Self-employed as a freelancer, responsible for my own health insurance, I was on the cheapest bronze-level Obamacare plan when I got pregnant, with no option to enroll in a different plan. Before I got pregnant, I tried to research the costs of a normal, healthy pregnancy on such a plan. But I had trouble finding any concrete numbers, or any women sharing their experience with real numbers all the way through the pregnancy. So, I’m sharing my numbers, now that it’s all wrapped up and I can speak definitively about what the costs were.

If you’re here for the first time, you may want to go back and read the details of my first trimester costs and second trimester costs (they are also summarized below, with the final total for the whole pregnancy).

The third trimester is intense, both physically and medically. The standard once-a-month visit to the obstetrician (OB) escalates: first to biweekly, and then to weekly. You get poked, prodded, and fed sickeningly sweet glucose solutions. And your pee is tested just about every five minutes – good thing most pregnant women already feel their bladders filling up that often!

Non-Money Obamacare Thoughts

A few things happened with my Obamacare plan and my pregnancy that didn’t have to do with money per se. And most of them happened in the third trimester, of course:

Insurance Needed to Be Verified, Over and Over

Several times, I would show up at a new facility – family doctor, OB’s office, hospital, ultrasound imaging center – and they’d have to verify my insurance. Not just “here’s my insurance card and ID” verify, but rather, they would spend five minutes with my insurance card, then come back to me and say it was going to be a while longer because they had to call up my insurance. Most of the time that this happened, the receptionist processing it would make a point of saying “We have to verify that this will be covered, because this is an Obamacare plan.”

Things That Were Supposed to Be Covered Were Rejected

My best example of this was my husband’s tetanus vaccine – the Tdap. Recommended for anyone who is going to have contact with an infant (because of the “p” in Tdap: pertussis aka whooping cough), this was one thing we were definitely not about to skip. But, we went to two different supposedly-covered pharmacies to get it, and both of them told us our insurance was rejecting it. We paid out of pocket at the second pharmacy, just to get it done with. But all vaccines are supposed to be covered in our insurance, and neither pharmacy nor our insurance company could explain to me why it wasn’t covered.

Address Change Was a Nightmare

We moved in July – within the same zip code, so it barely affected anything, and it should have affected our insurance not at all. I keep a huge spreadsheet of every single online account and whatnot that requires an address change when we move, and it’s a big pain in the butt. (I hate moving.) But updating the insurance was one of the first ones I thought to do… and then it became one of the ones that took the longest. I contacted insurance, they told me it had to be updated on Healthcare.gov. Okay. So I updated my address in my profile on Healthcare.gov, and got a confirmation.

Done, right? I thought so! But weeks went by, and my address never updated on my insurance company’s website. I called them to ask why, they said they hadn’t received the update from the Healthcare Marketplace. Odd. So they called the Healthcare.gov customer support line, and we did a conference call. The Healthcare.gov rep dodged the question, and was really suspicious of the fact that a rep from my health insurance was on the line. Huh? So I had the health insurance rep hang up, and I talked to the Healthcare.gov rep directly.

Turns out, if you move, even within the same zip code, you have to file a whole new Healthcare.gov application. Well, that’s a pain and a half. What really rustles my jimmies about it is that they don’t tell you that when you log in. They have a “Profile” section with your address that you can update, but this doesn’t actually do anything (except make you think you’ve updated your address!). The only way to know I was supposed to file a new application would have been to have called, or to have searched for “How to change address Healthcare.gov” instead of just, you know, logging in and trying to do it. They’re working off the assumption that you will ask for help to change your address.

I redid my application, submitted it, and eventually it did get updated with my health insurance. Except, things were never quite right with my mail after that – I stopped receiving my Explanation of Benefits (EOB) papers in the mail altogether after the address change. Considering that some of them aren’t available in my online account, I ended up having to call my insurance again to ask that the missing EOBs be mailed to me.

Health Insurance Rebate

I got a check for $29.65 from my insurance company. It came with a letter that said:

You are getting a premium rebate.

Sometimes our medical costs are higher than we planned. Sometimes they are lower. Under health care reform law, health care plans must spend a minimum amount on medical costs and quality improvement activities. When our costs are less than that minimum amount, we pay premium rebates to subscribers like you.

Sweet.

I’m not including this in the costs calculation below, because it was a rebate on my premium, not on the costs of the pregnancy. But, it’s worth noting. Technically, it’s a 0.6% reduction in the cost of my premium!

Bills, Bills, Bills

So many bills came in the mail after my delivery. Big bills, small bills, bills for $0, bills that didn’t have payments I had made reflected on them, bills that didn’t even look like bills… and then at least one “Explanation of Benefits” from the health insurance for every bill. (In fact, another EOB from the birth arrived today… at the end of January, almost 3 months after the birth itself. What?)

The flurry of paperwork was overwhelming, and somehow, I was expected to keep track of it all and make timely payments… while functioning on 2-hour bursts of sleep (at best) and managing a newborn. And then I had to submit all that paperwork to my Health Savings Account (HSA) to get the money out to pay the bills!

My Real Third Trimester Out-of-Pocket Costs

Now that the touchy-feely non-numbers stuff is out of the way, let’s dig into what I actually had to pay! (Above and beyond my insurance premiums, that is):

Breast Pump – $0

One of the really nice things about Obamacare is that it made sure that health insurance plans must cover the cost of a breast pump. Different health insurance plans use different “medical equipment suppliers” to conform to this requirement, so it’s best to contact your insurer to find out how and where to get yours, and if you need a prescription from your doctor. My insurance used Edgepark as their supplier, so I took a look at the different electric pumps they offer, and selected the Spectra S2 “hospital-strength” double pump.

One thing they don’t tell you when you order a pump is that you will end up buying several accessories for it. I haven’t included the costs of those accessories here because they were purchased after the pregnancy, once I figured out I needed them! But word to the wise: the flanges that come with your pump will likely not fit you. Heck, Spectra doesn’t even make a size flange that fits me! I had to buy off-brand on Amazon to get the right size.

Doctor Visits – $54.00

Since all prenatal care (in-network) is supposed to be 100% covered by insurance, this stayed pretty low. I only had to pay for a visit to my regular primary care doctor, to get my third trimester vaccinations (Tdap and flu shot). Not bad at all.

Drugstore – $76.17

More prenatal vitamins, and we also got the Tdap vaccine for my husband at our local CVS. See above for my annoyance on having to pay out of pocket for this… but in the end, it didn’t end up being much more than if we’d had him go into the doctor for it: $64.99 out of pocket at CVS vs. $54.00 for the doctor’s office visit to have it done there. It was just annoying to be told by two in-network pharmacies that the vaccine wasn’t covered.

Lab Work – $5.99

Only one test to pay for in the third trimester: the Group B streptococcus test that all pregnant women get.

RhoGAM Treatment – $208.42

Because I have a negative blood type (A- baby, just like my grades in high school!), and my husband’s is positive, I needed to get two of these at the hospital – one in the third trimester, and the other on the day after delivery. This was just the cost of the first treatment. The cost of the second one is wrapped up in my labor and delivery charges, below.

Labor, Delivery, & Hospital Stay – $6,140.35

Boom, there’s the big tamale! That was:

- Obstetrician: $1,325.35 (+$250 deposit, which was counted in the second trimester, when I paid it)

- Hospital: $4368.00

- Newborn tests and screenings: $447.00

Needless to say, I finally hit my $6,850 deductible!

Now mind you, this was for a normal, healthy, vaginal delivery without complications. Literally, my bill from the hospital charged it as “Vaginal delivery w/o complicating diagnoses.” But I suppose that if I had experienced any complications, I would not have paid more, since I hit my deductible. I guess that makes it sort of a flat rate, no matter what! 😛

My Total Pregnancy Costs on Obamacare:

| 1st Trimester | 2nd Trimester | 3rd Trimester | |

|---|---|---|---|

| Doctors’ visits: | $397.90 | $0.00 | $54.00 |

| Lab work: | $204.46 | $0.00 | $5.99 |

| Drugstore expenses: | $46.09 | $28.50 | $76.17 |

| Classes: | $0.00 | $125.00 | $0.00 |

| Breast pump: | $0.00 | $0.00 | $0.00 |

| RhoGAM treatment: | $0.00 | $0.00 | $208.42 |

| Delivery costs: | $0.00 | $250.00 | $6,140.35 |

| Subtotal: | $648.45 | $403.50 | $6484.93 |

Total Out-of-Pocket Pregnancy Costs: $7,536.88

Health Insurance Premiums for the Year: $4,446.23

Wow. That’s… a staggering number. Does that seem high to you? That seems high to me. Honestly, I didn’t even really know it was that high until just now, since all the bills came in at different times, and there was confusion over some bills, and all that jazz. This is the first time that I’m looking at the total number, and… wow.

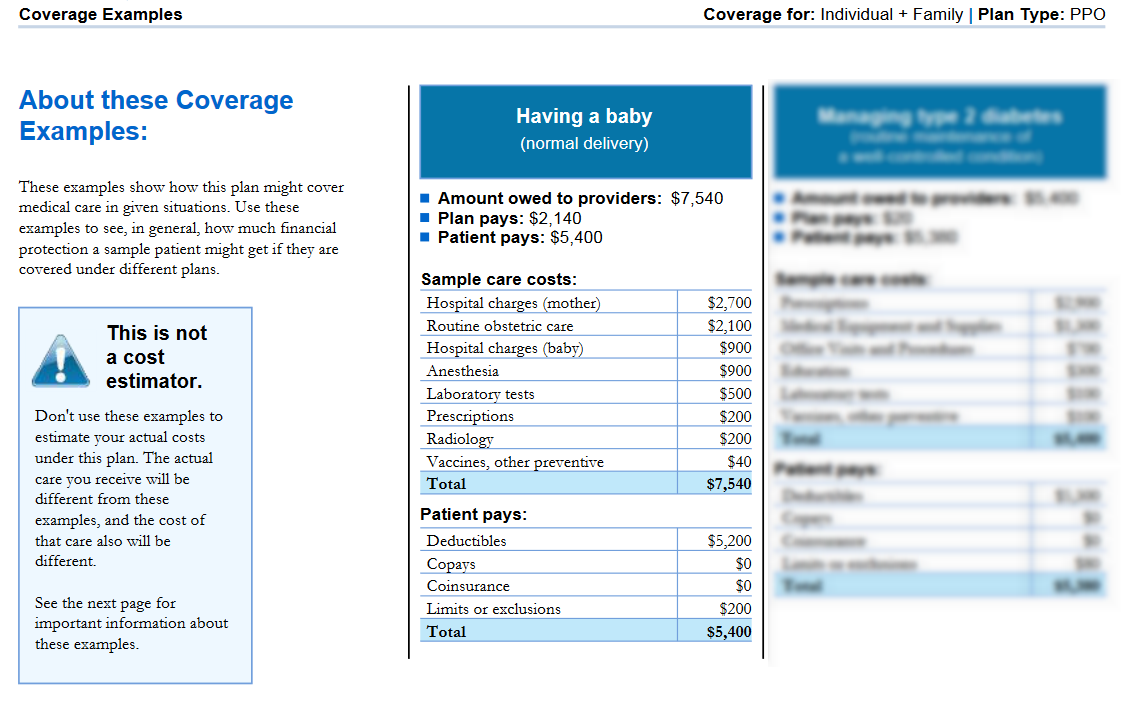

Remember this little graphic from my Summary of Benefits paperwork from the health insurance company?

Guess they were right to say “Don’t use these examples to estimate your actual costs under this plan.” Harrumph.

How much would it have been without insurance?

That’s a good question, and sadly, not one I have time to answer. As I said above, I got a ton of “Explanation of Benefits” papers from the insurance company. With a new baby in my life, I just don’t have the time to go back through them all and tally up the totals of how much each facility charged to my health insurance. But… let me put it this way: There was one bill for over $8,000 that was 100% covered by my health insurance (because I had hit my deductible already). So I can very safely say: without insurance, it would have been more than double what I ended up paying: $16,000+. (For a very standard, normal pregnancy without complications!)

I have questions. Questions that really have no answers, but I have them anyway: Why does this all cost so much? How are people supposed to keep track of all this (I’m a spreadsheet-loving Type-A crazy person, and I had trouble keeping track!)? Why isn’t pregnancy an event that qualifies you for a “special enrollment period” so that you can change health insurance plans? How are people supposed to PAY for all this?

We were really only able to pay all of these bills because years ago I had a job that offered a very generous HSA match, and I had never touched that money before the pregnancy. We spent everything that was in our HSA, and a good chunk of what we were able to add to it during the pregnancy, too. And now I have to choose between expensive day care and not being able to work much – how would we pay those bills if we hadn’t had the money up front? I really don’t know.

Have you gone through a pregnancy or other major medical expense on Obamacare? If so, I’d love it if you shared some info about the costs you incurred in the comments below. Or if you have a low-cost Obamacare plan – do you have any questions for me or others about our experiences?

Advertisement: eHealthInsurance is an alternative marketplace to Healthcare.gov, where you can search for and compare health plans quickly. If you are in need of health insurance, or want to see if you could save money by switching plans, check them out: