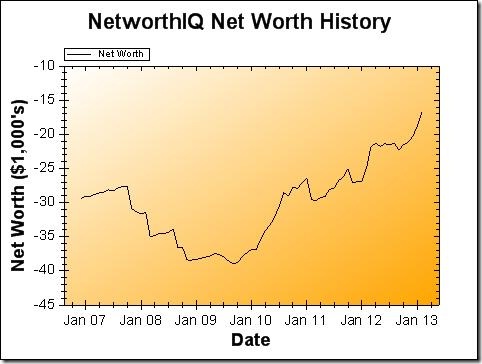

The world didn’t end and I somehow entered my 27th year more-or-less unscathed. So how did the financials stack up, when 2012 was all said and done? (And 2013 is already 1/6th of the way done! Egads!)

December: +$832 +3.94%

January: +$1,462 +7.20%

February: +$2,072 +11.00%

That, my friends, is what I call three productive months! I’m not ashamed to say I’m proud of the numbers in this update. Those increases put my net worth up to -$16,771 (yeah, negative sixteen grand).

Positive Net Worth Quest

Back in November, I laid out a plan to raise my net worth into the positive numbers by mid-September, 2014. At that time, I calculated it would take net worth increases at an average of $978/month to reach that goal. How’s that been going?

$4,745 increase over 4 months = $1,186.25/month

Woot! I beat the plan by over $100/month! Which means from this point forward, I only need to hit an average of $932/month in net worth increase over the next 18 months to reach my goal.

These over-achieving months early on are really vital to me. First of all, they give me confidence in the idea that this plan is totally do-able. More importantly, they will help pad any slow months later on, so that I don’t have to play catch-up if I can’t quite maintain this super-charged pace.

So how did I manage that nice growth these past few months? Well, I’m glad you asked!

December

Honestly, it surprised me that there was any increase in this month at all! Between Christmas presents (I’m a gifter. Like, a hello-my-name-is-Stephanie-and-I’m-a-giftaholic level gifter.) and cleaning out everything remained in my charity savings account for my video game marathon fundraiser, I was expecting a net worth decrease for December, actually.

So what saved December?

- I have a roommate now! Sharing the cost of my apartment has freed up some of the money that I was paying in rent to go to net-worth-increasing projects, instead. Even though I still pay the majority of the rent (we split the bill based on our respective income levels), every dollar freed up by sharing the load can be put to more productive use.

- My retirement accounts saw some really healthy growth. $429 in those, and $23 (almost 10%!) gained from having decided to put more investment into my Lending Club account the month before.

- Continued effort on my car loan and student loan repayments. I’m only paying the minimums (because the interest rates are fixed low rates), but still made $335 in progress on all of my debts.

January

The gains in this month were a little easier to understand right off the bat. My retirement funds exploded by more than $1,000 in January — nearly 10%! Part of that can be attributed to the dividends that my funds paid out, all of which were automatically reinvested into the same funds. All very nice to see — I just hope things keep up (or at least, steady) during these very uncertain times in the market.

Despite some unexpected travel (for a funeral, unfortunately), January rocked it. Not as much as February, though!

February

Tax refunds! Woooooo! Okay, not really something to get that excited about. Honestly, a tax refund is often just referred to as the government repaying its interest-free loan to you. And I actually did everything I could to avoid a big tax refund: adjusted my paycheck withholdings to try to get to that “sweet spot” of a very small tax refund. But, for whatever reason, it didn’t really work and I got a big fat direct deposit in February, anyway (and a small one from the Commonwealth of Virginia, as well).

Retirement funds grew a bit again, my car actually increased a bit in value (giving credence to my friend’s theory that Kelly Blue Book values have seasonality), and everything else continued on its usual path (debts down, assets up).

March Forth*

What’s next? Not much specific, I’m afraid! Aside from some small things (there are two weddings this year that will draw some cash out of my “Weddings” savings fund, for example), I will mostly be focused on packing away that $932/month to hit my net worth goal.

Questions? Comments? There’s a comment section below for that! 🙂

*Get it? This blog post was put online on March fourth, which is the only day on the calendar that is a complete sentence (albeit, a misspelled one), and this section is about looking into the future, the month of March specifically. I hope you’re half as amused by this as I am, cause I’m dying over here!

Big congratulations, if you continue the current trend you will be debt free within 2 years which I’m sure will be a fantastic feeling!

Congratulations on not only meeting your target, but exceeding it! I know first-hand how encouraging that feels – keep up the good work : )