Last week, I started up my Lending Club Experiment: to take the $50 bonus given to me for becoming a lender at Lending Club, and use it to test drive the service. It’s a hot topic – I can tell because I received a slew of emails asking me for referrals to get $50 bonuses. If you’re one of those that got a referral link from me, please feel free to share your experiences in the comments here.

It’s been a week, and a few things have happened. One of the loans I picked out last week fell through in the “review” phase, for whatever reason. My $25 was returned to my Lending Club account, and I chose to replace the first loan with a loan at a similar rate and risk level, so my estimated return is still around 13%. Now the two loans (or notes) that I’ve invested in have passed review, and are “issued and current.” They’re accumulating interest as we speak.

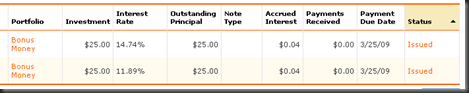

The above picture is a snapshot of my two loans, taken this morning (you can click the image to get a larger view if it’s hard to read). I cut off the identifying information that was on the left side, to protect my borrowers. But you can see that I’ve assigned these two loans to the portfolio “Bonus Money,” so that I can track them separately if I ever put money of my own in.

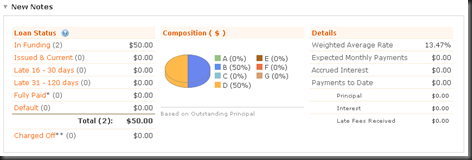

This is a wider view of my investments (again, you can click to view the full-size picture). You can see that my weighted interest rate is 13.32%, and my expected monthly payments are $1.68. I plan on leaving the payments in my Lending Club account, and when they add up to $25, possibly reinvesting in a new note.

There isn’t much for me to do for the rest of the month, except sit tight and wait for the 25th, when the first payments are due! We’ll check back in with things after that.