I’ve never been much of one for hot weather (I’m from the frozen north originally, after all), but during this record-breakingly hot August in northern Virginia, I noticed something: I have more tolerance for it than the dudes in my life who grew up in this region. What’s with that?

Well, let’s see what my tolerance is for this month’s numbers update:

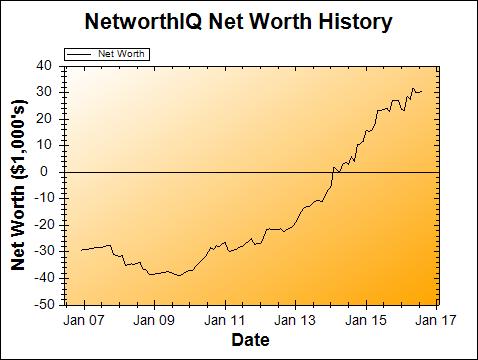

Change: +$671 or +2.23%

August Net Worth TOTAL: $30,728

Not bad increases if you can get ’em! 😉 And what I mean by that is, 2.23% in a single month is really rather great. If I were able to keep that up consistently, that would be 26.76% per year. At that rate, my net worth would double approximately once every two-and-a-half years!

Still, we’ll see if there’s any chance of consistently making those kinds of gains over the next several months. I’m more than two-thirds of the way through my Obamacare pregnancy now, so I’m still staring down the barrel of the gun of a huge ($4,000+ probably) delivery bill in a few months.

So there’s the expense of the delivery coming up, but there’s also the loss of income to contend with. Another side effect of being self-employed, besides paying for my own health insurance, is that I don’t get any form of paid maternity leave. (And same for my freelancer husband as well: no paid paternity leave.) So we’ve been squirreling away cash in our designated “Time Off Fund” joint savings account at Capital One 360, trying to build as big of a cushion as we can before my water breaks.

But there’s some very good news, something I teased about in last month’s net worth update…

Living Off One Income

It’s a very, very good idea when expecting a child to start trying to live off of just one partner’s income, and save the entirety of the other partner’s income. That way, you know you can do it if necessary when the child arrives, and you’ve saved up some money to help you through any unexpected (or expected) time off.

This wasn’t something we’d tried before: in our weird hybrid version of combined-but-not-completely finances, I was paying all of the bills out of my checking account, and asking my husband to give me half of the total expenses each month from his checking account, and we were both saving separately or contributing separately to joint savings accounts.

Because we’d never deviated from that system before, we just moved to a bigger (more expensive) apartment, and our income is irregular from all the freelancing, we weren’t entirely sure that we could live off just one income right now. So, I did the math. First, I estimated the averages of all of our expenses. Mint.com is really helpful in this, because it can tell you what you have been spending in every category, including groceries, gas, clothing, etc.. I didn’t make a strict budget, but I did need to know what our expenses are to know if one of us could reliably bring that much in each and every month (despite our irregular incomes).

And by golly, the math worked out. For the time being, we’re living off my income (which is usually a little higher because I have more clients – I’m winning!), and saving 100% of his after-tax income. So I’m paying all the bills now, without asking him for his half, and he’s stuffing our savings with the money he earns.

When the baby comes, we’ll reverse it: all of the bill payments and expenses will come out of his earnings, and anything I manage to make will be banked into savings (again, after taxes). That way, all the bills will get paid without having to tap too much into the “Maternity Leave” savings, except for any time he wants to take off as paternity leave. And hopefully, by not having to tap those savings too much, we can shift whatever’s left into retirement/long-term savings when I’m ready to work again.

But most importantly, this will enable me to not have to rush back into working before I’m ready. There’s a good chance that I’ll start working from home sometime shortly after the delivery (because I’m an antsy person who always has to be working on some project or another), though I have no idea how long “shortly” will really be, how much work I’ll really be able to pull off, etc. etc.. We shall see!

Using Our HSA as a Retirement Account

Back at the end of June, when I went through your answers to a poll about what I should do with some extra money after paying off my car loan, I talked about the idea that you can use an HSA (Health Savings Account) as a de facto retirement account. Because the money is tax deductible when you put it in, and tax-free when you take it out to pay for qualified medical expenses, it actually beats out tax-deferred or tax-advantaged accounts like a Traditional IRA or Roth IRA.

This month, we put the month’s entire retirement contribution into our HSA. Our IRAs will be a bit neglected, until we reach the contribution limit for the HSA anyway ($6,750/tax year for a family). The advantage is that the money will be in there if we need it for pregnancy costs, or the baby’s medical care, or medical needs any time in the future (including in retirement). And after we hit age 65, the HSA becomes like a Traditional IRA, in that we can take the money out for any reason without penalty, provided we pay taxes on any money taken out that isn’t for a qualified medical expense. (Because qualified medical expenses will still be tax-free!)

Of course, the hope is to take as little back out of the account as possible, and let the money stay in the HSA, invested in a low-cost Vanguard S&P 500 index fund, for many years to come. But the money is there if we need it for medical expenses, which – let’s face it – we just might, if my insurance company’s estimates of my out-of-pocket delivery costs are anywhere close to accurate.

Buying Stuff for Baby

We are still trying real hard not to buy this kid anything until we actually need to, and until after the baby showers so that we don’t end up with duplicate stuff. In August we bought a few things anyway, despite our efforts, because we were blinded by the clean, modern lines and efficiency of an IKEA. Damn you, cheap Swedish homewares!

But seriously, all we bought (for the kid) was $10 worth of a colorful bowl/plate/cup/cutlery set, and $21 in picture frames for some art we already had to hang in the nursery (we were buying frames for all of our art to hang around the apartment anyway). So we did break the rule, again, but only because we don’t really see ourselves managing to get back to IKEA before the baby is born, and then we certainly don’t want to go back to IKEA with a baby.

This level of self control to not buy every cute bear hat I see has been a part of what has enabled us to keep increasing my net worth (so far) and save up for the things the baby will really, actually need. Such as an R2-D2 hat.

That’s it for this month’s net worth update! When next we check in on the ol’ net worth numbers, I’ll no longer be a 20-something blogger. That’s right: I’m turning 30 this month. Wish me luck!

Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!

Comment Policy: Your words are your own, so be nice and helpful if you can. Please, only use your real name and limit the amount of links submitted in your comment. We accept clean XHTML in comments, but don't overdo it please. Read the full comment policy here.