Thinking you might want to refinance your student loans to get a better interest rate and save some money? You’re not alone! Several people have reached out to ask what I think, such as this message I got from a reader named Cindie:

I’m thinking about refinancing my student loans (already federally consolidated but I think I can get a better rate). I’m at 8.25% fixed, but it certainly looks like I can better. Anyway, I don’t mind doing my own research, but I wondered if you had some direction/suggestions? I see SoFi pop up frequently, but I don’t know if they’re reputable.

Separately, I also spoke to a friend whose wife has private student loans at 5% interest, and he wanted to know about SoFi, as well. My guess is that all of this hullabaloo around student loan refinancing is due to the very broad-reaching and clever marketing campaigns that SoFi has been doing over the past year or so. So I decided to dive in, using my own student loans as an example, and see if student loan refinancing is really worth all the hype:

My Own Student Loan Situation

Because I’m using myself as the example for my research, here are the details on my student loans:

- Type: All federal, Direct Loan consolidated. About 50/50 subsidized & unsubsidized.

- Balance (Payoff Amount): $28,555.99

- Interest Rate: 4.75% (includes a 0.25% interest rate reduction for auto debit)

- Monthly Payment: $204.97 (“Standard Level” repayment plan, meaning the payment amount doesn’t change over time)

When you’re refinancing a loan, you’re asking a new creditor to pay off the old loan for you, and issue a new loan to you at a lower interest rate. So I’d be looking for a new interest rate that beats 4.75% for myself (or the friend with a 5% rate). Cindie will want to look to do better than 8.25%. This can also pull together multiple loans (if that’s what you have) into one big ol’ ball of loan. This can be good if you’re currently dealing with several loans from different servicers, which can be a hassle.

Consequences of Refinancing Your Student Loans

The website Student Loan Hero has an awesome cheat sheet about student loan refinancing, covering topics like difference between consolidation and refinancing, the benefits of refinancing, which student loans to refinance (and which not to!), how to qualify for refinancing, and how to compare lenders.

Student Loan Hero also offers a free dashboard for tracking your student loans – again, handy if you have multiple loans from different sources. There are all sorts of other goodies on their site, from student loan calculators, to a personalized repayment plan tool, and more.

So what are some of the consequences of refinancing that you might run into?

- Your monthly payment may go up. This happens when you commit to a shorter loan term than what you currently have. This isn’t necessarily bad, but you need to make sure you can consistently afford the new payment, with some wiggle room (so you can pay it off even sooner, if you want!).

- Your monthly payment may go down. Of course, this is the opposite of the above, and happens if you take a longer term than what you have now. But be aware – a longer term means you’ll pay more in interest overall!

- Federal loans lose some benefits if you refinance them. By taking your Federal loans and making them private loans (which is what you’re doing with refinancing), you lose access to income-based repayment plans, Public Service Loan Forgiveness, and possibly even the ability to defer your loans due to unemployment or when you go back to school. Check the terms of refinancing to see what you’re losing!

- You can remove a cosigner from a loan. Ready to get Mom or Dad off the hook for your loan? Refinancing a loan that currently has a cosigner to a loan with no cosigner will get them off of there for you. And hopefully off your back in the process.

- Refinancing does not change the tax deductible status of your interest. If you were able to deduct your student loan interest off your taxes, you’ll still be able to do so after refinancing. But, if you refinance for more than the amount of your loans, the difference has to be used to pay for education expenses. Consult with a tax advisor on this stuff.

Be mindful of the two types of loans that Student Loan Hero points out you may not want to refinance: loans with super-low interest rates, and Federal loans that you want forgiven.

Since I’m not using an income-based repayment plan, I don’t qualify for student loan forgiveness, and my interest rate is low but not super-low, it seems like I could benefit from refinancing. But I’m sort of in the grey area where it might benefit me, or it might not. With a higher interest rate, or several private loans, the situation would be more clear cut.

Will Shopping for Student Loan Refinancing Hurt My Credit?

No.

All of the services for comparing student loan refinancing offers that I’m about to talk about check your credit to see what offers you qualify for. However, this is a “soft credit pull” for these sites, meaning your credit score is not “dinged” in the process. (I can only say this for the services I tried, however. If you shop with a different site, be sure to research whether they’re going to do a soft or a hard credit pull!)

However, the opposite is true: bad credit will hurt your chances to get a good student loan refinancing rate (or get refinancing at all!). Before you start shopping for student loan refinancing, make sure you’ve taken some steps to improve your credit score.

My credit score is between 750 and 780 (depending on which of the three credit bureaus you ask), which is “great” but not “excellent” (It would be excellent if I weren’t so young, and I had a mortgage – curses!). This will affect what rates I’m offered during the shopping process, so don’t expect to necessarily get the same rates as what I got. Again, shopping around doesn’t hurt my score one bit. So it’s totally worth shopping, just to see if I could save some money.

Of course, once you go past the “rate quote” stage and apply for an actual loan, you can expect that to show up on your credit report and be reflected in your credit score.

My Student Loan Refinancing Shopping Experience

Important note: I’m sharing my shopping experience below, so that you can see how I go about evaluating different offers. However, this is not meant to replace your own shopping experience. Interest rates change frequently, and are based on individual information such as income, credit score, and the amount of the loan balance. Since these factors will vary for you, you cannot assume that the rates I was quoted will be the ones you would get. You need to request your own rate quotes.

Direct Loan Consolidation

Before I get into any refinancing options, I want to take a moment to address the alternative: consolidation. My student loans are already consolidated (as are Cindie’s). Consolidation allows you to take multiple federal student loans and combine them into one loan. However, this is only available for federal loans – not private loans. I consolidated some of my loans back in 2010, giving me one payment through one single loan processor for those loans, and the low fixed rate that I have now.

If you have multiple federal student loans, you should definitely look into whether loan consolidation is right for you.

Consolidated loans can be refinanced, of course. So let’s take my consolidated loans and go shopping!

Credible – Offering a $500 Bonus through March 31st

Going where the money is, I started my shopping trip with Credible because they are offering a $500 bonus if you open a loan after you click a refer-a-friend link. (Which is what my links to Credible are, by the way.)

In order to show me offers, Credible asked for the following information from me:

- Undergraduate School

- Highest Undergraduate Degree

- Field of study

- Did you attend graduate school?

- Income information

- Total loan balance to be refinanced (estimate okay)

- Monthly portion of housing payment

- Name

- Date of Birth

- Phone number

- Address

- Email address (and create a password)

- Optional: Verify identity to see more rates (previous address and/or Social Security Number)

Once it has your rates for you (instantly – no waiting), you can fill out a little more information about your current loans in the sidebar, and Credible will update your rate offers with an estimate of how much you’ll save in interest with each offer. Be careful with this, though! Sometimes the interest savings are simply because the loan term is shorter. In some cases, you could save that much or more just by sending larger payments to your current student loans!

With my information, I was offered variable rates as low as 3.88% and fixed rates starting at 5.10%. Obviously with my loans currently at 4.75%, the 5.10% fixed rate would not be good for me, or for my friend with the 5% rates. But for Cindie with an 8.25% rate, there could be some real savings there!

What about the variable rate offers? It’s true that 3.88% is nearly a whole percent less than my current rate (and a whopping 4.37% less than Cindie’s!). By clicking the “View lender details and cost breakdown” option on the 3.88% variable rate loan offer, I get to the information I’m looking for. In Credible, I can see that this particular offer has “No origination, annual, or prepayment fees.” That’s good, because any fees like that can sour a good offer quickly. If there were an origination fee (a fee for getting the loan, basically), I’d want to add that fee to my balance when doing calculations for this loan. An annual fee would also be added to the balance calculation, by multiplying the amount of the fee by the years of repayment. And a prepayment fee? That’s right out. Don’t get a loan that charges you to make prepayments, because that will make it hard to pay off the loan quickly if you decide you want to do that.

Also in this section is a link to the loan disclosures, where I can find the missing information about the variable rate. For this particular loan, the rate can be adjusted monthly, starting right away, and the cap is 25%. 25%?!? That’s insane. It says:

The variable interest rate is based upon the one-month London Interbank Offered Rate (LIBOR) rounded up to the nearest one-eighth of one percent (0.125%) which is currently 0.75% and which may be adjusted monthly, plus a margin which is based on your and, if applicable, your cosigner’s credit history, information you provide in the application, and other factors. [Emphasis mine.]

“Other factors.” So they can just raise the rate, in one month, to 25%, based on whatever they feel like. This, my friends, is why you always want to read the disclosures!

Another piece of information you’ll find under “View lender details and cost breakdown” is the name of loan servicer. This is who’ll be managing your loan, and it’s important to research both the bank that’s offering you the rate, and the loan servicer. The Better Business Bureau is always a good place to start – you can see their rating as well as customer ratings for all of these companies.

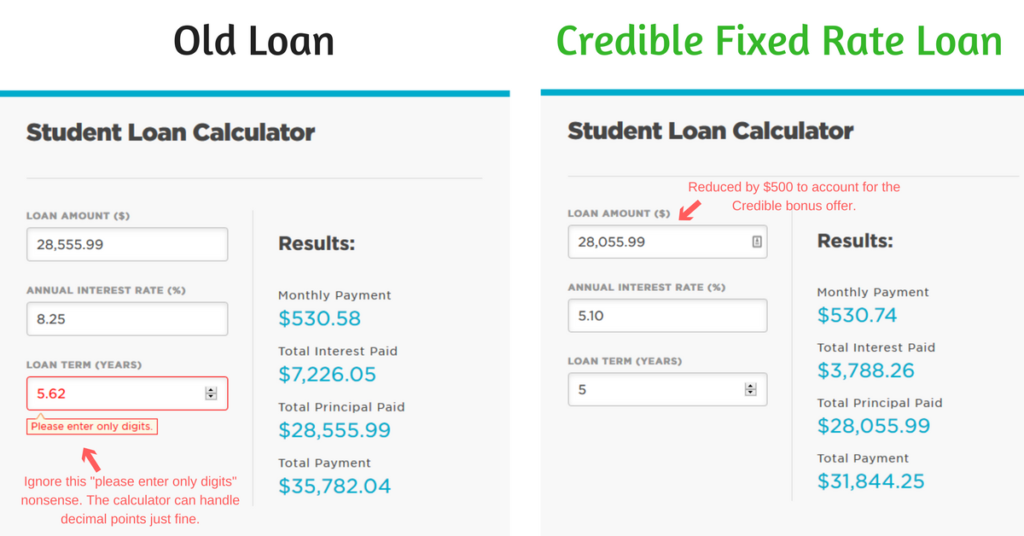

So despite the delicious $500 bonus offer, it doesn’t look like Credible has anything for my situation. But for someone like Cindie who has a higher interest rate, it could work out to a great deal. Using Nerd Wallet’s student loan calculator, I ran through what the savings would be if I had Cindie’s interest rate on my loans:

In order to compare apples to apples, I adjusted the loan term on the “current” loan so that the monthly payment is about the same as the new, fixed-rate loan. That’s because if you use a longer loan term, it’s going to show a much bigger difference in total interest paid. But that’s not a true savings, since you could achieve that just by paying a higher monthly payment on your current loan.

By throwing roughly the same amount at each loan each month, the difference ends up being $3,937.79 over the remaining life of the loan (including the $500 bonus), and the new loan would be paid off 7 months sooner, to boot! Of course, this will vary based on the actual balance of Cindie’s loans.

Credible showed me 18 different offers from 6 different lenders, all with interest rates below 7.5% (in my case). They also showed me some interest-only loan offers (where you pay just the interest for a number of years, and then your payment jumps up for the remainder of the loan). That really doesn’t interest me, and I’m hard-pressed to think of a situation where that would be good. If you are having trouble making your current student loan payments, you should check with your current borrower to see if you have a different payment option, before you go with an interest-only loan.

Still, I really appreciated all of the different offers Credible was showing me. It was a very quick and easy way to get several different rate quotes. Even though there weren’t any with a rate and terms combo that would work for me, now I know that. Credible saved me a lot of time researching some of those lenders individually, if nothing else!

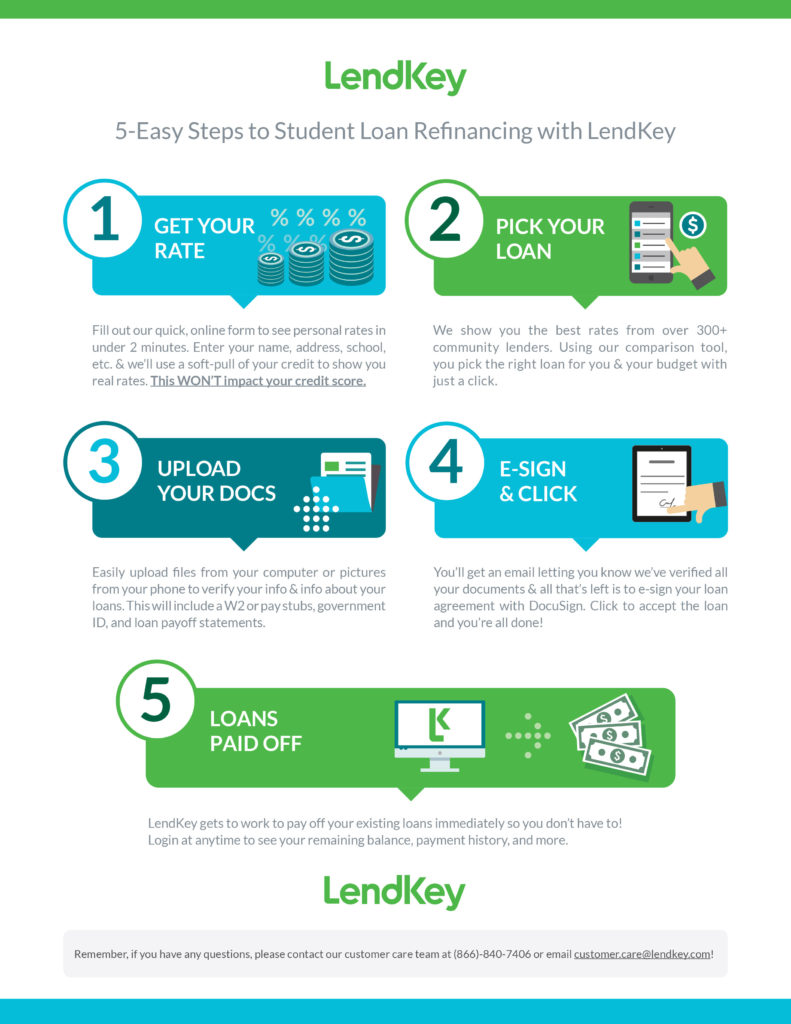

LendKey

I was excited about the idea of LendKey, because they search credit unions and community banks instead of the big ol’ national banks. I love my credit union (PenFed); I got a great car loan rate through them in the past. So I figured it was definitely worth giving LendKey a go to see if searching credit unions and community banks would give me better rate offers and terms.

If you already have a relationship with a local credit union or community bank, you may want to just contact them and see what student loan refinancing options they have for you. It’s worth going through a few of these online rate “aggregators” first, though – to get a baseline to compare your local offers to.

LendKey took the following information from me:

- Name

- Address

- Phone number

- Citizenship

- Income (unclear if they want you to include spouse or not)

- Degree

- School

- Loan Amount

- Loan type (private, federal, or mix)

- Asked me for my Social Security Number because I recently moved

LendKey’s site needs a little work. At the time I searched, it was hard to filter the offers properly. The fixed rate loans I was offered all had rates above 6%, but then I could no longer even see those once I started playing with the filter options. That’s because the APR filter doesn’t go above 4.97%, so once I touched it, the fixed rate loans disappeared on me.

So I do love the idea of LendKey, and if you are looking for a loan from a credit union or a community bank, it is worth checking them out. Hopefully their interface improves soon and you get a better experience!

Common Bond – $300 Bonus

If you refinance through Common Bond using the offer from Millennial Moola, there’s a $300 bonus in it for you. (Yes, I’m giving you someone else’s referral link. Why? Because it’s a better deal for you. My referral link would get me $200, but no bonus for you. I’d rather you take the better deal.)

Information that Common Bond asked me for to give me rate quotes:

- School

- Degree

- Field of study

- Income information (mine only – not including my spouse’s)

- Which loans I wanted to refinance (spookily, they have access to that!)

- Monthly portion of housing payment

- Name

- Date of Birth

- Phone number

- Address

- Email address

- Last four of my Social Security Number

The rates I was offered were between 5.25% (5-year variable) and 7.52% (20-year fixed). They also offer a 10-year hybrid loan, where the first five years have a fixed interest rate, and then it’s variable for the final five years.

What I like about Common Bond is that the variable terms are much, much better than some of what I saw on the other sites. The interest rate cap ranges from 8.99% to 9.99%, which is so much better than the utterly ridiculous 25%. However, I could not find on their website how often they can raise the rate, and by how much. This is something I would want to know before I signed on, so if I were going with a refinancing loan from Common Bond, I would contact them to ask first.

Common Bond also has something I haven’t seen anywhere else in the student loan refinancing space: what they call their “Social Promise:”

From Day 1, we have had a strong social mission – what we call our “Social Promise.” The CommonBond Social Promise: for every degree fully funded on the CommonBond platform, we fund the tuition of a student in need for a full year through our partnership with Pencils of Promise. CommonBond is the first-ever company to bring the “1-for-1” model to education and finance.

Inspired by the likes of TOMS Shoes and Warby Parker, we firmly believe that business can and should be a positive force for change. By empowering our students and investors to become Social Promise champions, we hope to make an exponential difference.

Again, not a solution for me, since the interest rates I was offered aren’t lower than the fixed interest rate I have now. But for the Cindies out there with higher rates, Common Bond could be a good option to explore.

SoFi – $500 Bonus

SoFi has been getting a lot of attention lately – seems like they’re popping up everywhere I go! Like I said at the opening of this article, I really think that SoFi has been driving a lot of interest lately in student loan refinancing. So my own student loan refinance shopping trip really wouldn’t be complete without a visit to SoFi. A little bit of Googling reveals that there are bonuses of up to $500 available (try searching for “SoFi 500 bonus”).

To do a rate quote, SoFi asked me for:

- Name

- State of Residence (and later, full address)

- Email address & create a password

- Phone number

- Optional: consent to text notifications

- Date of birth

- Citizenship

- Home ownership (Rent, Own, or Living With Parents – nice touch)

- Undergraduate University

- Undergraduate Program

- Graduation Date

- Optional: Graduate degree information

- Employment Status, Employer Name (and Self Employment status, if applicable)

- Total Individual Annual Income (note: NOT household income!)

- Total Years of Professional Work Experience

- Total Loan Amount

- Asked me for Social Security Number because I recently moved

They also provided a ton of information within the application itself, about fees, the variable rate offerings, etc.. This information can be found within the application itself, under a link that says “Information regarding rates, costs and fees associated with your SoFi loan application are detailed below.” Like Common Bond, the variable rate caps are reasonable: 8.95% for 5/7/10 year loans, and 9.95% of 15 or 20 year loans.

Unfortunately, my SoFi experience did not go well from there. I was really disappointed, because the rate ranges they were quoting gave me hope that I would finally find a loan that could beat or match my 4.75% interest rate. However, SoFi couldn’t seem to confirm my identity to do the soft credit pull, even after I gave them everything. So they couldn’t/wouldn’t give me an actual interest rate quote, just a range.

Then, a few days later, they emailed me to say they were denying my application outright. The email says that I can write them a physical snail mail letter to request the reason. Again, a pity – I really hoped that SoFi was the answer for me, but I never even got to find out if their rates were in my range. The rate ranges they were offering all would have been a net gain for Cindie… but she’d have to make it through the application process.

Earnest

Earnest was not really on my radar before I began shopping. But when I put a call out on Twitter for people to share their student loan refinancing experiences with me, I got a response from Corey VanSchaick about Earnest. Corey is a commercial credit officer for a community bank in Illinois, and knows a thing or two about lending that the average person doesn’t.

Corey sent me an email detailing the whole story of what went on with his attempt to refinance his loan with Earnest. It’s a whopper of a tale, but here are some relevant snippets as to what went down:

In the application process for a student loan refinance, Earnest requests a 10 day payoff letter from your current loan servicer. This is a very standard practice in the financial services industry. What this does do though is create a reasonable expectation that the loan you are refinancing should be paid off by the date on the 10 day payoff letter.

This is where things went sideways. I was diligently watching both accounts for activity, and there was nothing. No updated from Earnest saying my payoff was sent, or that they were experiencing a delay. On February 6th I contact my current loan servicer … to see if they had received a payoff for my account. They informed that they had not received a payoff yet. This was a full three weeks after the date that my payoff was to be sent. I immediately contacted Earnest to see what was going on. This is when I first learned that the company was experiencing a 45-60 day delay in processing loan payoff [emphasis added]. At no point was this communicated to me.

Since there is this large delay in processing payoffs (that they are not informing their customers of) it has a few crucial effects on the consumer:

1. The consumer must now continue to make payments to their current loan servicer. Some consumers may not be financially savvy enough to

know that they will need to continue to make the payments to their current servicer (especially seeing how Earnest is not communicating this, or was not communicating this to their consumers).2. You are possibly paying more in interest expense as a result of Earnest’s failure to process payoff in a timely fashion. If you refinanced your loan into a better rate than what you are currently paying, you are now incurring increased interest expense.

3. If consumer was not wise enough to continue to pay they will incur late fees, and have negative information reported on their credit reports.

Corey also found that going directly to Earnest’s customer service, and even a formal complaint to the Consumer Financial Protection Bureau, did not bring a satisfactory resolution. Reviews for Earnest on the Better Business Bureau are mixed, with some borrowers reporting that their experience went smoothly, and others being similarly unhappy with customer service or some other aspect of the process.

I thought Corey’s experience was particularly important to share because no matter who you choose for your student loan refinancing, you’ll want to make sure to track both your old loan account and the new one carefully through the transition. Only because Corey stayed on top of what was happening was he able to catch the problem and continue to make payments to the old loan servicer.

In the end, Corey opted to take his business elsewhere. Needless to say, after reading Corey’s email I decided to skip Earnest on my own shopping trip.

So What Did We Learn?

Student loan refinancing can save you a good chunk of change in interest… depending on what your interest rate is now, and what rates you can get for refinancing.

Don’t be swayed too much by bonus offers – take the extra 2 seconds to run the numbers through a simple student loan calculator (and to adjust the loan term so you are comparing apples to apples!) to see what your true savings would be.

Find out who you’re dealing with before signing anything. Check the Better Business Bureau and do a little Googling.

Read the disclosures! Find out what the interest rate cap is on variable rate loans – or else you might be caught off guard when your “great rate” climbs above 10% or 20%!

No matter what, paying off your loans sooner is going to save you on interest charges. But you probably already knew that!

Have you refinanced your student loans? Would you care to share your experience in the comments below, for Cindie and anyone else thinking about going through the process?

And if you have a question you’d like me to tackle, send it on over!

Photo credits: Rochelle Nicole, LendKey