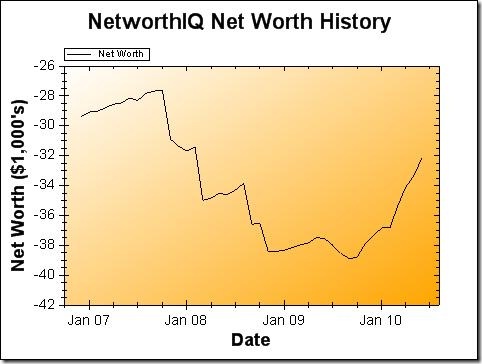

I’m back again for another spin ‘round the ol’ Net Worth calculation! It’s time to see what happened in June and how some big changes (relatively speaking) to my student loans affected the bottom line. Here’s the sitch:

Change: $1,220 or +3.66 %

Yep, I still go it! (“It” being that awesome knack I have for making my net worth climb upward these days.) I managed to sock a good amount away into my savings, while weathering a few tiny storms that threatened to pull my net worth back in the downward direction. It’s all about the savings, my friends.

Student Loans: You may note, if you click the graph above and visit my detailed net worth chart for June, you’ll note that my student loan balance increased a bit, by $44, instead of it’s usual downward direction. This is mainly because I didn’t have a payment due in June for two of my loans.

Why? Because I consolidated my student loans this month! Well, two out of the three, anyway. See, the benefit of consolidating student loans is getting a fixed interest rate instead of a variable one. I won’t get into too many details here — consolidating student loans is a thing that deserves a post all to itself.

By the way, even though I didn’t have a payment due for those student loans (due to the transition period), I just scheduled an extra payment for today (huzzah for extra payments!). My new payment amount, which starts at the end of July, is higher than what I was paying on those loans before. But I’ll pay way less in interest in the long run, so it’s all good.

Retirement Account: My Roth IRA? It could be doing better. I’m really trying not to care too much about the month-to-month rises and falls, but it taunts me! Just gotta keep this in mind: the fact that the value is down means I can buy more shares for my money when I make my next investment. The stocks are on sale! I haven’t lost any money unless I cash out, which I am so not doing right now.

Emergency Fund: My big behemoth savings goal at the moment. I have to adjust my savings snowball to reflect that this is the new top goal in my life. But right now, I’m looking at a short term goal of getting it up to $3,000 by October. It’s on a rockstar pace — it’s up to $1638 at the moment. Hot!

For July, I’ll be focused on socking away money and job searching. Hopefully I can transition gracefully when my job ends in September, but if the cards don’t fall that way, that emergency fund will come in mighty handy.

If you have any questions about my net worth or how it is calculated, feel free to ask them in the comments. Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Wealthy Blogger List. (Spoiler alert: the name of my site is highly accurate.)

Stephanie,

A couple of questions for you…I’m new to blogging. I have a blog spot as well an ehow profile. Where do I go from here?? I love to read and write and would like to learn this blogging thing!! I love to read and write nad am a stay at home mom. Second question–how do you go about consoidating my student loans?? I read in your blog that you just recently consolidated yours and would like to know how I could consolidate mine 🙂 If you could get back to me on these two questions I would greatly appreciate it!! Thank You!

Joleen

No accidents… I was just talking to my Son and has been stressed out, becuase

of his student loans… Now I can tell him that he can do that too. We are going to do more research on this… thanks for the information

I think it’s great how financially aware you are and what you’re doing to sort out your student loans and also save at the same time. That’s a great message to send out to other students/graduates.

WOW! That’s great information for any one trying to think about having some savings. Although it’s a difficult mission to accomplish but what you say if there is a will there is a way. So I wish you all the best keep it up.

Great information it is very informative. It is always hard to save money but when you do it can reduce the stress in your life, that’s for sure.