I had one job to do this last month: open a Solo 401(k) for my retirement savings from self-employment and freelance income. Okay, really, I had like four jobs to do: mommy stuff, my job-job, my freelance job, and opening a Solo 401(k). But those first three were pretty much a given. A collective given? What’s the plural of a given – givens? A murder of givens?

The following post is mostly about the reasons I did or did not accomplish my “one job” this month. But there are gifs and I use funny words, so stick around, because it’s about to get all retirementy up in here:

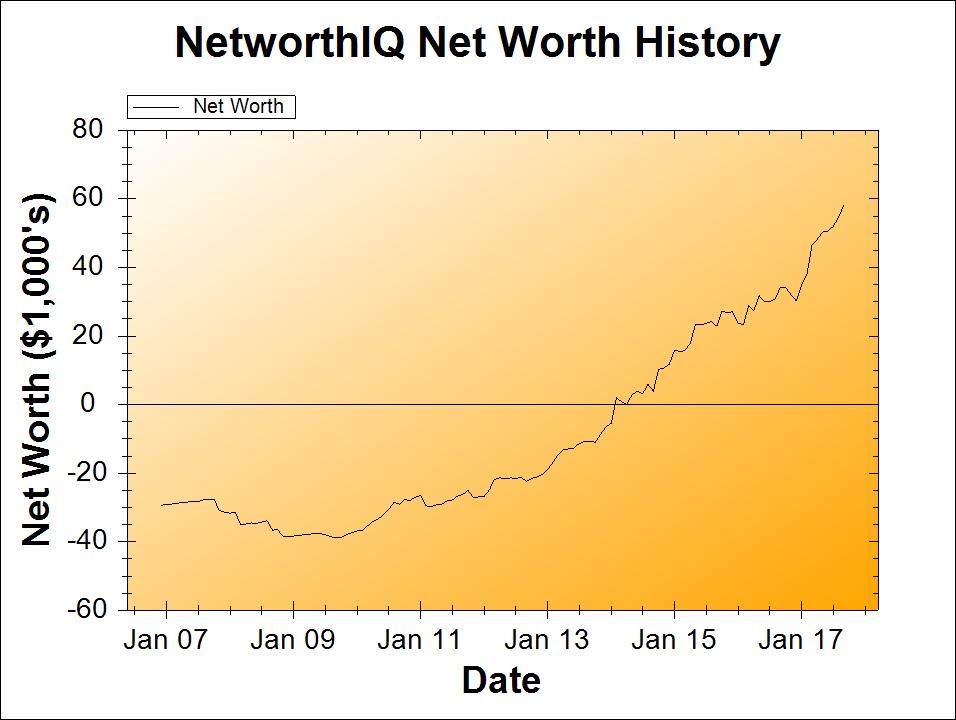

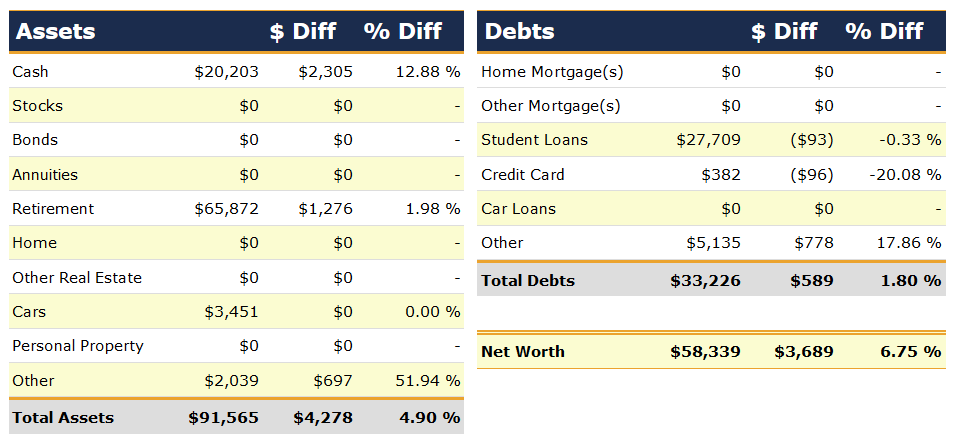

Change: +$3,689 or +6.75%

September Net Worth TOTAL: $58,339

Cash & Retirement

Despite my best efforts to hold less cash, it’s up again this month. Why? Because I still haven’t started that Solo 401(k) yet.

Oh, I know. What’s up with that? Wasn’t I supposed to do that this month? Wasn’t I supposed to do that last month?

You’re not wrong. But I started the paperwork late in the month, and boy howdy is a Solo 401(k) a lot of paperwork. 19 pages of glorious IRS gibberish and they just expect any yahoo with a sole proprietorship (aka. one-dude-or-dudette business) to figure this stuff out? This isn’t even my first rodeo with this stuff – I spent all that time studying to get my FINRA Series 65 license*, which covered a lot of this exact 401(k) gobbledygook, and this form is still intimidating to me.

Intimidating, but not impossible. One phone call to E*TRADE (where I’ve decided to open my Solo 401(k)) and I should be able to get through the parts I’m not sure on with their help. Of course, we all know how much I love making phone calls.

And Also, SEP-IRAs Are a Thing

I found out that once you open a Solo 401(k), you can’t easily open a SEP-IRA (because of the way most SEP-IRAs are set up). But you can easily open a Solo 401(k) if you already have a SEP-IRA, no problemo. So if I ever want to contribute to a SEP-IRA, I should open one before I open the Solo 401(k). It seems like a SEP-IRA would only be better than a Solo 401(k) for my situation if my business made a whole lot of money, and if I added employees later on. Not sure if that will ever happen, but opening a SEP-IRA is simple enough that I might just do it just in case, because I’m experiencing some FOMO.

(Yes, my version of “fear of missing out” is that I might miss out on the opportunity to open a different kind of self-employment retirement account. My life is exciting.)

If you read all the above (or skimmed it) and said a lot of “I don’t even know what a Solo 401(k) or a SEP-IRA are!” – don’t worry. Unless you have a side hustle or small business or get paid as a 1099-MISC contractor… in which case, welcome to my boat! These are retirement accounts and they’ll basically save me a boatload on taxes, including possibly reducing my income enough to qualify for tasty tax credits or Obamacare subsidies (which contributing to a regular IRA would not do for me). So if you are in this boat with me, you too should probably be looking into either a Solo 401(k) or a SEP-IRA, or something similar. The Oblivious Investor has a great, simple breakdown of the self-employment retirement accounts.

So Will You Ever Open a Solo 401(k), Stephonee?

Yes. I’ll get there. Hopefully before the end of this month (October). But definitely before December 31st, because that’s the real deadline. I don’t have to make my entire year’s contribution before then (I have until the April 15th tax deadline to do that), but I do have to open the account before the end of the calendar year for it to count. So, I’ll get there. I’m just one SEP-IRA and a 19 page form away!

Okay, moving on!

So, the increase in “Retirement” on my balance sheet was, once again, not from me making any actual contributions this month, but just from market growth. I hate that. My contributions are waiting in cash for this whole Solo 401(k) quagmire to be resolved. Bah!

Milestone Progress

$58,339 out of $61,099 by January 2018 – only $2,760 to go! That’s $690 needed per month to get there. SO CLOSE NOW. LOOKING VERY REAL.

Nyan cat real.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

*I should point out I do not currently have the FINRA Series 65 license any more, so I’m not claiming to be licensed right now, that was from a previous employer and now I’m a rogue blogger again. Let no one claim that I claimed to be carrying a license right now.

Just wanted to say hey & thank you for writing this blog! I am possibly two decades older than you and STILL struggling with the Money Monkey in terms of understanding investing, retirement, etc. I think your blog is awesome for anyone wanting to get a better grip on their finances, but especially for the 20s and 30s out there who don’t think they have enough wealth or power to get savvy with money. So not true! What I have finally come to understand is that economics and money is a giant, high stakes game of sorts. Those who know how to play win – those who don’t, lose. And there are many, many ways that “They” try to stack the odds against regular people ever understanding this game, let alone winning it. Your blog does A LOT to empower young and regular people to see the truth and be empowered. So thank you for doing this!!

Wow, thank YOU, Shannon! I’m so glad that I can be a living example for people out there. The path is not always easy, and one of my goals is to show that it can be hard at times, but progress is possible. And we’re on this journey together, so let’s all talk about it and try to help each other, right?

If you ever think of a specific topic you’d like to see me write about, please just let me know. 🙂