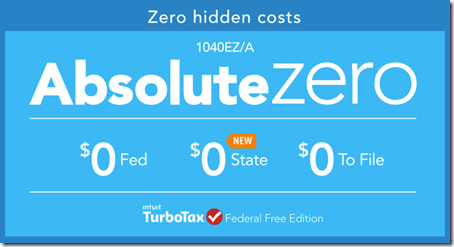

If you’ve got a simple tax return, you are in for some serious good news my friend: TurboTax just announced a new product, TurboTax Absolute Zero, which will let you file a federal 1040A or 1040EZ and a state return, for precisely $0. FREE. And no additional costs for claiming your earned income tax credit or complying with new health care laws, either.

So if your return is fairly straightforward (unlike mine, with all this self-employment yadda-yadda), rejoice! And get yourself over to TurboTax right now to start your return. You don’t even have to be ready to finish it today; you can just get it started right now and finish it up when you have all of your paperwork in hand.

Remember, if you’ve got a refund coming to you, you get it sooner by sending in your return sooner. And if you’ve got a tax bill due this year? Well, I find it’s better to know that sooner, too. You can hang onto the completed return and file it sometime before the April 15th deadline, so why not do your return ASAP?

Image Source: The TurboTax Blog

does a 69 year old woman who does not work but gets a social security check have to pay taxes?

I am not a tax professional, but a quick search of TurboTax’s website leads me to this: https://turbotax.intuit.com/tax-tools/tax-tips/Taxes-101/When-Does-a-Senior-Citizen-on-Social-Security-Stop-Filing-Taxes-/INF14328.html

Which says basically: no, if Social Security is her only source of income, she does not need to file a tax return.