This is the year! If I can max out all of my tax advantaged retirement-type accounts, then I’ll start paying extra to my student loans. The problem: I’ve already been sending “extra” money to my student loans with MOHELA (my student loan servicer) each month, and they weren’t applying that “extra” payment to the loan principal! Wait, what?

What I Want MOHELA To Do With Extra Money I Send Them

It seems so simple: when I make a payment to my student loans, the money normally goes toward the “amount due,” which consists of some amount of interest (the “fee” I have to pay for borrowing the money) and some amount of loan principal (the amount I borrowed in the first place that I’m paying back).

If I send any more money than the “amount due,” then it’s extra. There’s no interest on the account because I’ve already paid that for the month, so all the extra that I send should pay off the principal, right? This would reduce the total that I owe, meaning that less interest would be charged, and my loan would get paid off faster.

But nope, by default, that’s not what happens when you send an extra payment to MOHELA (or pretty much any other student loan servicer).

What MOHELA Was Doing With My Extra Money Instead

So if that money wasn’t reducing my principal… what was it doing? It was doing something that they call “Paying Ahead.”

Paying Ahead means that your current payment has been satisfied and you have paid at least a portion of your future bill.

…

Each time you satisfy a bill due, we will automatically advance your next payment due date and your billing statement will indicate a payment is not required for that bill.

– MOHELA’s website, Payment Information – How Payments Are Applied

Instead of straight-up reducing my principal, the default for extra payments is to reduce or eliminate next month’s bill. So the next month after I send an extra payment, I get the bill (electronically, of course – what am I, some sort of savage that gets paper bills?), and it says all the normal stuff, except the Total Due is “$0.00.” So I could just not make my payment the next month and be super duper okay, because the bill is already paid? Huzzah! … right?

MOHELA’s website is quick to point out that yes, this should be a “huzzah!” yes yes definitely! (Which is exactly when you should be at your most skeptical.) They say:

Paying your account ahead of schedule offers many benefits such as:

- Decreasing your total interest cost

- Paying your loan off sooner

- No prepayment penalties

And technically, they are right. (And the “No prepayment penalties” bit is super important – make sure that your student loan servicer has a similar policy before you send any extra payments!) But wait a second… the whole “Paying Ahead” thing doesn’t lead to me getting no bill the next month, it just leads to me getting a paid off ($0 due) bill every month, with accrued interest! So I won’t realize any benefit from this until:

A. I have to miss a payment for some reason, in which case I can just turn off my autopay but not get hit with any late fees or have to deal with putting my loans into deferment or forbearance (two fancy terms for “you don’t have to pay these loans right now but you will have to later”). The benefit wouldn’t be reduced interest, it would just be the ability to not make a payment for one month (or however many months I’ve “paid ahead”).

B. OR, at the very end of my loan, I won’t have to pay the last payment, because I already paid it!

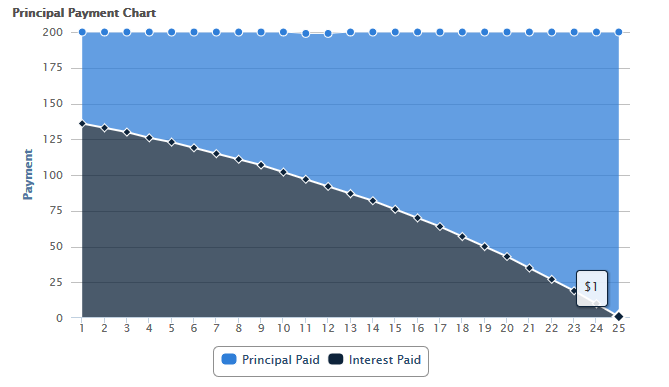

Scenario B is what MOHELA is referring to with all that “decreasing your total interest cost” and “paying off your loan sooner” – any payments “ahead” that I make mean payments I don’t have to pay at the end of my loan. But hold up, here’s a thing: payments at the end of a loan have hardly any interest at all!

Oh of course MOHELA is over the moon to have me pay ahead and then not pay my final payment… they get a whopping $1 of interest on that final payment!

Why not always default to having extra payments “pay ahead?” Well, if you’re the student loan servicer, this is a pretty sweet deal – it only costs you a dollar! But you’re not the student loan servicer – you’re the student loan payer and this is a bad deal for you. And me. So I went through the steps to get them to cut that out.

How to Get MOHELA to Let Me Pay the Principal on My Student Loan, Instead of Paying Ahead

Option #1 – One-Time Payment Instructions

Just sending in one extra payment that you’d like MOHELA to apply to your loan principal? This could be quite easy for you… if you don’t have a consolidated loan. (Which I do, so this option isn’t available to me… whomp whomp.) You can just follow the instructions on MOHELA’s Payment Information Page (under “Submitting Special Payment Instructions” > “One-Time Payment Instructions”) to target your payment to a specific loan.

But if you do have a consolidation loan, you won’t be able to do the Web instructions – you’ll be stuck with only the Phone or Mail options. And if you’re going to mail in a payment with instructions, why not mail in instructions for all future payments? Because you can totally do that:

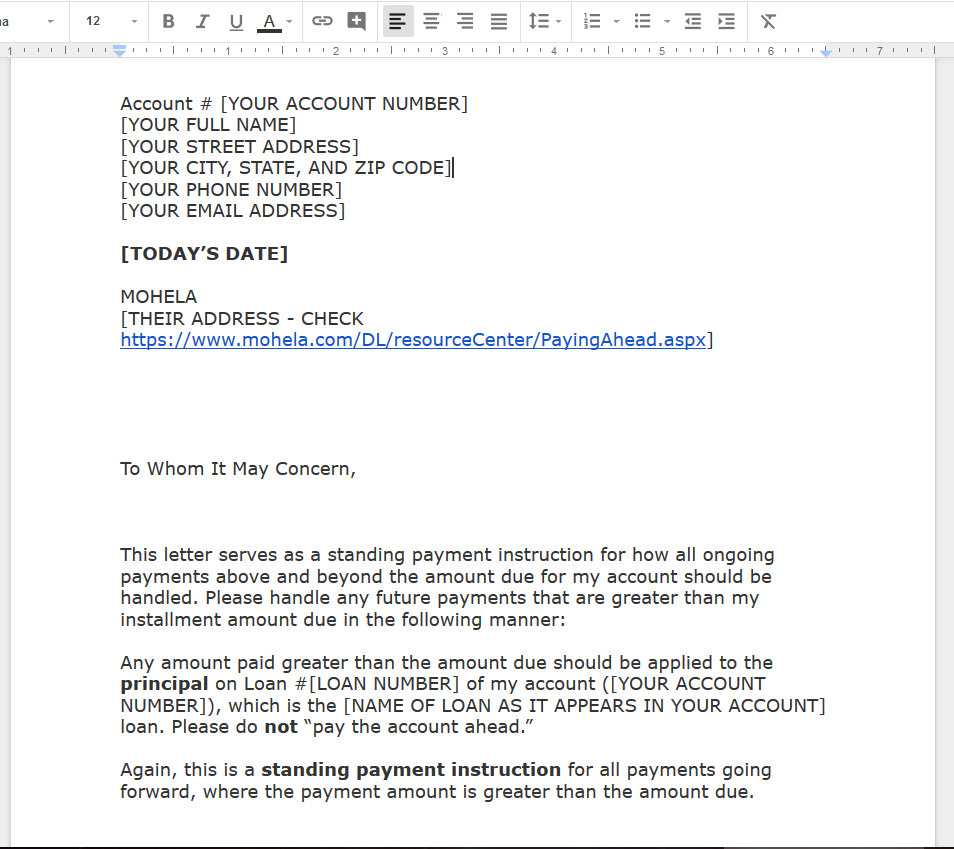

Option #2 – Standing Instructions for All Future Payments [With a Free Letter Template!]

To tell MOHELA how you’d like them to handle all future extra payments, you need to mail them a letter with specific instructions about how you want those payments applied. You need to include the loan type, especially if you want to target one specific loan versus another. For example, I have both a subsidized and an unsubsidized student loan with MOHELA, and I’d like to target the unsubsidized loan. Because that’s the one that still racks up interest even if I go back to school or put my loan into deferment for some other reason. Let’s get rid of that loan first, shall we?

Please note that MOHELA’s online instructions say your letter should include the “amount and disbursement date,” but that doesn’t seem to actually be necessary.

I took the very letter that I sent MOHELA with my standing payment instructions, and turned it into a handy dandy Google Docs template for you.

Copy the letter template to your own Google account, then replace all the [ALL CAPS] stuff with your information. I’ve left MOHELA’s address off of there just in case they move or change the address, but included a link to where you can easily find their current address. You can find your account number, the loan number, and the name of your loan by logging into your MOHELA account.

Then print it out, sign it (very important – your signature is required!), and mail it in to MOHELA. You’ll get a response in a few weeks (by secure online message if you’ve signed up for paperless communication – otherwise, it might come in the mail), confirming that they’ve received and processed your instructions:

Will this letter template work for student loan servicers other than MOHELA? Probably! If you send in written instructions like this, they pretty much have to follow them (or at least respond and tell you why they can’t). I don’t have student loans with anyone other than MOHELA to test this, though. You can feel free to be a guinea pig and try it out. Just Google “[name of your student loan servicer] apply payment to principal” to get the information you need, such as the address for where to send the letter.

Now What Happens?

The next time I send in an extra payment to my student loan, MOHELA should apply the entirety of my “overpayment” to the loan principal on my unsubsidized loan, rather than advancing my due date up by another month. I will see this with my very next automatic payment, because I already (accidentally) “paid ahead” by one month, so I have a $0 bill for the current month. This has been the case for years because of that one accidental double payment – each subsequent automatic payment was always applied to the next month.

But now, no longer! The next automatic payment should be considered an “extra payment” and handled precisely according to the letter that I sent in – applied to the principal on my unsubsidized loan, of course.

And what if the day comes when my unsubsidized loan is paid off thanks to all this “applying the extra payments to the principal” stuff? Well, we’ll see what MOHELA (or whoever has bought my loan out by that point…) does then. My guess? They’ll default back to “paying ahead” on my remaining loan, and I’ll need to send in another letter to get them to apply payments to the principal of that loan. Good thing I’ve got a template for that!

If you’ve got student loans with MOHELA, feel free to use the letter template and report back on your success. If your loans are with someone else, leave a comment below about the process for getting your servicer to apply payments to the principal – other people will benefit from the knowledge you share!

Photo credit: MILKOVÍ