This update isn’t coming out until nearly Christmas, and I’m totally okay with that. December is crazy enough for most people, but this is my eleventh consecutive December working in online retail, and I do thrive a bit (or a lot) on the chaos, and have also learned to accept and expect it. I told many people that I could not commit to helping with even relatively small things this month, and said often “To my family, I don’t exist until the evening of Christmas Eve. For everyone else, I don’t exist until after Christmas.”

So really, it’s a Christmas miracle that this is getting posted before Christmas at all. I exist! But only briefly, and only now that my work has passed all shipping cut-offs except “Priority Overnight.” Time for some Glühwein (mulled Christmas wine) and a net worth update! And actually, this may be the penultimate net worth update…

Change: +$4,054 | +3.18%

November Net Worth TOTAL: $131,400

If you’re new to my net worth updates, here’s what you need to know (returning readers may choose to skip on down to the new stuff by clicking here):

Net worth is assets (what I own, on the left of the green chart) minus liabilities (what I owe, on the right of the green chart).

The net worth is for me alone, though I am married. My husband and I maintain “separate but combined” finances, especially for the purposes of what’s shared on the internets. What you see here are the totals of all of the accounts that are in my name only, plus one half of joint accounts. This does occasionally cause some wonkiness in the numbers, but I will always call that out and explain it (look for me talking about “the marriage bonus” or “the marriage penalty” from time to time). Also, it tends to even out in terms of helping my net worth about half the time, and hurting the other half.

If you’re interested in looking at my past numbers, there’s a handy “Time Travel” navigation section at the bottom!

Now, on to what’s happened this month:

Cash: +$699

Not my usual cash-hoarding, but still an increase. We put down a retainer on an estate planning lawyer this month (that sounds so goddamn fancy I can’t even take it), but that didn’t come out of cash – we put it on a 0% interest credit card instead, and we’re working on building up the cash to pay that off starting now. So this increase goes almost exclusively to the fund to pay that off.

Retirement: +$4,914

The stock market had another good month, and nearly all of my retirement money is in total stock market index funds (except for a portion of my HSA equal to our family’s out-of-pocket maximum on our health insurance plan, which I keep in a bond fund). I only made my automatic HSA contributions last month, nothing more was added by me, so this is literally 88% attributed to growth and only 12% my own contributions to retirement (this month).

Car: -$84

Despite its “book value” decline, my car is doing quite well, and we are still a one-car family. We’ve been spending a bit more on Lyft rides lately, because we’re doing more things with our toddler out and about in the world, so the parent going to work rather than carting the toddler around often ends up taking a Lyft maybe once per week or so these days. That’s still very low cost versus getting and maintaining an entire second vehicle, though we’ll have to keep an eye on it.

Other Assets: -$203

I cashed some checks and I have no outstanding checks left to cash, so this is actually a good drop. I’m not sitting around on any checks this month!

Student Loans: -$75

Boring old regular minimum payment. Still not to the point of returning to repaying this faster (that will come after the Estate Plan Payoff Fund is full and we’ve both maxed out IRA contributions for 2019 & 2020).

Other Debts: +$23

An increase in tax & expense liability for the blog as a business. Nothing all that exciting. This may go down quite a bit in December or January when I make a Solo 401(k) contribution (I have until January 31st to make an “employee” contribution according to the rules of my Solo 401(k) provider, E*Trade). I’d like to do the contribution in December, but it may be better to wait until the books are closed on the year and I know the full and total income and expenses and then do it in January.

Milestone Progress

Debt Freedom: I entered the new debt (the retainer for the estate planning lawyer) in Undebt.it, and my debt freedom date went from July 2024 to February 2024. What, wait?!? Why did my debt freedom date move up sooner from entering a new debt?!?

But actually, after closer inspection, it makes sense, weirdly enough. The new debt comes with a new minimum payment ($35/month), which adds to the “snowball” of payments on the other debts once it’s paid off (in October 2020). That little extra $35/month starting in November 2020 will accelerate my debt freedom by five months! The power of saving small amounts is real.

$200,000 in Retirement Accounts: Thank you, stock market! I now need $1538 per month, minus HSA ($583) and IRA ($500) contributions, that’s $455 needed in stock market growth per month over the next 45 months. Barring a recession (which hey, that could happen), I may just hit this milestone early!

Wait a Second…

Stephonee, you say, weren’t you saying something (in the intro that I mostly skimmed past) about this being your LAST net worth update?!?

Actually, what I said was “penultimate,” meaning second-to-last, but yes, I did say that much.

But what? Why?

When I started doing these net worth updates a million years ago, I was (as the title of the blog states) feeling poorer than anyone else. I believed that my net worth would eventually climb, and that I could show the journey along the way. I wanted to show that journey, to keep myself accountable for making it happen, but also to help anyone else feeling like they were at the base of a tall mountain to climb… to have them see someone who was also making that journey, maybe someone who was a little bit ahead saying “hey, this is the path I took to get to this ledge, wanna come up with me?”

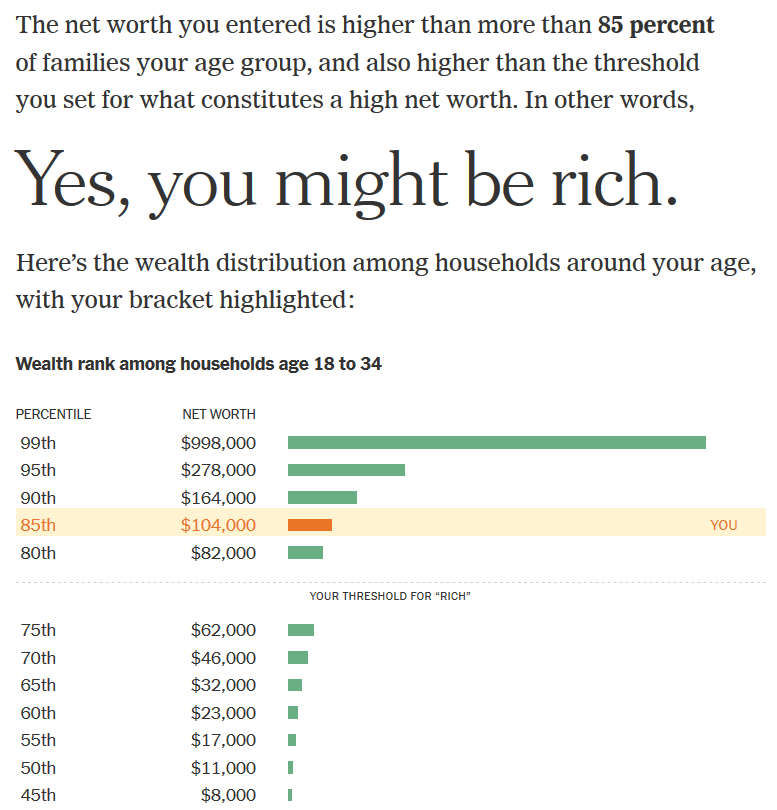

But now… I’m rich. $131,400 net worth isn’t enough to make me financially independent, but it is enough to make me rich. According to this New York Times “Are You Rich?” calculator, anyway:

My net worth alone (say nothing of the net worth of my husband, which I don’t publish here, but is a positive number that pushes our household even higher) puts me in the top 15% of households for my age group.

But now that I’m here… it feels like the net worth updates don’t serve their function anymore. To someone just starting at the bottom of the mountain, it looks like I’m way up at a summit that may feel unreachable. (And sitting on top of a dragon’s hoard of gold on top of that.) The early updates still exist, but I do feel like the newer updates aren’t really adding much to the story.

It’s become clear over the last few years that, with the busy life that I lead (and happily so!), I’m only going to get 12-14 blog posts written and posted per year. But when 12 of those are net worth updates, that means 0-2 other blogs posts about anything else per year. And while the net worth updates have helped keep me more consistent, they’ve also created an obligation in my mind that has prevented me from posting other blog posts. For example, I’ve had a post about 401(k)s and IRAs mostly written since early November, but then I felt like I shouldn’t finish it until October’s net worth update was posted. Then I didn’t have time to finish it before December came ’round and it felt like I should get this net worth update posted. And that could go on for a while, and it has with past posts.

I’ve thought a lot over the past year about the direction I want to take with a blog called “Poorer Than You.” Since the very early days of the blog, people have made jokes about how I’d someday have to change the name of the blog to “Richer Than You.” (Apologies to everyone who made that joke this year, someone else beat you to it by 12 years!) But rather than change the name, I’d like to refocus. Rather than keeping it always on my current situation, there is a lot I can talk about (and bring in others to talk about!) that fits the title and helps people who feel like they’re starting from well below zero.

So… I feel like it’s just about time to give up posting the net worth updates. But, I didn’t want to do so suddenly and without warning, because there may be some of you who get a lot out of these, and don’t want me to stop. There may be reasons that I should keep going with them, that I’m not thinking of. So I’m opening the floor (well, the comments below) to hear your thoughts. I may just end up doing what I want in the end, but I’m open to hearing your feedback on this.

So maybe next month will be the final Net Worth Update, capping off 13 years of net worth posts with one final update. We’ll see. I welcome your thoughts!

I used to run these numbers by hand in a spreadsheet, but recently I’ve hooked up my spreadsheet to Tiller and now my balances are imported automagically. It’s saving me hours per month of digging numbers out of various accounts! Try Tiller for free for 30 days and see how automatically-updating financial spreadsheets can save you time and money.

Time Travel

- Previous month’s net worth update (October 2019)

- One year ago (November 2018)

- Five years ago (March-December 2014) (the dark time, when I wasn’t allowed to write in this blog!)

- Ten years ago (November 2009)

- Go back to the very beginning (December 2006)

Makes total sense to me. Perhaps you could switch to just a % change note? If you still want to share to some degree, but want to take the hard (big) numbers off the screen.

Also – now I want some Glühwein.

I really love your logic here. Congrats on all the progress over time! Can’t believe that joke was told 12 years ago?! I was thinking of it when I clicked on the article (ha, ha).

I like this approach:

“But rather than change the name, I’d like to refocus. Rather than keeping it always on my current situation, there is a lot I can talk about (and bring in others to talk about!) that fits the title and helps people who feel like they’re starting from well below zero.”

You’ve certainly learned a lot and have a lot to offer. I like net worth updates as a nosey person, but overall everyone’s situations are so different, cost of living varies so much, some people include their parter and others don’t, etc. I’ve started to wonder how useful they really are outside of context and extensive explanation. They’re great to conduct on your own once in a while, but I’m not sure how healthy they are for others who are struggling? Best wishes going forward.

Just came across your blog again Stephonee – fun to see that you’re still active 12 years later! If I’m remembering right, we were both in the same HP “Better Together” launch back in 2008 when I was writing Debt-Free Scholar.

I love that you’ve kept this up so consistently – it’s inspiring and exciting to see the progress you’ve made through relentless sustained effort on both finances and blogging. Twelve years is a long time for anything, so congrats on holding the course!

Just curious , we got a detailed estate plan for our multi million dollar estate for $500. This was with the same lawyer that guided me through being the executor of my parents seven figure estate. So I had a wonderful chance to try him out and he was extremely good. I’ve been told we got a very good price at $500. Does that sound ballpark based on your experience?

I hear you so much on this, Stephonee. I stopped writing our net worth & budget updates once we hit a big milestone and realized, oh shit, this is probably discouraging more people than it’s encouraging.

If I’m not lifting people up or motivating them, I’m not sure it has a place on my blog. It felt like bragging at some point.

Anyway, congratulations on your progress and a great 2019. Hope you survived the holiday season without too much stress from retail, friend.

I changed my net worth posts a long while back to share what’s been going on with us in the month and some numbers but I enjoy everyone’s net worth posts no matter how many or how few numbers are included. I enjoy seeing their change over time and a peek into their daily lives. I feel like we’re losing much of the latter, and I don’t follow blogs that focus solely on teaching than sharing personal stories anymore because they don’t resonate quite as much.