Is retirement the last thing on your mind right now? Fair enough! With textbooks, professors, and homework assignments taking up all of your brain power, it’s hard to think about starting your career, let alone ending it! But hear me out:

Did you ever have a math teacher ask you which you would rather have, $100 now, or a penny that doubles every day for a month? Did you take the $100?

Silly you. If you’ve got a penny that grows at 100% interest (which is what doubling is) per day, you’ll have $5,368,709.12 at the end of the month. That is the awesome power of compound interest.

Of course, if you can find an investment that truly returns 100% per day for 30 days, I’ll hire you as my financial advisor and we’ll start building our Scrooge McDuck money bin! But even 8% or 10% growth per year can net you a sweet future, especially if you let the money sit around for say, 40 years. Try playing around with this retirement calculator, keeping in mind that the stock market (as a whole) generally returns between 8 and 10%.

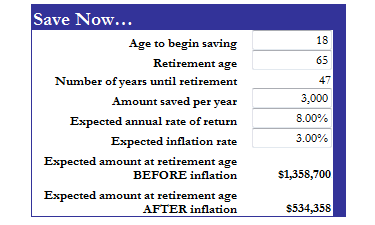

So if you start investing $3,000 per year at age 18 as a freshman, you’ll have $1,358,700 at age 65. After inflation, that works out to $534,358 in spending power (in today’s dollars). Not bad for $250 per month! But what if you wait? Wait until you’ve graduated from school and had a few years to establish yourself?

So if you start investing $3,000 per year at age 18 as a freshman, you’ll have $1,358,700 at age 65. After inflation, that works out to $534,358 in spending power (in today’s dollars). Not bad for $250 per month! But what if you wait? Wait until you’ve graduated from school and had a few years to establish yourself?

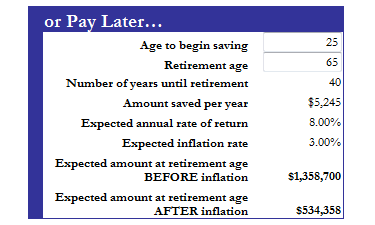

To get that same $1,358,700, you have to contribute $5,245 per year if you wait until age 25 to start investing. That’s $437 per month, or nearly twice as much just for waiting seven years!

Are you ready to get this show on the road and see big returns on your money? If you’ve followed all of the previous college money tips, you are. Because you’ll have a reasonable level of student loan debt (or none!), no credit card debt, and you’ll already be saving for your short and medium term goals. Which means if you’ve still got money left over, it’s time to think long term and open a retirement account.

For a college student, a Roth IRA is the type of retirement account you want to get. To learn what you need to do, I recommend the Get Rich Slowly Guide to Roth IRAs. Written by J.D. Roth (no relation to “Roth IRA”) of Get Rich Slowly, it covers everything you need to know to get started. It’s a really easy read at only 31 pages, but it packs a lot of punch.

The ebook costs only $7 — the cost of a combo meal at a fast food place. And if spending that $7 gets you investing now instead of waiting until after graduation… well, you do the math.

Check out all of the College Money Tips!