The fourth quarter of every year has been a crazy time for me since… oh… ever? Since 2009 when I first got a job in online retail, certainly. This year is shaping up to be a little less insane, but still busy-busy and keeping me on my toes. One nice thing about being on the retail side of things during the holidays? I hardly ever spend anything on Black Friday. I’m always working, instead of shopping! Gotta make that money. Speaking of that money…

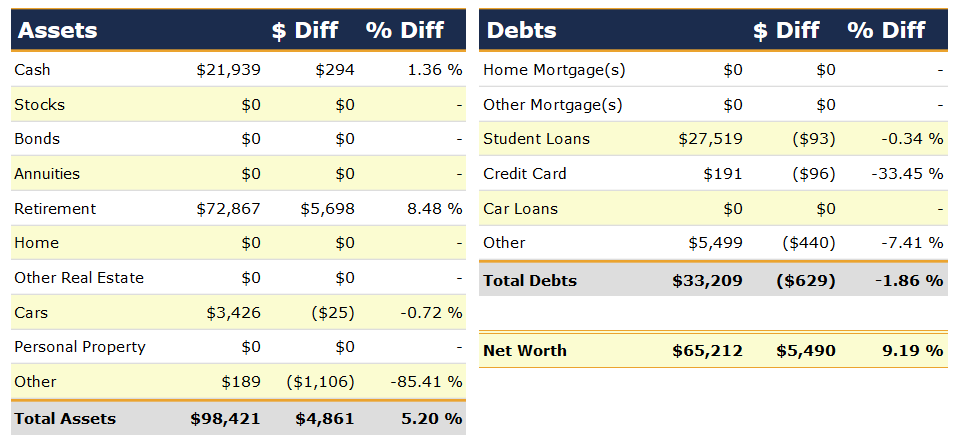

Change: +$5,490 or +9.19%

November Net Worth TOTAL: $65,212

Is this… my best month ever? Nope, unfortunately not. That title is still held by February 2014, when I was laid off. Being laid off is strangely lucrative, at least in the short term. I can’t say that it’s a great long-term plan, though. This month’s accomplishment feels a lot better, even if it was less in terms of dollars and cents.

So let’s break it, break it, break it down! (And yes, there will be more gifs. So many more. We hit the milestone, you guys!)

Retirement

Retirement accounts, you da real MVP of this net worth update. Specifically, the Solo 401(k).

Yes, dear readers, I finally got my Solo 401(k) opened with E*TRADE. It took two phone calls to their Retirement Specialist (HALP) line, but what finally got the job done was using their online file upload. Which is, apparently, a thing they have. But not a thing they tell you about on the application. Possibly because you have to already be an E*TRADE customer in order to use it, which thankfully, I was. [Shout out to their Complete Savings Account, which I opened to get a bonus like 10 years ago!]

Once I submitted my paperwork electronically, the account was opened for me, no joke, the very next day. And I was able to make my first contribution immediately, especially since all of my banking info was already set up from the aforementioned Complete Savings Account. And someone on the internet once said I shouldn’t keep random fee-free savings accounts open with just $5 in them! HA! I sure showed that guy-or-gal-but-let’s-face-it-that-was-probably-a-dude!

And with that (with minutes left on the November clock, because that’s how I roll), I transferred in all the cash I’ve been sitting on since I started dragging my feet on this Solo 401(k) thing (*cough*August*cough*), driving my retirement balance up, and simultaneously driving my tax liability (which I track under “Other Liabilities”) down, because traditional 401(k) contributions lower that tax burden, folks.

Milestone Progress – Goooooooooaaaaaaaaallllllllllll!

So needless to say, I hit my goal this month – a whole two months early!

As a refresher, the goal was a total net worth of $61,099 by January 2018. That number comes from adding $100,000 to my lowest-ever net worth number of -$38,901 in September 2009. So in just a little over 8 years, I’ve made $100,000 in progress.

They say the first $100,000 is the hardest, so… hard part over! Phew. All done. Smooth sailing from here on out, right? Right…?

Hey, can we break out the West Wing gif now?

That’s right, what’s next?

- $100,000 in straight up assets. This one isn’t far off – less than $1600 away. Hardly counts as a milestone, but we can give it a gif next month or so when we hit it, all the same.

- $70,635 net worth. Also not too far off, and sort of arbitrary – this represents $100,000 in progress since the start of this blog in January 2007. Yes, I backtracked for 2 years (student loooooans, my friends). But anyway, not a huge milestone, but possibly gif-able.

- $100,000 net worth. Oooo now that’s a nice round number. If I could maintain this year’s rate of growth (which doesn’t seem remotely possible, but hey, you never know), I’d hit it sometime in early 2019. Supremely gif-able.

So let’s go all ahead full (that’s a thing people say, right? I got it from Titanic so it must be a real thing, because that movie is super legit), and charge at these milestones like… oh, right, the Titanic going all ahead full towards an iceberg is maybe not the metaphor I want here. You know what? Patton, why don’t you play us out here, cause this goose is cooked.

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!

Congrats on reaching this exciting milestone! It’s always a great feeling when you add in a sixth digit! 🙂

Thanks, Kristine! I’m still doing the happy dance 😀

Great job on the upward trend! And I hear you on taking for-ev-er on opening new retirement accounts. It took me an embarrassing amount of time to open my vanguard IRA (and still have $$ yet to transfer from other accounts).

Wonderful Job! I am hoping to reach 35K by the end of next year if I can manage! Seeing your progress is heartening.