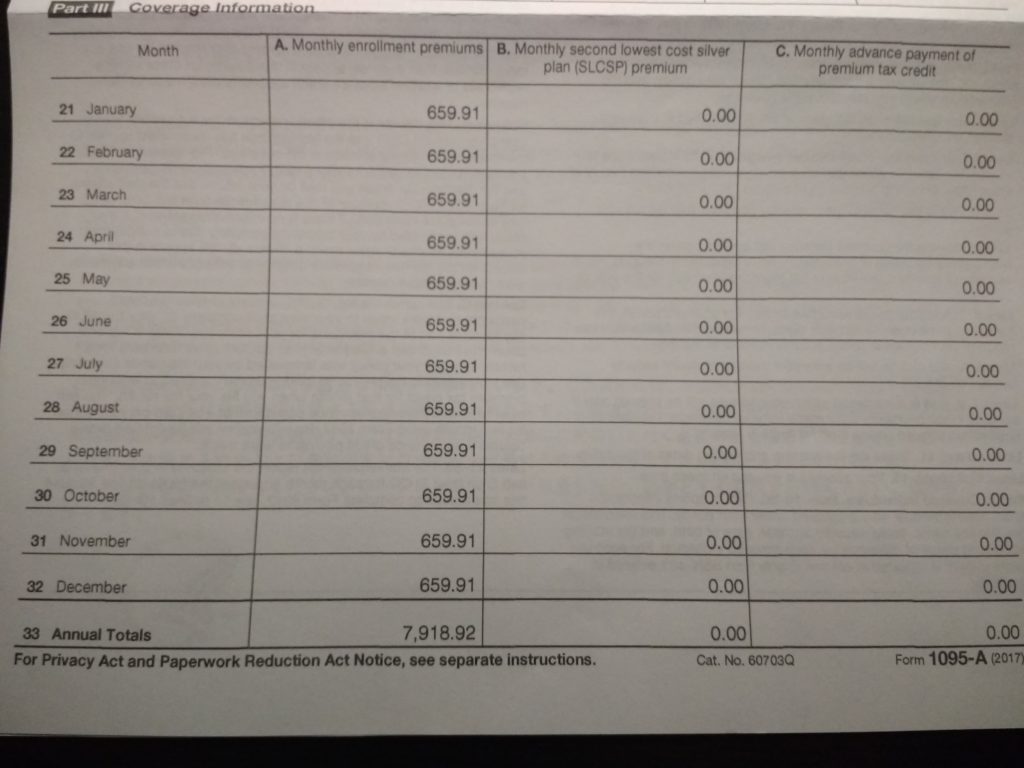

Your tax forms are rolling in! Including one for the health insurance premiums from your Affordable Care Act marketplace plan: the 1095-A form. You look it over. Names and social security numbers for you and your dependents look good (hopefully). The amount you paid in premiums is correct. But – what’s this? Your 1095-A Column B is zero all the way down? It can’t be right that the Second Lowest Cost Silver Plan premium costs $0! The form is wrong! What now?

Please note: I’m not a tax expert and this should not be taken as tax advice. I’m just a lovely lady on the internet, a citizen like you, who also had an Obamacare health insurance plan last year, and who also received a 1095-A where my column B was all zeros. This post is for educational purposes only, showing you what I learned and what I did to deal with this issue. If you are concerned about your tax situation, please consult with a real tax professional.

What Is Part III Column B of the 1095-A For, Anyway?

Part III Column B should show the cost of the “second lowest cost Silver plan” (SLCSP) premium. In other words, the not-quite-least-expensive Silver Plan that you could have signed up for. This number is used to calculate the health insurance premium tax credit (“Obamacare subsidy”) that you could receive, based on your income.

Tip: Even if your total income was too much for the premium tax credit, you may qualify for it anyway, because certain actions (such as contributing to a 401(k) or other employer retirement account, or contributing to a Health Savings Account) lower your income for the purposes of the tax credit calculation. Run your numbers through tax software to check – but you’ll need to make sure you have the right numbers on your 1095-A Column B, first!

The way that the subsidy is calculated is super confusing, but you don’t need to know the exact specifics. What matters is: if your income (minus those 401(k) and HSA contributions) is low enough, the subsidy consists of the difference between the second-lowest cost Silver plan premiums and a certain percentage of your income. So the cost of the second lowest cost Silver plan is absolutely necessary for the calculation.

What It Means to Have All Zeros in Column B

The instructions on the back of your form 1095-A are less than helpful:

See the instructions for Form 8962, Part II, on how to use the information in this column or how to complete Form 8962 if there is no information entered. If the policy was terminated by your insurance company due to nonpayment of premiums for one or more months, then a -0- will appear in this column for the months, regardless of whether advance credit payments were made for these months.

Well it says to see the instructions on Form 8962, Part II if there is no information entered, but it also says that zeros will appear in this column if you didn’t pay your premiums. If you’re like me and paid all your premiums in full and on time, this is confounding. And enraging.

So I put out the call to Twitter to help me figure out why Column B would be all zeros, and Harrison from Financially Awkward helpfully found an answer hidden in the H&R Block community forums:

When there is no amount in columns B and C of the Form 1095-A this means that you did not receive any advance payments of the premium tax credit (APTC). This generally occurs when the Marketplace determines you are ineligible for the premium tax credit at enrollment because your income was outside of the eligibility range or if you declined to receive APTC instead preferring to claim the credit on your return.

Ah, there it is. Personally, I wasn’t sure whether I’d qualify for the subsidies. I declined to receive them as discounts on my insurance premium (APTC), just in case. But the Health Insurance Marketplace decided to not include the information needed on my 1095-A because… reasons? Alrighty.

How to Get the Correct Numbers for Column B

To even see if you could possibly get the tax credit, you need the right information for Column B. Most tax software won’t let you enter all zeros for Column B anyway. Thankfully, it’s rather easy. No need to file a request for a “corrected” form or fill out any complicated paperwork (thank goodness).

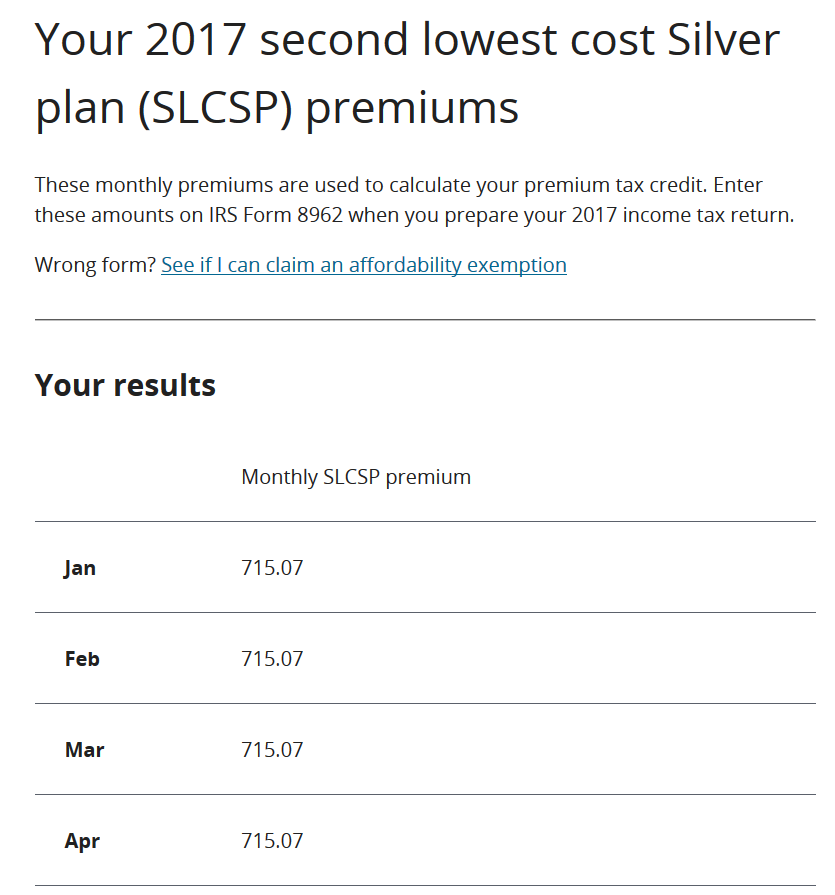

Forget about “Form 8962, Part II” from the 1095-A instructions, and instead hop on over to this helpful page of Healthcare.gov (why they don’t just say this in those instructions, I’ll never know): Healthcare.gov Health Coverage Tax Tool

Here you’ll find a tool to “Figure out your premium tax credit: Get your ‘second lowest cost Silver plan’ (SLCSP) amount. You’ll use it to fill out IRS form 8962, Premium Tax Credit.” YES! Okay. Awesome.

To use the tool, you’ll just need some very basic information:

Answer questions about who in your household qualifies for a premium tax credit and information on each person, including date of birth, location(s) they lived in for the year, and months of marketplace coverage.

It took me about 2 minutes to fill in the information and get the real numbers for my Column B. And you can scroll to the bottom to print, email, or save a PDF of your numbers. I highly recommend you do at least one of those, and keep a copy of it with your 1095-A.

What Difference Does It Make On Your Taxes?

If the second lowest cost Silver plan premiums really were $0.00 (ha!) or the $0.01 that H&R Block’s forums suggest you use instead, then you would get no subsidy at all, even if you qualified for one. It’s better to use the real numbers, because you could be in for a big fat tax break!

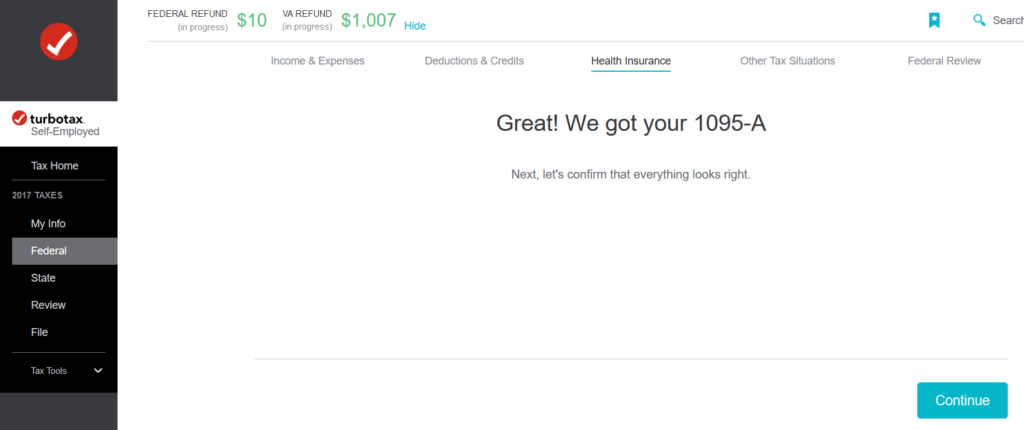

Using TurboTax, you can do your entire tax return online without giving any payment information. Which makes it great for seeing how much of a difference the tax credit can make:

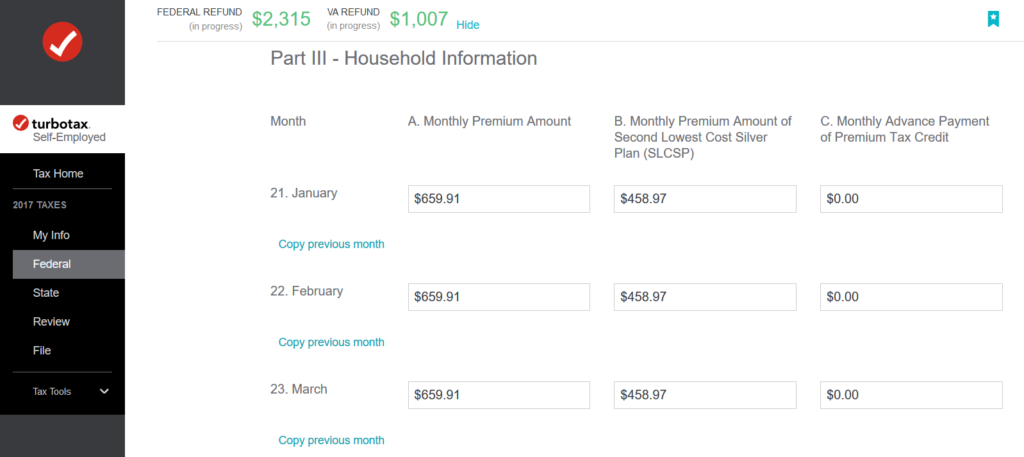

TurboTax was able to import my 1095-A from the PDF I got from my Healthcare.gov account. But when it did, Column B ended up a little wonky:

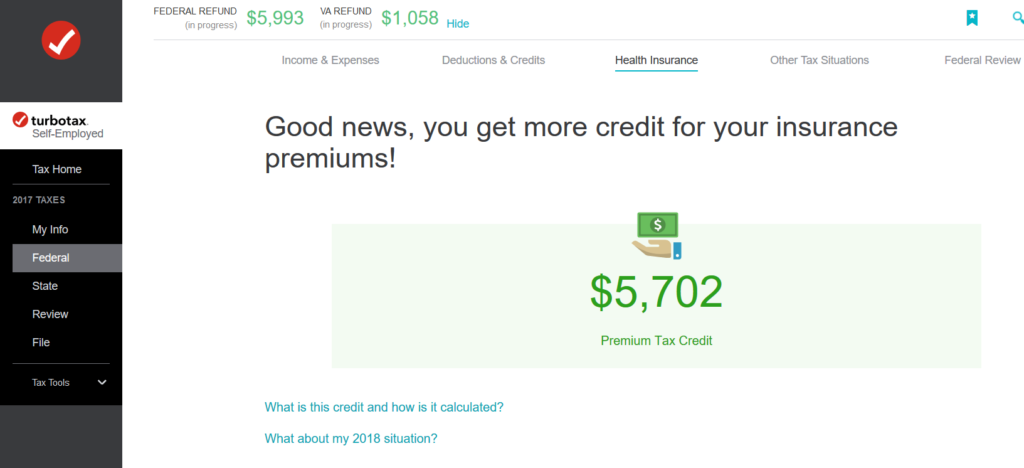

To TurboTax’s credit, their Help section refers you to the Healthcare.gov Health Coverage Tax Tool. I keyed in my correct numbers, and submitted the information to see what my tax credit would be:

So what difference does it make? Potentially thousands of dollars of difference. I don’t know about you, but there are a lot of things I can do with that extra $5,702. Like, funding an entire IRA for the year with money left over. Or taking another Disney World vacation. Or 23 year-long-subscriptions to the Oreo of the Month subscription box (er… for 23 friends. yes. for friends.). (In reality, it’s already earmarked for the IRA.)

Winner Winner Chicken Dinner?

Not everyone who got all zeros on their 1095-A Column B is entitled to a $5,702 tax credit. No siree! This is just an example. Your income has to be high enough to qualify for a Marketplace plan (versus Medicaid in some states). But your income also has to be low enough to qualify for the subsidy, after deductions like 401(k)s and HSAs. And the amount of the tax credit will depend on the premiums you paid, and the SLCSP for your situation.

Still, the Healthcare.gov Health Coverage Tax Tool takes less than 2 minutes, and tax software like TurboTax can do all the calculations for you in just a few minutes. So the whole process to check takes what, 5 minutes? That’s like earning $68,424 per hour in my example. And if you don’t qualify? You only wasted 5 minutes and you have the peace of mind of having accurate information.

Key Takeaways

- If you got a 1095-A where Column B is all zeros, don’t panic.

- But do get the right numbers, because it could mean big money.

- Use the Healthcare.gov Health Coverage Tax Tool to get the correct numbers.

- Use tax software like TurboTax to quickly see what a difference the right information could make.

Happy tax season, everyone!

I don’t think you understand how much this has helped me this tax season. Well, maybe you do!

But thank you, thank you, thank you for recognizing this as a problem, writing about it and publishing it in layman’s terms for people like me.

You are very welcome, Le’Yante! I wrote it because I lived it, and I knew I couldn’t possibly be the only person who scratched her head hard when the form came in the mail with all those 0.00 values! I didn’t want the knowledge I gained about what to do to just sit in my head and only benefit me. I’m super glad to hear that it helped you. 🙂

Hey, we found the “tax tool” and corrected the zeroes as you did after the good people at “Healthcare.gov” refused to issue a corrected 1095-a. Used the correct numbers on the 8962. Problem is that the IRS has flagged our return because the numbers we used don’t match the 1095-a. Sent documentation and now we’re being audited. Don’t know what to do!

Hey Ed, sorry to hear you’re being audited. I’m not a tax professional so I really can’t help you there—pretty much everything I know about this issue is right on this very page. It does seem strange to me that there would be any problem with using the Healthcare.gov Health Coverage Tax Tool since that’s what you’re supposed to do in this situation. Hang in there! Hopefully it’s one of those simple audits where they just ask a few questions by phone and have you send in the documentation you have.

I have worries about a similar situation here. I have 3 1095-A’s and when I add in the SLCSP numbers from the Healthcare.gov page Turbotax tells me that my refund should be around $13K, but I only paid about $12K in estimated taxes this year. So I don’t think that this is right at all. There is no way that I should get a refund that is greater than the total estimated taxes that I paid this year. That seems like it would be highly likely to flag me for an audit like the person above.

@Michael Prentice: I understand your concern, and again I am not a tax professional, and if you are concerned you should definitely talk to someone who is! I will challenge your thought that there is no way you should get a refund that is greater than the amount you put in for the year, though. Have a look at this page on the IRS’s website about the Affordable Care Act Premium Tax Credit (the very tax credit we’re dealing with here): https://www.irs.gov/affordable-care-act/individuals-and-families/questions-and-answers-on-the-premium-tax-credit

So yes, you can get back more from this credit than you paid for the entire year. (This happened to me as well! I got a bigger refund than everything I put in for the year, and my effective tax rate for the year was about -10%!) This is because the health insurance premiums that you paid throughout the year are effectively also taxes you paid during the year, and you are just getting a part of those “taxes” back. It’s just not calling the extra in premiums you paid “taxes” even though that’s effectively what they are.

In 2016 I had positive numbers for 2016 and they audited me saying I was not do any refund because I already received a subsidy. I was told by more than one IRS person that staff did not like processing Obamacare tax returns because they were so complicated. I sure agree with that. Took me a good 6 hours to make sure the CPA did the forms right and reply to the IRS. Took me 1.5 years to get the money from them. Now for 2018 I have zeros in column B and have zero doubt this will be a 1.5 year fight with them as well.

Hang in there Ed you are right and they are wrong and have not properly educated their staff on how to do Obamacare return. It is complicated and most of these employees are simply clock watcher who do not want anything challenging on their desk and it is easier to simply deny you what is yours than take the time to think. I will try really hard to get them to give me a proper amended 1095-A. After all how on earth could it be ZERO……Impossible. The clock watcher are in full swing at the IRS.

Oh…..and thank you so much for this article. It gives me hope that I will get the money coming to me at some point. The part that sucks is that I now have to earn the money all over again in the form of time spend arguing with the Exchange and the IRS. Thanks Obama for making my life annually and monthly (paying premiums that are 4 times what they were before this hateful legislation) miserable.

I just found this https://www.irs.gov/affordable-care-act/individuals-and-families/health-insurance-marketplace-statements

Scroll down to What is a second lowest cost silver plan shown on my 1095-A?

It tells you exactly what Stephonee posted here. It is also here https://www.irs.gov/pub/irs-pdf/p974.pdf

Sure wish these people would quite wasting so much of my time. It is bad enough I have such low income…..why do they want to make my life miserable as well just because I am self employed.

I should have read more before my last post. They appear to have changed this since 2016 when I last had an exchange policy.

I was due money back in 2017 however I purchased an Obamanationcare plan from Cigna but not on the exchange. If you do not purchase on the exchange you never every get any money back even though is is a Obamacare plan. That just means you did not have to pay the penalty. Wonder how I was suppose to know that. They purposefully made this so complicate so Hillary could ride in on her white horse and create universal healthcare…but she did not get elected. Ok enough on my political commentary.

If you read this doc for 2018 https://www.irs.gov/pub/irs-pdf/i8962.pdf (previously I posted the 2017 version). Go to page 12 and you will see this. Ed on the 2017 (if you are still arguing with the IRS) look at page 29 of that doc https://www.irs.gov/pub/irs-pdf/p974.pdf ) and show them that it specifically says that if you did not request a subsidy then it will be zero in column B).

No APTC was paid for your coverage. If no APTC was

paid for your or your family member’s coverage, the SLCSP

premium reported in Part III, column B, lines 21 through 32, of

Form 1095-A may be wrong, left blank, or reported as -0-. To

determine your applicable SLCSP premium for each month, see

Pub. 974 or, if you enrolled through the federally facilitated

Marketplace, go to HealthCare.gov/Tax-Tool/. If your correct

applicable SLCSP premium is not the same for all 12 months,

check the “No” box and continue to lines 12–23.

I have little doubt that the computers still check the amount you put on form 8962 to the column B of 1095-A and even though it is suppose to be zero for those of us who did not claim subsidy the program will kick out and audit and I will spend 1.5 year arguing with them and making them understand their own job.

Hope my rants help others looking at this mess that Obama created. Thanks Obama. Why do you hate the self employed and other who have fluctuating income and want to wait till the end of the year to understand what they are entitled to receive for a refund (PTC).

Frustrated in AZ…… John

Hi John! Totally understand your frustration, and I have no idea why any of this is the way it is with regards to the IRS paperwork. But, I wouldn’t worry quite so much about it being an audit risk – I had Obamacare insurance for 3 tax years (2015, 2016, 2017) and declined the subsidy discount on the premium every time, and though I always got the 1095-A with column B zeros… I’ve never been audited. Certainly, I can’t confirm or deny whether it is an audit risk or not based on my 3 data points, but at least it’s something that’s easily explained and legitimate, if one does need to defend it to the IRS.

Thanks …that is interesting. In 2017 they filled in column B for me but as I said it took me 1.5 years of arguing with them to get them to send the money to me. Since you have seen 1095-A with Zero and not audit I hope I draw that person to review my tax return for 2018. I think this is part of it. If you draw someone that knows their stuff you are good as you are doing it right and per the instruction. If you get a clock watching employee that is lazy well then it might just turn into the mess I experienced in 2017. I have my figures crossed and again sure thank you for writing your detailed article since I was so mad when I saw my form with zeros and now I know what to do and already have my silver numbers to used from the site you pointed to.

As a self employed person it is just so frustrating when I pay two times for Medicare and Medicaid and this is how Obama thanks me. Makes my premium 4X larger with 5 x the out of pocket that I had in 2018. Will never stop disliking Obama. Ever. He stole at least $25k from me from 2016 through 2019 and I still have two years before Medicare. Never thought I would want to be 65. Just hateful legislation for the self employed and middle class that does not work for a large corp.

Um, Obama doesn’t control the Affordable Care Act plans or their pricing (despite them being referred to as “Obamacare”). And he wasn’t in office in 2018 to have any influence on your premiums in 2017, 2018, or 2019. Their pricing went out of control in 2018 when President Trump removed the subsidies that the insurance companies were receiving for them (not the same subsidies as the ones we’ve been talking about, which are premium subsidies, but different ones that the insurance companies were receiving directly.

Additionally, I don’t think the ACA is hateful toward the self-employed or the middle class. Before “Obamacare,” it was incredibly difficult and expensive to get health insurance as a self-employed person – it was basically the wild west. And if you had a pre-existing condition? Forget it.

But that’s all I’ll say on the matter as that’s pretty much the extent of the financial discussion of these things. Any further political discussion will be removed from the comments per the comment policy.

Wow, thanks so much. This post was of a tremendous help. I knew something didn’t make sense, but I was freaking out as to how to solve it. Thanks!!!

I’m glad I found your article within a few minutes of searching. $0 SLCSP didn’t seem right and that tax tool at healthcare.gov took at most 90 seconds to complete. Thank you so much!

You certainly can get a bigger refund after entering 1095A data…..

My colA 265.52. ColB 655.50. ColC 93.50

This was the same for two children. As I understand it the col3 figure was a monthly credit as I paid 198 per month for both kids.

Tax refund before entering 1095A data was about 2700.00. After entering all three columns for both kids…..my refund jumped to over 5200.00.

So, as mentioned earlier, it simply appears that monthly health ins payments of 198 x (2) are just ‘taxes’. And I’m getting most of it back.

Wow,

You just saved me $9,336. That is how much my subsidy turned out to be. I had filled out Turbo Tax with the numbers on the form, as I thought I should, including all of the 0.00 in Column B. Used the Healthcare.gov tax tool to get the correct numbers and then got the correct subsidy.

Thanks for posting and being the top google search with helpful information!

Wow, a $9k subsidy! I’m very glad that I could help, because that’s an insane amount of money to be up in the air like that. I really wish that the Healthcare marketplace could just send out the forms with the correct information in the first place, or put “see Healthcare.gov” in the boxes instead of zeros, or something! But until they fix it, I’m glad I put this post up to help people like me and you.

Now, I’m not gonna say you should send some of that $9k my way (not that I’d be opposed!), but if you want to check out the “How You Can Help” section of my post about my ongoing dental work, there are a few ways you can pay me back (without actually sending me money 😉 ), if you feel so obliged: https://poorerthanyou.com/dental-work/#your-help

I just got off the phone with healthcare.gov after having an escalation to try to get my 1095-As revised (due to just one month being 0 when it shouldn’t’ve been for 2018) and finally got what I think is the proper advice on this.

The front line caller checked with her support staff and answered that if your column B values are not right for any month, complete the tax tool here (as mentioned above): https://HealthCare.gov/Tax-Tool and you can safely use those numbers to enter in your tax return (form 8962).

She said doing that is unlikely to trigger an audit with the IRS. However, if you have a problem with column *C* (the amount of advance tax credits received) there you must get a correction made and filed with the IRS or you are likely to trigger problems.

Again, typical advice of this just being my experience (and I’ve not yet filed with these revised numbers, I filed for an extension back in April due to this whole mess) and YMMV, but thanks for this post Stephanie and for all of the other discussion above.

I’m a bit worried. The most I’ve gotten was $7,900. I had just put in column A and my tax refund came out to 5,600. I found out about the column B thing on my own, but here is where I’m confused.

I put in both my wife and child together and it came out to $587. Now, on my taxes I put that into column B for both my wife and my child. It went from $5,600 to $11,000. That seems crazy to me!

Am I supposed to put that number into both their column B’s?

Hi Patrick. (Reminder that I’m not a tax professional, but I would like to help you try to figure this out as a fellow layperson.)

I’m a bit confused by your question – you talked about putting “in both my wife and child together and it came out to $587” – were your wife and child on separate health insurance from you? If so, were you and they both on separate ACA marketplace plans, or only them, or only you?

Thanks so much for this! I’m now doing 2 amended returns because my tax preparer did not file the 8962. The way their system is set up, having -0- in the 1095-A column B and C did not signal them to include an 8962.

I am currently in the same boat. I used the tax tool on the healthcare. Gov website, and received a letter from the IRS saying that column B on 8962 doesn’t match information on form 1095. Was anybody able to resolve this?

I had this problem 2019.. I filled in the correct numbers and IRS sent me a letter that numbers didn’t match. I sent in print off of the lowest silver cost numbers and they took it fine- but it held up my refund for 7 months! Same problem now- 2020 taxes. I called Heath care.gov and they wouldn’t budge and sent corrected form- just said to fill them in myself. I will- but so afraid of another hold up. My advice going foward would be to take. $5 subsidy so if you owe it won’t be that bad and if they owe you- you’re numbers will be filled in in section 3 column B. Live and learn I guess!!

Yep. Same issue here. What if you get a letter from the IRS saying your 1095-A and your 8962 don’t match and they won’t process your return until they do?

Another reminder that I am not in any way a tax professional – my understanding is that if you’ve received a letter from the IRS, you’ll need to follow up with the IRS. In a comment above, Amy mentioned having luck printing off the lowest cost silver plan numbers (I am not sure but I believe they mean from the Healthcare.gov Health Coverage Tax Tool https://www.healthcare.gov/tax-tool/#/ ) and including that in their response letter to the IRS.

If you have a tax professional that helped you prepare your return, or you used a tax software with any sort of help or audit protection, you should contact them first to check in on your particular situation.

Thanks. I’m still trying to straighten this out. Have been in touch with the IRS and with the Marketplace about half a dozen times. Don’t know if this will help anyone, but here’s a page on the Marketplace website that specifically says your 1095-A is incorrect if there are zeros in column B and you were covered by a marketplace plan at that time.

https://www.healthcare.gov/tax-form-1095/

Also, Publication 974 from the IRS backs that up, saying that if there are zeros in column B during months when you were covered by a Marketplace plan, you need to figure the SLCSP premium yourself, and that you DON’T need to get a corrected 1095-A.

Ben can you resend the information on Publication 974 , the link you added isn’t working.

https://www.healthcare.gov/tax-form-1095/

Some of what I just sent is redundant. Sorry!

THANK YOU SO MUCH!!! I spent so much time on Google trying to figure out what was going on.. I remembered opting to pay the full monthly premium rather than take a monthly tax credit so that I would get a bigger tax refund in April, and based on my income I knew for a fact I qualified for the tax credit, so I’m like, why is it showing up as 0… you rock, thank you for posting this! Do you have a Venmo or a paypal for a tip? You just saved me $2,000 so at least let me buy you a cup of coffee and a bagel!!!

Thank you SOOOOOO much for figuring this out, and for explaning it so simply. I had no idea what to do and you got me $1800 back!

This was so helpful. Thanks and you just got me a much larger refund.