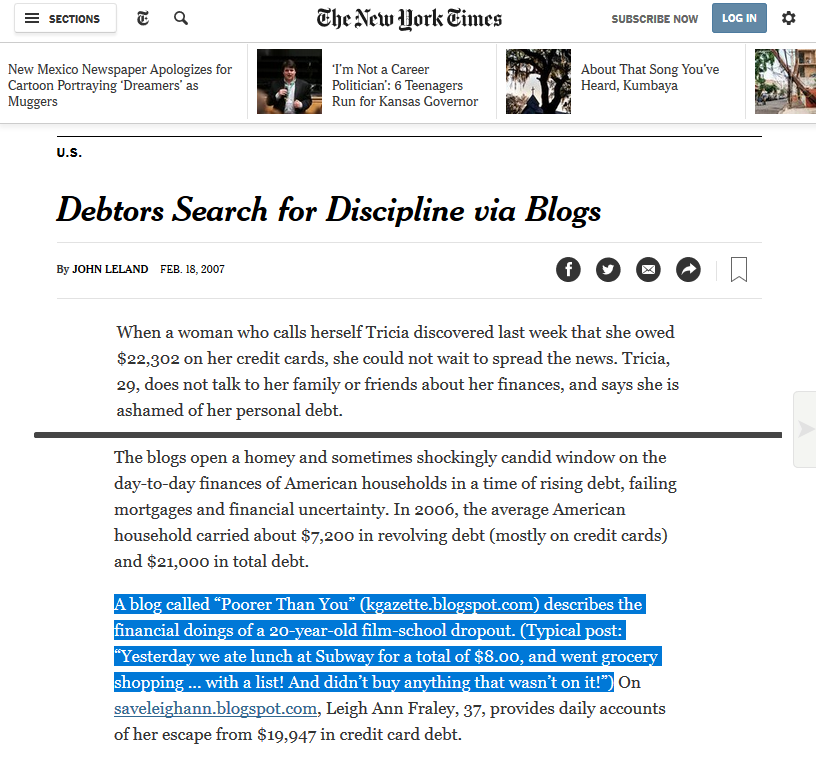

I must admit, I’m blushing. I had no idea that the New York Times was going to mention me in their article about debt bloggers – I was caught completely off guard!

I think they just liked that they could describe me as a “20-year-old film-school dropout” (accurate). 😉

If you enjoy what you’ve been reading, consider subscribing to Poorer Than You in a feed reader or by email.

I’m one of those New York Times readers, writing from Down Under, where my wife and I emigrated last year to escape Bush fascism, but that’s another story. Congratulations on your honesty and openness. It’s odd that people feel freer to talk about their sex lives and all sorts of other intimate details, but not money. In a dollar-driven society like America, being inadequate in the bank is more shameful than coming up short in the bedroom! At least they have pills for the latter… (For guys, that is.)

Your suggestions that I’ve read seem sensible. It’s stuff that I already glommed instinctively, even when I was your age. I think some people are just born with a conservative nature, like the Aesop’s fable of The Grasshopper and the Ant. But you should feel good about the thought that your writing might help even ONE person get it together better.

I feel sorry for your generation. You start out being much more screwed than mine (the Boomers) was. I got my first college degree in the late 70s-early 80s, at a large state university, where the tuition was less than $2,000 a year. If one played it smart, other annual expenses came to less than that. When my previous industry hit the skids and I had to find a new career in the early 90s, I was able to get through nursing school (not my first choice in life, but one which has guaranteed employment whenever and wherever I wanted it, even allowing me to move internationally on a work visa!) at an inexpensive community college. So I didn’t emerge with my back against the wall like Gen. Y. And when I was growing up, there wasn’t the relentless drumbeat of “gotta-have-it” consumeristic pressure that you have. My wife and I like the good things in life — holidays in Europe, fine wine, gourmet meals — but we were raised up with the puritanistic discipline to wait if need be.

Keep up hope! You’ve got an advantage in that you’re educated and have a realistic viewpoint. Your generation is also on the ropes because the U.S. economy is changing to the disadvantage of the working class. The coming years will not be easy, especially if the economic crash that I fear actually happens. (Thank goodness we got our money out of U.S. dollars and into other currencies in a nice European country known for its mountains…) But even in hard times, savvy people such as yourself stand a better chance of coming out better. Good onya!

Congrats, Steph, for captivating the Times! *hugs*

I’ve loved reading your blog since I found it, and hope you’ll continue to chronicle your journey for us. There are no coincidences in life 😉

Hope you had a lovely Valentines!

=^..^=

Congratulations for being featured in the NY Times! Looks like more and more people really care about personal finances and we pf bloggers are on the right track not just concerning ourselves.

A Pile of Coins: […] The New York Times published an insightful article about the personal finance blogosphere today and mentioned some really good blogs I regularly read and enjoy myself […]

Congratulations! Way to go!

Congrats Steph! Seems like everyone is getting some love from the NYT this weekend. I’ve even got some trickle down hits too, Yay! Your blog is definately one of my favorites so keep it up!

Juan

Thank you all so much! =D I have very much enjoyed the chance I’ve been given with this blog to establish a new voice – I certainly won’t be quitting any time soon!

I am so happy for you, I saw the article and thought of you.. and there you were, in it! I know I said this on facebook but I’m still so happy for you! Mozel tov again!

Great job, dollface. Getting the word out about being debt-free is something that this crazy world needs. The key to having cash is living on a budget and deep-sixing debt. Once you have no payments, you have lots of dough. Let’s get the word out, baby! http://www.debtective.com

Congrats! Give yourself a pat on the back you deserve a bit of recognition.

Thanks for sharing your blog. It kicks *&@!