This post is laaaaaaate and I have almost no excuses. The good news is that before the end of October, I finally finished switching my net worth spreadsheet over to Tiller, which automatically imports my balances into the spreadsheet directly. Before this, I was hand-copying each balance from either Mint (if I was lucky) or from each bank/financial institution’s website. One. By. One.

So part of my delay in getting this post out was just… making the spreadsheet pretty again once I got it all hooked up. I’m sorry that I wanted to make it pretty for you! Alright, well, let’s get into the numbers before we waste any more time:

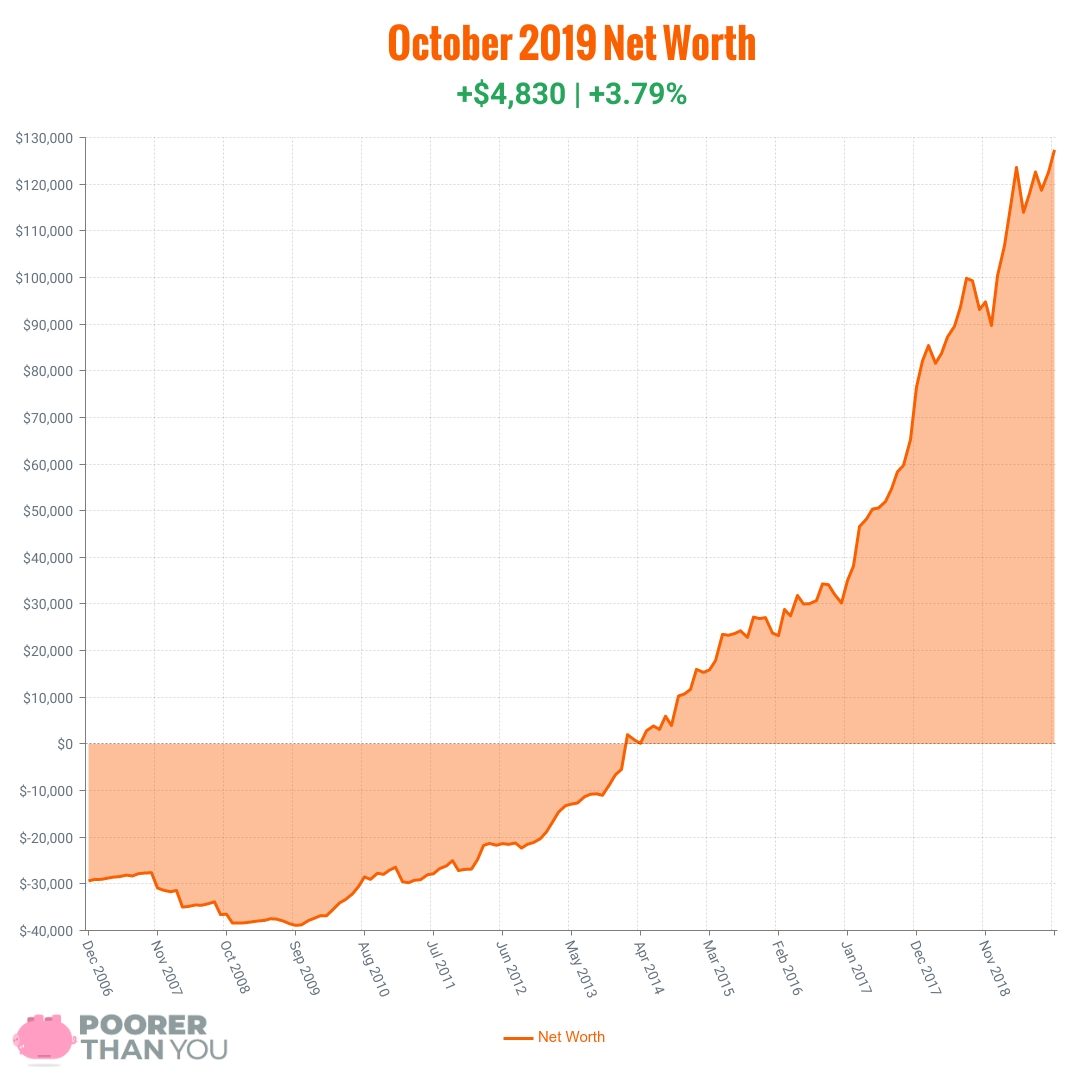

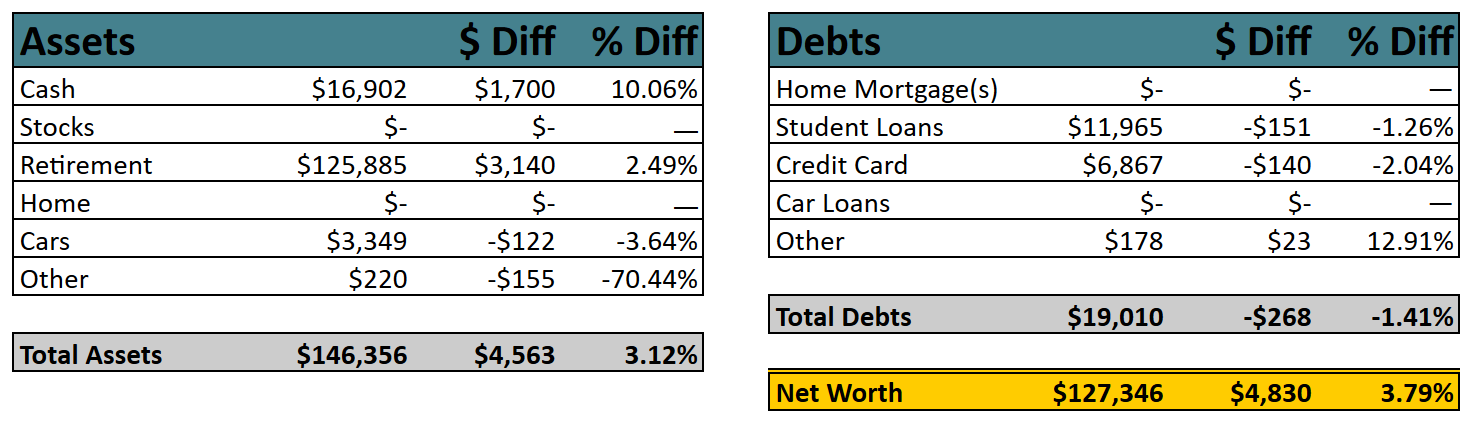

Change: +$4,830 | +3.79%

October Net Worth TOTAL: $127,346

If you’re new to my net worth updates, here’s what you need to know (returning readers may choose to skip on down to the new stuff by clicking here):

Net worth is assets (what I own, on the left of the green chart) minus liabilities (what I owe, on the right of the green chart).

The net worth is for me alone, though I am married. My husband and I maintain “separate but combined” finances, especially for the purposes of what’s shared on the internets. What you see here are the totals of all of the accounts that are in my name only, plus one half of joint accounts. (Debts are all in my name because my husband would rather eat his socks than take on debt. Not anymore! The credit card for his dental work is in his name and I’m counting that toward his net worth. But also, the savings to eventually pay the card off is all in his name.) This does occasionally cause some wonkiness in the numbers, but I will always call that out and explain it (look for me talking about “the marriage bonus” or “the marriage penalty” from time to time). Also, it tends to even out in terms of helping my net worth about half the time, and hurting the other half.

If you’re interested in looking at my past numbers, there’s a handy “Time Travel” navigation section at the bottom!

Now, on to what’s happened this month:

Cash: +$1,700

Doing better now that the dental work is all paid for! Not a huge gain this month though, as I took some time off to attend Cents Positive in Seattle, and stayed a few extra days to enjoy the Pacific Northwest (a place I’d never been before!), socialize with friends from Twitter, and to finally do all the numbers for my dental work dashboard. It was time well-spent, but my husband had to also take the time off to watch our toddler, so it did result in some lost wages, and travel expenses as well. The flights were covered by credit card points I had been hoarding, and I split the hotel room with two other ladies, then stayed a few days at Angela‘s house (because she’s the best), but there were still a few meals and incidental expenses, of course.

But now that the dental work is paid for, the cash hoarding may end! Oh wait, nope, now we gotta do our estate plan (finally) to the tune of $2,900. WHOMP WHOMP. Back to the 0% interest credit cards with opening bonuses we go!

Retirement: +$3,140

As usual, this is a dash of my HSA contributions and then a whole heaping pile of market growth. After the estate plan is paid for, we’ll restart contributions to other retirement accounts (I haven’t forgotten about you, 2019 IRA!), but not quite yet.

(I may make a detour and contribute to my Solo 401(k) in December, but that’s something to figure out after the end of November!)

Cars: -$122

The Camry continues to make its slow, inevitable decline into worthlessness. And needs an oil change.

Other Assets: -$155

Lending Club is almost non-existent at this point (slowly been pulling my money out for what feels like forever now, due to lots of defaults on my loans). What I do have in this category is some uncashed checks because both of my Cents Positive roomies paid me with paper checks, which is kinda hilarious for internet friends. I hadn’t unpacked my bags by the end of the month, so these were still uncashed. Good news is I cashed them right after doing these net worth numbers, so I didn’t keep those roomies waiting forever. (Sorry roomies!)

Student Loans: -$151

Two month’s of principal at once! (Because last month, the payment didn’t settle until after the 1st of October, le sigh.) Also, this brought my balance down below $12,000! It feel like “four figures” (sub-$10,000) is within reach now. You know, once we pay for the estate plan and then max out my IRA. And next year’s IRAs. And the Solo 401(k). Le sigh.

Other Debts: +$23

Just another month of hosting/security/PO Box for the business (this blog, mainly).

Milestone Progress

Debt Freedom: I keep up with my debt repayment in Undebt.it, but nothing has changed from last month (still just paying basically the minimum payments) so my debt payoff date is still estimated at July 2024. There’s really no hope of moving that any closer by the end of this year (see above regarding the student loans) but it’s not really bothering me, either.

$200,000 in Retirement Accounts: Good progress this month! I now need $1,611 per month, minus HSA ($583) and IRA ($500) contributions, that’s $528 needed in stock market growth per month over the next 46 months. The goal is to get this to the point where the “growth needed” number is zero so that it’s all just contributions. At this current rate, I’ll hit that “crossover point” in 16.5 months, or the middle of March 2021, and then contributions alone would carry me to my goal. (This is virtually meaningless, but hey, most milestones are! They’re just fun numbers!)

To sum up: I surpassed July’s number, bringing my net worth to a new all-time high. That’s +$166,247 in just 10 years and 1 month since my all-time low in September 2009!

I used to run these numbers by hand in a spreadsheet, but as of this month (!) I’ve hooked up my spreadsheet to Tiller and now my balances are imported automagically. It’s going to save me hours of updating the spreadsheet each month, and I’m already glad I finally made the switch! Try Tiller for free for 30 days and see how automatically-updating financial spreadsheets can save you time and money.

How about you? How is your net worth doing… and how long do you spend updating it?

Time Travel

- Previous month’s net worth update (September 2019)

- One year ago (October 2018)

- Five years ago (March-December 2014) (the dark time, when I wasn’t allowed to write in this blog!)

- Ten years ago (October 2009)

- Go back to the very beginning (December 2006)

Comment Policy: Your words are your own, so be nice and helpful if you can. Please, only use your real name and limit the amount of links submitted in your comment. We accept clean XHTML in comments, but don't overdo it please. Read the full comment policy here.