We’re into the real heat of summer now! I’ve pretty much sequestered myself entirely inside the air-conditioned apartment until that big burning orb in the sky goes away. Except, I did spend a week hanging out at -gasp!- the beach, which is basically a first for me. I don’t think I’d ever been to the beach more than 2 days in a row before in my entire life.

How did taking a week off to frolic in the ocean waves affect my money? Let’s have a look at this month’s numbers!

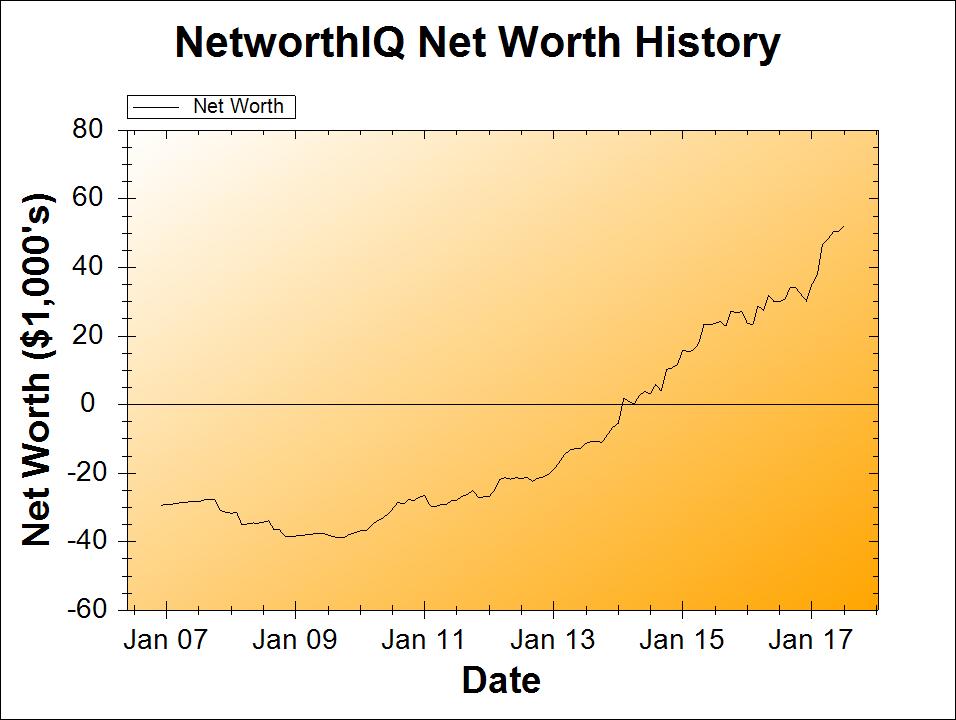

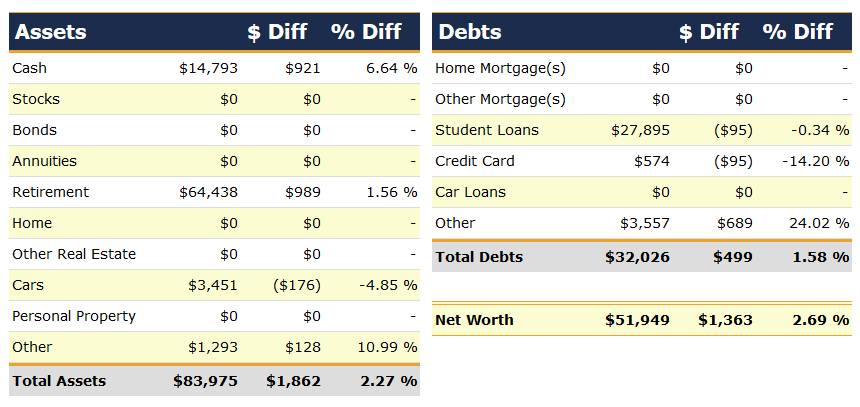

Change: +$1,363 or +2.69%

July Net Worth TOTAL: $51,949

Okay, so, first? I want to talk about that Retirement number. Went up by $989 – nice, right? But wait… I didn’t contribute to retirement this month! Not a red cent. We’re in a lull right now for my retirement contributions, focusing on my funding my husband’s accounts instead. So that nearly-$1000 was all gains, baby!

Except… I can’t actually get excited about that. Well, not too excited anyway. I’m in my “wealth accumulation” years, which is a fancy way of saying “I’m buying right now, not selling.” And when you’re buying something, you want the price to go down, not up! So those on paper gains may be exciting to look at, but I’m actually hoping that number will go down some, so I can buy “on sale.” Just a thought.

Vacation Spending

Cash is up this month, despite the fact that we took a week of vacation (unpaid time off). We kept our spending for the trip pretty light – the shared cost of a beach house with my parents, siblings, and their broods; we bought a round of groceries and beer for the whole group; we stopped at a McDonald’s for lunch on the way back and used a gift card (which we got from our coworkers last year as a “Congrats on the baby!” gift), and that was it for vacation expenses (well, plus a few sundries such as sunscreen, inflatable pool for the baby, adorable baby sun hat, etc.).

The real cost of the trip is in lost wages, since my husband and I both lack any paid time off benefits. That cost won’t be reflected anywhere until next month, since it affected the last paycheck of the month and we haven’t had that come through yet. But we had enough saved up in our “Time Off” savings account (our self-funded “paid time off” savings) and our “Travel” savings account to cover the lost hours. Also, I worked through the trip, which ended up being more than a little interesting when the internet at the beach house was out due to a fried modem from a lightning storm. O_O

But I survived the multi-day lack of internet and still managed to get my work done. Working on vacation isn’t exactly ideal, but if you’ve got to work, you can’t really beat doing so while sitting in a porch swing, enjoying cool ocean breezes!

The baby thought sand was awesome and waves were scary, in case you were wondering. Also, we stuffed ourselves on donuts.

Vacation was the “big news” this month, but again, we won’t see the full effects of it until next month.

Milestone Progress

$51,949 out of $61,099 by January 2018, $1,525 per month to go! That seems very doable, considering the $1,363 gain during what was a “down” month (no retirement contributions and travel spending). Of course, that just makes me want to run to the finish line on this – quick, where can I get a spare $9,000 right now?

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

You have been doing this consistently. That is so disciplined! I am sure you’d do well and meet your Jan 2018 goal.

Btw, I see you don’t invest in stocks (and its a personal choice), but why don’t you start with an ETF (it will give you market returns on average)..

On another note, you and I have similar amounts of balance remaining on student loan debts. I am looking to pay this off ASAP..

Thanks PAI! It does look from this chart like I don’t own any stocks, but that is just a misleading categorization. I own a lot of stock (total stock market index funds) within my retirement accounts. I just don’t currently own any stock outside of retirement accounts, which is why it shows the “Stocks” category as $0. I prefer to get that sweet, sweet tax-free investment as much as possible.

Good luck with those student loans! I’m hanging onto mine for the time being as they are at a less than 5% interest rate and therefore I put a lot more emphasis on maxing out those retirement accounts, first. Perhaps if I max out every last retirement account available to me (HSA, IRA, and I may open a Solo 401(k) this year), I’ll consider accelerating student loan payoff, but that’s a bridge that I’ll evaluate when I get to it! 😉

Interesting. I am not sure what the retirement packages and rules are in US, but in Canada we can essentially claim the amounts that we didn’t contribute for our retirement accounts. So, when we earn more, we can essentially contribute more and sort of re-claim it for the year we didn’t contribute.

A part of me wants to continue paying the bare minimum essentially to take the interest rate advantage and the fact that there is income tax credits for the same. But having a chunk of my income paid towards my loan just annoys me, and I can’t seem to get past that..

In the US the deadline varies by the type of retirement account, but once the deadline is passed, you can never contribute the retirement savings for that year again. For example, with 401(k)s, the deadline is the end of the calendar year, or December 31st. After that, you are in a new year and a new contribution limit. For Individual Retirement Accounts (IRAs), the deadline is extended to tax day (about April 15th each year), but still, once April 15th 2018 has passed, you can never “go back” and contribute for 2017 after that time. So it makes a lot of sense to contribute as much as possible during the year if you are not hitting the contribution limits, because in the US we simply can’t go back and recapture that tax-deferred or tax-free contribution later. Interesting to learn that you can in Canada, though!

I completely understand being annoyed by having to send off that student loan payment each month, though! I have a 0% interest rate “credit card” (which is actually a cleverly-refinanced student loan in my case), and it bugs me to have the amount sitting there, especially now that it’s down to an amount that I could probably pay off in one fell swoop. But from an efficient-use-of-each-dollar standpoint, it makes no sense to pay it off early. The student loans are a bit murkier since they’re at nearly 5% for me, but still the scales tilt toward investing instead, especially in tax advantaged retirement accounts. It would annoy me more to do the less efficient thing, but that’s just how my brain works!

(Homer Simpson voice …) …. ummm … donuts! They look so good! I like your technique of cutting them up into bite-size pieces. I’m guessing that way you can sample a bunch of them!

Yesssssss someone who understands! 😀