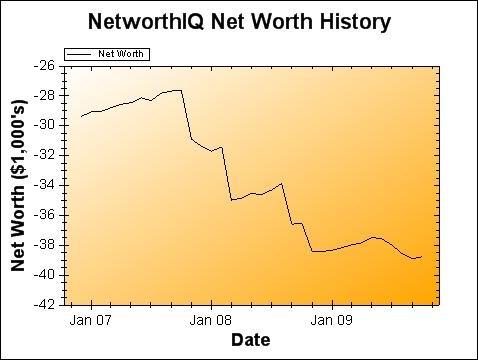

Did it go up? Did it go up?!? Did it go UP?!?

Oh yes, it went up! 🙂

Change: $112 or 0.29 %

Finally, a little breathing room! The last few months of moving and not finding full-time work right away really took a toll on me emotionally — and on my finances. But, things are starting to come solidly come together!

Finally, a little breathing room! The last few months of moving and not finding full-time work right away really took a toll on me emotionally — and on my finances. But, things are starting to come solidly come together!

Work: Income is a little funny right now. I’ve got a huge freelancing job that’s 40+ hours a week, and the clients are pretty awesome. I love working with them. But, I still have to be careful about money. Because I’m an “independent contractor,” I have to take care of taxes myself — nothing is withheld for me. So, as I’ve always done with freelance income, one third of my income is put aside for such things. Between moving to a new state and having only 1 month of W2-type work this year… my taxes are just gonna suck.

Savings: Now that I’m working “full time,” I’m ready to ramp up my savings and siphon some of the two-thirds of my income (what’s not going to taxes) into my goals.

- Weddings Fund, Formerly called my “Brother’s Wedding Fund,” I’m expanding it out because I was asked to be the groomswoman in my best male friend’s wedding. Also, I figure I myself may do the white-dress-and-veil thing, and there’ll be no money coming in from this bride’s family, so I’ve got to save for it myself. With the first wedding scheduled for the end of May, it’s time to really ramp up my contributions to this fund.

- Retirement Fund, growing at a pitiful $5 per month right now, needs to be kicked into high gear. I still don’t think it’s a good idea for me to sign up for a Roth IRA that requires certain monthly minimum contributions, since I’m still on irregular freelancer income. I’d much rather save up $3,000 in my savings account and then open a Roth IRA at Vanguard. Not sure how long that will take me, but I have this pipe dream of doing it before April 15th so that I can open it for the 2009 IRA year. (IRA years go from January 1st of the year in question until April 15th of the following year. Yeah, it’s weird, I know.)

- All other savings funds are going to stay the same… for now. I’m going to have to adjust my Savings Snowball a bit, but all that really needs to be changed is moving Retirement to the top.

Phew… so relieved to see that little line go up! Do you guys have any questions about this month’s net worth update?

I recently became an independant contractor and all the recordkeeping is a big pain.

Glad to see that things are finally looking up for you. Keep up the good writing!

Thanks Nicole!

Morning Steph! Just want to congratulate for moving in a positive direction! NICE!

A 40 hour / week consulting job is sweet! Just go on a spending moratorium and buy nothing other than food and gas. I did that from Sept 1 to Nov 1 and it was quite liberating and good for the bank account too!

You should be able to rent the groomswomen dress for under $100 no? Hope it doesn’t cost too much.

Also, you’ve got one of the highest ranked blogs for PF, do you think there are some ad revenue optimization opportunities? I have no idea b/c I ignore most everybody who comes to me, but just saying… cuz $5/month for retirement doesn’t sound like a lot, and I’ve got to imagine you make MUCH more than $5/month from the revenue of this site yeah?

Best,

FS

The worst thing I have found managing anything business related is the amount of data you have to maintain. The biggest flop at first was that I did not know where what was and my brain hurt from just thinking about that. Not even talking about the stress the work brought.