landlord never raised the rent for 9+ years (this did happen to my ex, actually) but they are rare or maybe even lying. Because “real estate always goes up,” so do rents.

Owners sign up for a mortgage, and that’s exactly what they pay until the mortgage is paid off. It doesn’t go up with the market changes. Yeah, sometimes you find that person spinning a tale of their property taxes and homeowners insurance increasing every year. Or of rising HOA/condo fees, climbing utility bills, or changing city ordinances, but again: rare or maybe even lying.

Owning a Home Makes You an Adult

Buying real estate takes guts. (But also, it’s really easy – see above.) It’s a big responsibility! And nothing says “I’m officially an adult” like putting on your big girl/boy pants and taking ownership over a piece of property. There’s this little thing called “Pride of Ownership” and you absolutely cannot be a real adult without it.

Sucka renters may feel like real adults because they’ve hit other adult milestones, or because they are upstanding renters who always take good care of the place they live in and make timely payments. But if there’s a monetary reward for taking care of your space (getting your security deposit back) and that space is not actually yours (or on the way to becoming yours in 30 years when you finish paying off the mortgage), then you are just playing adult.

Paying property taxes, dealing with an overflowing toilet or a flooded basement yourself, negotiating with your neighbor’s insurance after a tree from your property falls over onto their house, paying for new siding or a new roof, working through half the contractors on Yelp to get the darned HVAC system fixed—these are the things that make a grownup out of you.

But your mortgage payments don’t just provide internal validation that you’ve become an adult, but external validation as well. The “You’re Approved” stamp the bank gives you for your mortgage may as well say “You’re an adult!” After all, banks must protect their money and only lend it to responsible adults with good credit and the means to pay the money back. Banks would never hand out mortgages willy-nilly, so you’ll be able to wear your mortgage approval as a badge of honor that proves—emphatically—that you are a grownup.

See, renting isn’t just throwing your money away literally, it’s also throwing your money away figuratively because you’re spending your money on something useless (housing and convenience) rather than spending your money on becoming a grown-up and accepting real responsibility.

Stop Paying Someone Else’s Mortgage For Them

Who gets the last laugh when a sucka renter throws their money away on rent? Their landlord, of course. The renter is paying their landlord’s mortgage and that landlord is just laughing their way to the bank.

This is the argument that really hit it home for me: a few friends pointed out to me that renting could never be a better deal than owning. Why? Because landlords would not rent out homes if they were losing money on the deal.

This makes so much sense that I honestly felt really stupid when my friends pointed it out. Your landlord must be making money. Every single person who gets into rental real estate knows to treat their properties like a business and how to estimate the costs associated with owning a rental. To be a landlord, you have to be quite savvy and a Real Adult™ (see above) so a landlord would never overestimate the value of their property just because they already own it and therefore keep renting it out because they are reluctant to sell it at a loss.

Isn’t It Time You Stopped Throwing Money Away Renting?

Take this poor sap, Mortimer. He thinks he can’t afford a mortgage, so he’s throwing away $1600 in rent every single month. All he gets for that money is the temporary use of 2 bedrooms and 2 full bathrooms (and a fitness center and a pool).

But his landlord could raise the rent on him. Or kick him out at the end of the lease. Or decide to sell the place and maybe the new owners are terrible landlords.

Or maybe Mortimer gets a new job right in the middle of his lease and then what? It costs money to get out of a lease if he has to move, unlike owning, where you make money when you move because of all that sweet, sweet equity you’ve built up. There are absolutely no costs whatsoever associated with moving when you own, and all houses sell quickly at all times for their asking prices, so Mortimer is really missing out.

Get it together Mortimer, and buy yourself a place. Become a real adult. Make an investment. You’ll get a steady housing payment and then you’ll live rent-free forever. It’s easy, you get to use leverage, and you get great tax breaks. It’s time to stop paying your landlord’s mortgage for them, because there has never been a better time to buy a house.

Photo credits: Gary Chan, Daniel von Appen, Daniel Barnes, Erda Estremera, Breno Assis

UPDATE AT NOON ON APRIL FOOLS’ DAY: I just added the disclaimer to the post that this was, in fact, and April Fools joke post. But please keep in mind that the disclaimer was not there when some of the comments below were posted. Please be kind to anyone who was April Fooled… and remember, some of these folks (most?) were probably just playing along! 😉

If you’re not kind to each other, I’ll bring out the banhammer. That is all.

You have very valid reasons, Stephanie.

We wrote about the other side in this post. https://www.smartmoneyandtravel.com/rent-not-buy/

As we don’t plan to live in Chicago long term, the math just doesn’t work out for buying. We came really close to buying last year but decided against it and now still pay slightly over 2k in rent.

Happy Easter!

We don’t plan to live in Northern Virginia long-term either, so the calculators have always told us the math was “better” for renting. But I can’t ignore the fact that we’re throwing away money renting, no matter what the math says!

Happy Easter and Happy April Fools’ Day, Quynh!

Haha you got me! Happy Easter.

I was kind of waiting for this to shout APRIL FOOLS! 😉 There’s a lot to be said about owning a home. However, I think there are definite mathematical advantages to renting, too, depending on the housing market in someone’s area. As for a house as forced savings, it depends on the house you buy. I know a handful of people who bought “fixer uppers” and are now so sunk in terms of the money they’ve poured in. That being said, we are homeowners and wouldn’t trade it for anything. The reasons are more emotional and psychological, though. Our mortgage is the bane of my existence.

I think you will find I have no history of April Fools’ Day pranks whatsoever. I am quite a serious person.

Mathematical advantages for renting are a myth, because renting is throwing money away. There can be no advantage to throwing money away!

Urgh, Penny, do you understand how HARD it was for me to type a response that including ignoring math just to keep up the joke until noon Eastern Time? THIS WAS KILLING ME. If you intentionally put me in that corner… well played. Happy April Fools’ Day!

Great article we have been really pleased with owning our place for the past 4 years!!!

Thanks, Greg. Happy April Fools’ Day!

My husband and I decided to purchased our first home when we were full time phd student, had tons of student loans and only part time jobs. Why? Because we decided not to pay for other people’s mortgage and like you said: throwing money away! We chose a little different approach, we got a three family instead of a single family, in such way, one unit’s rent help pay for our mortgage and the other unit’s rent help pay for our living expenses. Guess what, we completely live for free! That is the step stone for our future success.

Hi Jun. I think you may have missed the thickly-laid-on sarcasm (and the warning that it was an April Fools joke) when I said that renting is “throwing money away.”

What you did, buying a multi-unit, living in one unit and renting out the others (commonly referred to as “house hacking”) is very different from simply buying one’s primary residence, which is when the “renting is just throwing you money away” argument is usually made. House hacking is a way of buying your residence and a side hustle (landlording) in one single purchase. I’m very glad to hear that house hacking side hustle has worked out for you and makes you enough to pay your living expenses. But there are a lot of side hustles that produce enough income to cover living expenses, for those who don’t have the time, start-up capital, or inclination to be a landlord. That doesn’t mean that people who pursue other side hustles (or just maintain a primary job to cover their living expenses) while renting are “throwing their money away.”

Here’s a way of thinking about it: you almost certainly have a lot of sunk costs associated with your tri-plex that you don’t get to keep as equity. Property taxes, maintenance on the unit you live in, maintenance on the other two units, insurance, etc.. Is that money “thrown away” or is it a part of the cost of your real estate investment (the costs of your “landlording side hustle”)? Compare that to me, a renter. I have the sunk cost of my rent, but not being a homeowner my time is freed up from maintenance on my home, and I use a lot of that time to pursue my own side hustles (blogger, freelance writing, etc.) that pay more than I could expect to get from landlording where I live (very competitive expensive real estate area). Is my rent still throwing money away if it’s an investment in my side hustle, same as the costs of maintaining your property are investments in your side hustle?