This is the year! If I can max out all of my tax advantaged retirement-type accounts, then I’ll start paying extra to my student loans. The problem: I’ve already been sending “extra” money to my student loans with MOHELA (my student loan servicer) each month, and they weren’t applying that “extra” payment to the loan principal! Wait, what?

What I Want MOHELA To Do With Extra Money I Send Them

It seems so simple: when I make a payment to my student loans, the money normally goes toward the “amount due,” which consists of some amount of interest (the “fee” I have to pay for borrowing the money) and some amount of loan principal (the amount I borrowed in the first place that I’m paying back).

If I send any more money than the “amount due,” then it’s extra. There’s no interest on the account because I’ve already paid that for the month, so all the extra that I send should pay off the principal, right? This would reduce the total that I owe, meaning that less interest would be charged, and my loan would get paid off faster.

But nope, by default, that’s not what happens when you send an extra payment to MOHELA (or pretty much any other student loan servicer).

What MOHELA Was Doing With My Extra Money Instead

So if that money wasn’t reducing my principal… what was it doing? It was doing something that they call “Paying Ahead.”

Paying Ahead means that your current payment has been satisfied and you have paid at least a portion of your future bill.

…

Each time you satisfy a bill due, we will automatically advance your next payment due date and your billing statement will indicate a payment is not required for that bill.

– MOHELA’s website, Payment Information – How Payments Are Applied

Instead of straight-up reducing my principal, the default for extra payments is to reduce or eliminate next month’s bill. So the next month after I send an extra payment, I get the bill (electronically, of course – what am I, some sort of savage that gets paper bills?), and it says all the normal stuff, except the Total Due is “$0.00.” So I could just not make my payment the next month and be super duper okay, because the bill is already paid? Huzzah! … right?

MOHELA’s website is quick to point out that yes, this should be a “huzzah!” yes yes definitely! (Which is exactly when you should be at your most skeptical.) They say:

Paying your account ahead of schedule offers many benefits such as:

- Decreasing your total interest cost

- Paying your loan off sooner

- No prepayment penalties

And technically, they are right. (And the “No prepayment penalties” bit is super important – make sure that your student loan servicer has a similar policy before you send any extra payments!) But wait a second… the whole “Paying Ahead” thing doesn’t lead to me getting no bill the next month, it just leads to me getting a paid off ($0 due) bill every month, with accrued interest! So I won’t realize any benefit from this until:

A. I have to miss a payment for some reason, in which case I can just turn off my autopay but not get hit with any late fees or have to deal with putting my loans into deferment or forbearance (two fancy terms for “you don’t have to pay these loans right now but you will have to later”). The benefit wouldn’t be reduced interest, it would just be the ability to not make a payment for one month (or however many months I’ve “paid ahead”).

B. OR, at the very end of my loan, I won’t have to pay the last payment, because I already paid it!

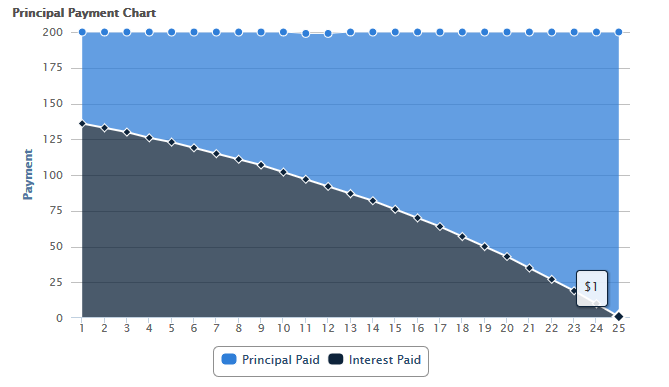

Scenario B is what MOHELA is referring to with all that “decreasing your total interest cost” and “paying off your loan sooner” – any payments “ahead” that I make mean payments I don’t have to pay at the end of my loan. But hold up, here’s a thing: payments at the end of a loan have hardly any interest at all!

Oh of course MOHELA is over the moon to have me pay ahead and then not pay my final payment… they get a whopping $1 of interest on that final payment!

Why not always default to having extra payments “pay ahead?” Well, if you’re the student loan servicer, this is a pretty sweet deal – it only costs you a dollar! But you’re not the student loan servicer – you’re the student loan payer and this is a bad deal for you. And me. So I went through the steps to get them to cut that out.

How to Get MOHELA to Let Me Pay the Principal on My Student Loan, Instead of Paying Ahead

Option #1 – One-Time Payment Instructions

Just sending in one extra payment that you’d like MOHELA to apply to your loan principal? This could be quite easy for you… if you don’t have a consolidated loan. (Which I do, so this option isn’t available to me… whomp whomp.) You can just follow the instructions on MOHELA’s Payment Information Page (under “Submitting Special Payment Instructions” > “One-Time Payment Instructions”) to target your payment to a specific loan.

But if you do have a consolidation loan, you won’t be able to do the Web instructions – you’ll be stuck with only the Phone or Mail options. And if you’re going to mail in a payment with instructions, why not mail in instructions for all future payments? Because you can totally do that:

Option #2 – Standing Instructions for All Future Payments [With a Free Letter Template!]

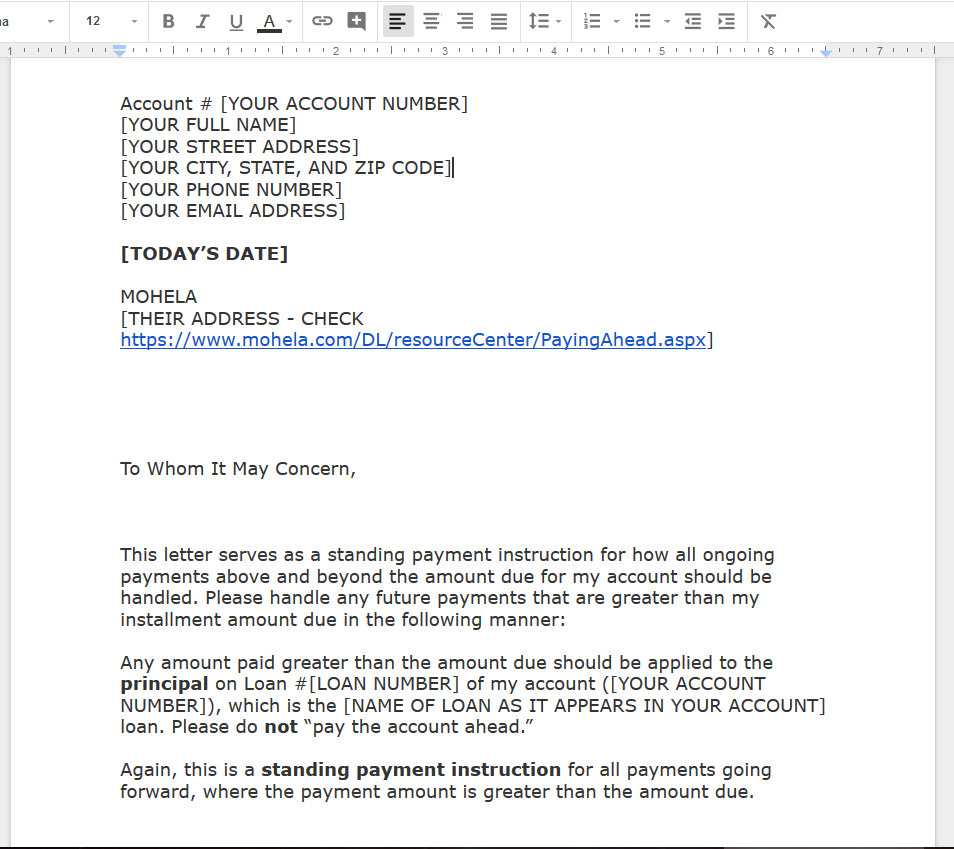

To tell MOHELA how you’d like them to handle all future extra payments, you need to mail them a letter with specific instructions about how you want those payments applied. You need to include the loan type, especially if you want to target one specific loan versus another. For example, I have both a subsidized and an unsubsidized student loan with MOHELA, and I’d like to target the unsubsidized loan. Because that’s the one that still racks up interest even if I go back to school or put my loan into deferment for some other reason. Let’s get rid of that loan first, shall we?

Please note that MOHELA’s online instructions say your letter should include the “amount and disbursement date,” but that doesn’t seem to actually be necessary.

I took the very letter that I sent MOHELA with my standing payment instructions, and turned it into a handy dandy Google Docs template for you.

Copy the letter template to your own Google account, then replace all the [ALL CAPS] stuff with your information. I’ve left MOHELA’s address off of there just in case they move or change the address, but included a link to where you can easily find their current address. You can find your account number, the loan number, and the name of your loan by logging into your MOHELA account.

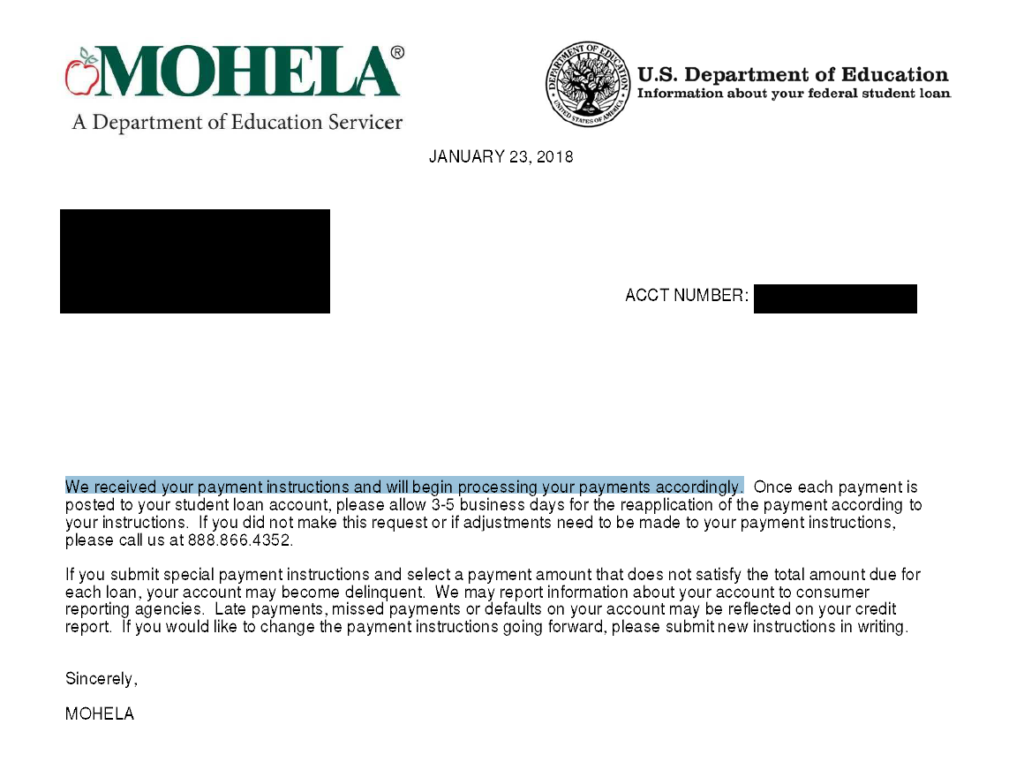

Then print it out, sign it (very important – your signature is required!), and mail it in to MOHELA. You’ll get a response in a few weeks (by secure online message if you’ve signed up for paperless communication – otherwise, it might come in the mail), confirming that they’ve received and processed your instructions:

Will this letter template work for student loan servicers other than MOHELA? Probably! If you send in written instructions like this, they pretty much have to follow them (or at least respond and tell you why they can’t). I don’t have student loans with anyone other than MOHELA to test this, though. You can feel free to be a guinea pig and try it out. Just Google “[name of your student loan servicer] apply payment to principal” to get the information you need, such as the address for where to send the letter.

Now What Happens?

The next time I send in an extra payment to my student loan, MOHELA should apply the entirety of my “overpayment” to the loan principal on my unsubsidized loan, rather than advancing my due date up by another month. I will see this with my very next automatic payment, because I already (accidentally) “paid ahead” by one month, so I have a $0 bill for the current month. This has been the case for years because of that one accidental double payment – each subsequent automatic payment was always applied to the next month.

But now, no longer! The next automatic payment should be considered an “extra payment” and handled precisely according to the letter that I sent in – applied to the principal on my unsubsidized loan, of course.

And what if the day comes when my unsubsidized loan is paid off thanks to all this “applying the extra payments to the principal” stuff? Well, we’ll see what MOHELA (or whoever has bought my loan out by that point…) does then. My guess? They’ll default back to “paying ahead” on my remaining loan, and I’ll need to send in another letter to get them to apply payments to the principal of that loan. Good thing I’ve got a template for that!

If you’ve got student loans with MOHELA, feel free to use the letter template and report back on your success. If your loans are with someone else, leave a comment below about the process for getting your servicer to apply payments to the principal – other people will benefit from the knowledge you share!

Photo credit: MILKOVÍ

It’s so annoying that loan companies want to apply extra payments towards the next payment rather than the principal. They’re also not doing it out of the goodness of their hearts – otherwise they’d be applying extra payments towards the principal to begin with – but rather to maximize the amount of interest they get.

Exxxxxxxactly.

Um, I know this is tailored to student loans… but I did NOT know this and I’m writing to my mortgage company today to give them these instructions. Wish I’d known it when I was throwing extra payments at my student loans!

Oh man, YES. If your mortgage company is “paying ahead” your extra payments, that’s just… sucky. Do the thing!

(Oh, and CONGRATS on getting your student loans paid off, by the way!)

Thanks for this great post. These companies are so crooked. People shouldn’t have to send such letters! But in the meantime, thanks for providing these samples.

I’m all for paying off student loans as fast as possible. Check out how I paid off my $40K student debt before graduating.

https://99to1percent.com/paid-40k-student-loans-graduating/

I totally agree – the default shouldn’t be “paying ahead” and even if it is, it should be an easy checkbox online to change it, not a letter that you have to write and send in. Le sigh. But happy to help people navigate the broken system when I can.

I love your story, Ms99to1percent! I’ve read it before, but I enjoyed going back and reading it again. I didn’t do the “choosing a field and school wisely” part myself (followed a dream, instead!), but I sometimes wish I had – then I wouldn’t be still making payments on these loans now, 9 years after graduation. But, at least I managed to pay off my credit card debt before graduation. It was a start! 🙂

I had been on a 0 payment plan for 2 years. Now I started to pay monthly installments of ~300$. According to my calculation 210$ should go towards the interest and 90$ should go towards the principal, but they are charging everything towards the interest. When I called them they said I when I was on 0 payment plan I aquired some interest and my monthly payments are going towards repaying that first. And my current principal is still collecting interest and increasing every month! This is wrong-if they can add my current interest to my current principal, why could they not add the 2 years interest (when i was on 0 payment plan) to the current principal and let me make payments on the total? ( i calculated my payments would increase just by $25). How can I make them do it? Please advise.

Hey Ray0fh0p3. I’m having a little bit of trouble following the details of your situation exactly, but what I will say is that I don’t think you want them to “add the 2 years interest to the current principal.” That would be the interest capitalizing (becoming a part of the principal) and yes, it would make your payments increase, because you’d be paying interest on the interest! That’s not what you want at all.

What I would do in your shoes is ask them to send a letter detailing how much interest you accrued during those 2 years, and when it will be paid off given $300/month payments. It sounds like you will not be able to get them to apply any payment to principal until that back interest is paid off – this is definitely the downside of taking advantage of a “0 payment plan.” Interest accrued while you were not making any payments and you will have to work through the unpaid interest before you can tackle your loan’s principal.

Thanks much for the response.

My worry is, as I am paying off the interest accrued during those 2 years, I might collect more interest on the principal, making it go up each month.

Here is an example:

Say if my beginning principal is $100. Date of disbursement is 2008; I did not make payments until 2015 (i was still going to school) and the principal grew to $150, which they are calling ‘current principal’. Then I was on 0 payment plan from 2015 to 2017 for which I accrued $50 interest. I started making payments from July 2017 which is going towards the $50 and will take me 2 years (until 2019) to payback. My worry is, from July 2017 to July 2019 I will still be collecting interest on the current balance $150 and it will grow to say $170?

Hope that made sense.

Yes, it does sound like that might be the case. That is why I do suggest you get some information from them in writing as to how long it will take you to pay off the accrued interest with $300/month payments, so that you can see how long before your payments can be applied to principal. Basically, because of the 0 payment plan, this is what happens—you may be stuck making “interest only” payments until you can get the interest balance down. But it’s still better than having that interest capitalize and become principal. Once it becomes principal, it can accrue more interest, which would only make this harder and take longer.

Hey Stephanie!

So I’m trying to understand your loan situation because I also have consolidated loans. Maybe I have this mixed up, but i understood that consolidated meant to combine the loans you previously had. You mentioned you wanted to pay one loan over the other for the “extra payments”. Does this mean you had an additional loan on top of your consolidated one? I am just a bit confused.. I have 4.6% interest on my consolidated loan now with SoFi/Mohela. There were 2 separate loans but now they display as one. When I make the “Extra payment” I will instruct them to have it go towards principal on my overall loan.. I think lol

Hi Julian! Sorry that it’s confusing, but yes, I have 2 separate consolidated loans. I had lots of little loans of 2 different types (Subsidized Federal Stafford Loans and Unsubsidized Federal Stafford Loans). Basically, I had 1 small loan of each type for every year I was in school, if I remember correctly.

When I consolidated, they did not allow me to combine the subsidized loans with the unsubsidized loans, even though all the loans were from the same place. So I ended up with 2 consolidation loans in the end, a subsidized one, and an unsubsidized one. (I also had a Federal Perkins loan with another loan servicer that I chose not to consolidate with the other 2, but those are long paid off and not a part of my current picture.)

For your situation, where you only have 1 consolidated loan with SoFi/Mohela, yes, you want to just direct them to apply your extra payments to the principal of the loan in your letter.

Hope this helps!

100%!!

Thanks for the insight and template!

Hi Stephanie,

Thank you for sharing this great information with us. I am in a similar situation at the moment; my question to you is- Does this also apply to someone who is currently in school and “paying ahead”? For example, I will be graduating in September 2018 and have already started making payments towards my loan. Does that mean that when I select a repayment method in February 2019 and I officially start paying my loan back, I will get the “$0 bill due” for whatever month’s I paid ahead?

Thank you,

Alex

Hey Alex! I know I already answered this via email for you, but since you left a comment as well, I figured I would paste my answer from the email here too, so that anyone else in your situation has the answer if they read this. 🙂

Hello! First of all, thanks so much for this!

I also have a subsidized loan and an unsubsidized loan on Mohela. Right now my payment just gets split between the two, which is fine. Not able to pay extra until December, just getting ready to!

My question is, I see my “Account Number”, but not individual loan numbers? Do yours have loan numbers, separate from your account number?

Thanks!

Jackie

Hi Jackie! Yes, my loans have individual numbers, but they are just 001 for the subsidized loan, and 002 for the unsubsidized loan. I can see these numbers by clicking “Loan Detail” in my Mohela account, and then it’s the very first column (“Loan #”). Hope that helps!

Thanks!

They don’t have this detail on the loans differentiating them. I had to ask by calling them but it’s another way of them not being transparent and untrustworthy. I find that these companies (Citi, BofA, Sallie Mae etc) use these same tactics to destroy rather than provide help to us. They make it hard to contact, avoid servicing, and transfer servicing to lose the trail of errors and records needed to straighten out the corruption behind the scenes.

I recently discovered an odd quirk with one of my student loans while looking into this very topic. I called the loan holders at EdFinacial to ask how I can direct overpayment specifically to the principal.

Guy said there is a box you check when making a payment that says ‘Do not advance due date’.

Cool, I say, but why don’t I see that box?

Oh, he says, you have to pay more.

How much more?

Double. The button doesn’t even appear unless I intend to make a full double payment.

Current amount due $63.16

Amount I’d have to pay to ‘not advance due date’: $126.32

(Even if I’ve already paid for the month, but I will double check that fact once this payment I’m making now clears)

Urrrrrgh why do they make it so difficult?!?

I’m just kidding. We know exactly why they make it so difficult. Because they make more money when it’s difficult. >_<

Follow up: If I already paid for the month I have to put in at least $63.16 to get the magic button. So, still double. :-/

UGH. That’s the type of loan I move to the top of a “debt snowball” simply out of spite.

Hi,

Thank you for creating this post, it is so helpful. I sent this letter to Mohela and they still say that any extra payments applied to a specific loan have to cover interest on that loan first and then the rest will go to principal. Is that correct? Or should any extra payments be able to go straight to the principal?

Thank you so much for your help!

As far as I know, that’s correct – if you owe any interest (interest is calculated daily), the interest must be paid before anything can be applied to the principal.

Stephonee, thank you for this.

And thank you Mohela for being a shining example I can show my daughter of what to watch out for. (She’s still in school. I’m accumulating PLUS loans.)

This policy makes it clear you’re not a customer, but a resource. So any “thank you!” that appears on their statements I’ll consider a typo. And any advice the “minimum legal requirement.”

You rock! Thank you for this post (and included template).

Holy crap, I am so pissed off. I am a little different position than many of you. My student loans were enormous but my income is also respectable. I called MOHELA a few years ago and asked them why my extra payments were not just deducted from the principal. They responded with a lot of mumbo jumbo about how they do things. So, I had my accountant call them. More mumbo jumbo and he said they were using accounting jargon that he had never even heard used before. Even he could not figure out why my extra payments had interest deductions.

I am paid up about five years into the future. My next payment due is five years from now. In 2018 I paid $82,000 on my consolidated loan. Despite being paid up so far into the future they still applied $20,000 to ‘interest.’

So I guess that I can now fix this with the form letter. I wish that they had explained this to me and my accountant when we were first calling them years ago.

Soooo pissed off.

THANK YOU SO MUCH for this! I should have been doing it a long time ago.

Thank you, thank you, thank you!!! I had no idea why my due date has been pushed back by over a year. Its because they’ve been screwing me out of my hard-earned money this whole time. Not cool. Thank you from the bottom of my heart for having this template and taking the time to help us poor suckers out here in the wilds!

Interesting. I didn’t have to send MOHELA a letter at all. I just messaged them on the MOHELA app and said “please have all extra payments go to principal. This is a standing request”. That was it.

Frustratingly enough, I called many times to ask about the process of targeting the principle with my extra payments, and despite the fact that the CSRs told me “that’s what happens automatically,” the extra payments just went towards future payments and I am paid ahead to 12/2020. I am always shocked by the inadequate and inaccurate information provided by Mohela employees. Although over all, I should not be surprised, since there are lawsuits out there that address the same issue with other student loan providers….

Thank you so much for sharing this. I had no idea and I thought it was odd that my schedule showed as paid ahead. When I inquired about it over the phone, they did not explain to me any of this information.

Hi there,

I have been making additional payments to my highest interest loan and have indicated in “Special Payment Instructions” on the Mohela Account Portal to direct the additional payments entirely to the principal. However, when I checked the payment, they directed it to interest and principal. I called Mohela and spoke to a representative. They said that all payments including additional payments are directed first to interest and then to principal. Has this policy changed in recent years? Have you heard of the hardcopy letter working in the last few few months? Thank you!

Thank you for writing this! I’m signed up for auto-debit and a payment plan, and was becoming increasingly frustrated when MOHELA would apply my monthly payment to my loans, but not according to the payment plan.

Your article gave me the answer why – I had been making one-time payments and MOHELA had placed my account on paid ahead.

An update and question! The update: On the Auto Debit page, MOHELA allows me to cancel my paid ahead status and not advance my due date when additional payments are made. My question: Does this eliminate the need to submit standing payment instructions? Can I continue making one-time payments and reduce the principal of my loans?

Thank you for all your help!

Yes – this is an older article from before MOHELA had that option on the Auto Debit page. Canceling your “pay ahead” status should have the same effect as sending in a letter with standing payment instructions. Of course, if it doesn’t work, a letter might be what you need to get them to finally turn it off!