I just got back from FinCon (the financial media conference, where money nerds like myself go to meet up with fellow bloggers, podcasters, vloggers, freelancers, companies, and—most importantly—old friends). And I do mean just—I’m writing this paragraph on the Metro platform, navigating my way home from the airport.

I wanted to write an intro before I got home and ran my numbers for the net worth entry below. Because one of my key takeaways from #FinCon18 (which was my first FinCon ever, believe it or not) was that there is something way more important than numbers: the amazing community of people who support each other in building financially healthy lives.

Check out the picture below. It’s blurry and dark, which is honestly not a bad thing, considering several of the people are anonymous bloggers that would have needed to have been blurred out anyway. Here are a bunch of us that went out on the very first night of FinCon, to celebrate my 32nd birthday. Of the 23 people here, 16 had never met me before in person, though they’ve all known me on the internet for varying lengths of time (from a few months to more than ten years, in the case of the two bloggers from “the before times” that were in the bunch).

I mention this because it was abundantly clear, even at this conference dedicated to talking about finances, that money takes a big ol’ backseat to community and relationships. That can be hard to remember when running the numbers for say… a net worth update blog post where I may or may not hit the $100,000 milestone. But it’s always there, and nothing brings that to the forefront quite like connecting with old friends and new ones over smashed bits of piñata and churro.

But on the other hand… LET’S SEE THOSE NUMBERS!

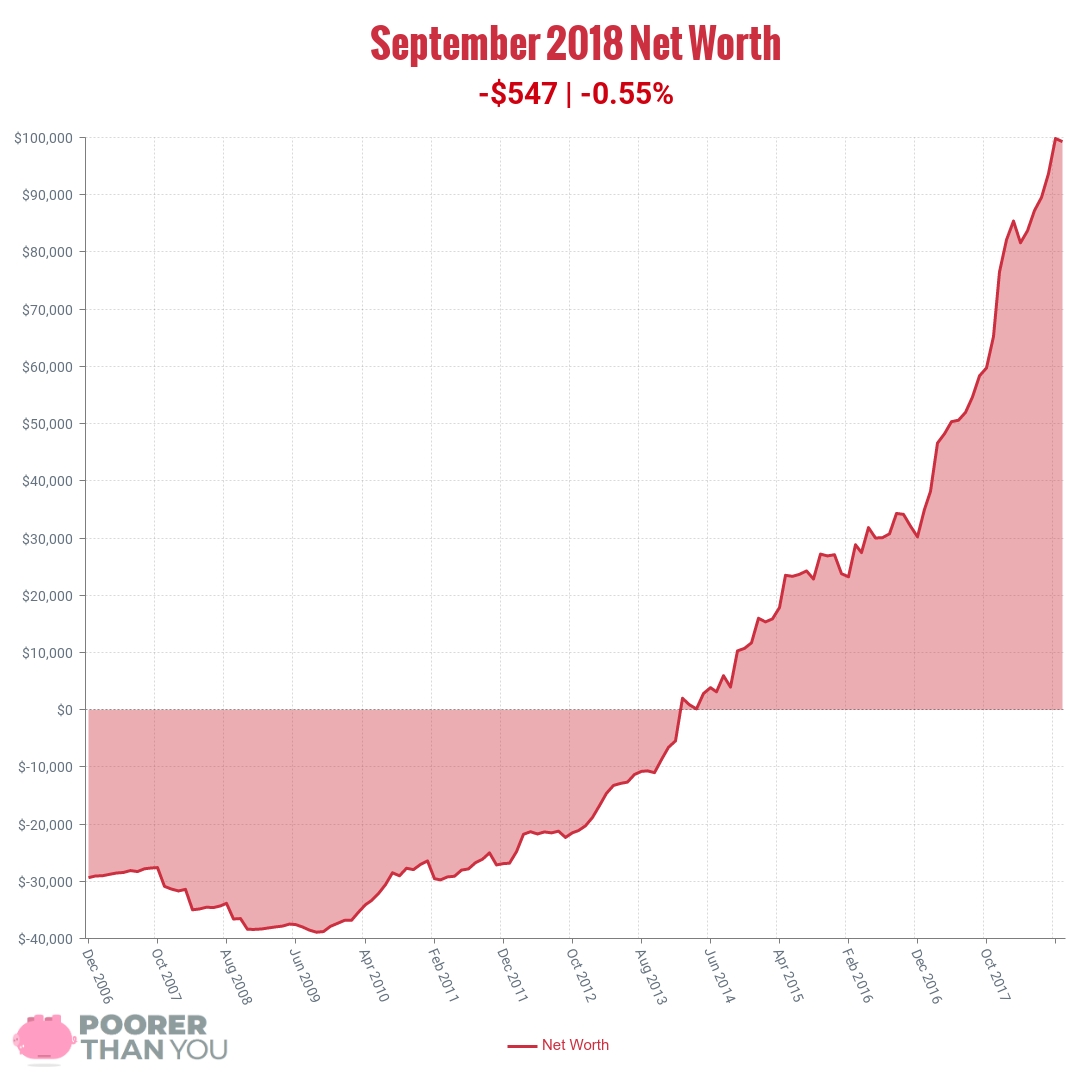

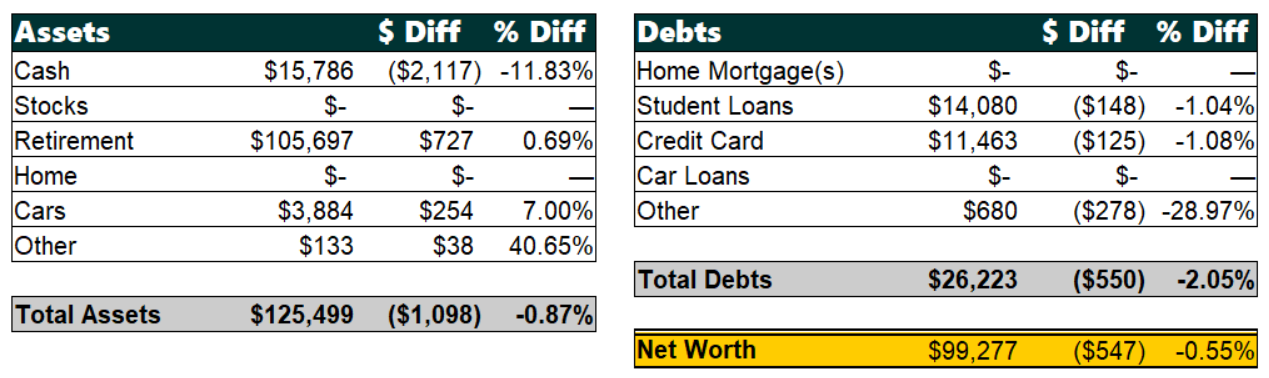

Change: -$547 or -0.55%

September Net Worth TOTAL: $99,277

Whomp whomp whomp whhhhhhhhhaaaamp.

Whomp whomp whomp whhhhhhhhhaaaamp.

Okay, okay, it’s not that bad. It’s basically flat. But I did not, as I had hoped I would, hit the coveted “$100k in net worth” milestone this month. And here’s why:

Cash: -$2,117

Ugh. You might be tempted to think that I spent all of that cash on the chocolate piñatas at FinCon, but no, those were only $20 each and I did not buy 100 of them. In fact, FinCon really had a negligible effect on the cash flow this month (though the missed hours of work will be showing up in October’s first paycheck).

The explanation here is actually pretty simple. Over the course of September:

- We received a pile of medical bills. Having a toddler means going to the emergency room. Yay?

- We fought off illness brought on by an active, socializing toddler. We missed some work because of sick days.

That’s it, really. We were sick or had doctor-y things to do, and it cost us a lot of cash this month. Discouraging, but not the end of the world. In fact, we hit our health insurance deductible this month, so now it’s time to SCHEDULE ALL THE DOCTORS’ APPOINTMENTS!

Everything Else

Normally I’d break out the rest of the net worth update by category, but there’s barely anything of interest going on there. I think we can do a few quick bullet points and then just move on:

- Retirement: normal contributions to HSA and a little bit of growth

- Car: I have no idea why this keeps going up in value. Camrys be hot right now?

- Other Assets: I got a birthday check that I haven’t deposited yet

- Student Loans: regular minimum payment + 3¢

- Credit Card: (refinanced student loan) regular minimum payment

- Other Debts: my tax liability for my business actually went down thanks to FinCon spending

Milestone Progress

The Milestone: $100,000 net worth. We already know I didn’t hit it this month. A few hundred per month until the end of the year would get me there, but I’m kinda hoping to knock it out in one fell swoop in October, even with the lower paycheck from FinCon. LET’S DO THIS.

The Milestone: Paid off Unsubsidized Stafford student loan. I’ve got $1,217.78 left on this bad boy. And I even have my student loan payments set up so that any extra I pay automatically goes toward paying this one off. But, I’m not really sending any extra to it right now (well, $0.03/month extra, because rounding). Besides focusing on the above milestone more than this one, I’m also big on maxing out all of my available retirement contribution “space” before tackling my student loans. Still, I’m tempted to throw a little extra at it next month, just to speed things up. Maybe instead of $0.03 extra (what I’m doing every month now, yay rounding!) I’ll do $1.03 extra next month? Whoa, look out debt, I’m coming for you!

Bonus: Carmen from Make Real Cents is DEBT FREE!

I had the pleasure and the privilege of spending my first afternoon at #FinCon18 with Carmen from Make Real Cents during the FinX event we both participated in. (An eye-opening experience that I am definitely preparing a blog post all about.) At that time, Carmen was only two days away from sending in her very last debt payment. And so now, as of the end of September, she is officially DEBT FREE!

Soo I’m finally debt free ???? https://t.co/KPnNW6kCwB pic.twitter.com/z2H6I1yuVL

— Carmen (she/her) ??????????????? (@Makerealcents) September 29, 2018

Her “back to school” debt freedom photo shoot is even more adorable than I imagined! Look at that happy debt-free face and that shiny sign!

Congrats Carmen! It’ll be a while before I join you in debt freedom, but I’m so glad to see that you got there. 😀

And you, dear reader? Have you paid off debt or celebrated another net worth milestone recently? Leave a comment below to let me know, and you could be featured next month!

Don’t know where you’re at with your money to be able to celebrate? Tracking your net worth month to month is the best way to find out! You can do it by hand with a spreadsheet like I do, or you can check out Personal Capital for some automagical tracking. You and I each get a $20 gift card if you sign up through me and then link at least one valid investment account.

Darn, so close! Except for the bills, not a bad month. You will crush that $100k, no worries 🙂

You had chocolate pinatas at Fincon? Nobody told me!

Sorry Seonwoo, it was organized on Twitter! (See why you’ve GOT to be on Twitter? 😛 ) But fear not! Since next year FinCon is being hosted in my city, I’m already trying to figure out what sort of fun field trips I can organize, and you will absolutely be invited! 😀

So many faces I recognize in that picture even though I haven’t met them all yet ? Happy birthday!! So bummed I couldn’t celebrate it with you all. And you’ll get that $100k next month! Sooooo close.

I had a rough September too with a destination wedding to Germany (not destination for the happy couple, they live there lol) and a bestie visit. I definitely didn’t increase my net worth this month

What is it about September? I’ve always noticed that it’s likely a net worth drop for me (in fact, my lowest net worth of all time was September of 2009). Little Brother Life Coach noticed this trend, as well. I’ve always chalked it up to it being when my car insurance bill is due (it’s also due in March, but usually I get a tax refund to offset it then), but I feel like there’s more to it than that when I see other people having rough Septembers in terms of net worth…

Maybe it’s the curse of my birthday! XD

SO CLOSE WE CAN TASTE IT. But staying flat this month given all the sickness is pretty dang good all by itself.

We are *leagues* away from paying off our one massive debt but I love dreaming about making it happen sooner. They all involve highly unlikely events though 😀

You are so close that you can literarily smell that $100k. There is still next month and I wish you all the best as you close that gap.

Thanks George! I can definitely smell it… and it smells like delicious cookies that are just out of my reach! XD

It sucks that you didn’t quite reach your goal. But missed work days and a trip to the ER? It’s impressive that you’re where you are, net worth-wise. It could have been much worse.

Yuuuuuuup! I have to keep reminding myself of that. It sucks to get so close to a goal and then backslide (even if it was for totally-understandable reasons), but you’re right! Sooooooooon….

Way to go – you’re almost there! I need to get to the next FinCon event in London – had to miss the last one due to work commitments 🙁

Thank you! So close now! And I definitely love FinCon local events. I need to get my area to do more of them this year!