My generation: do we have a name? We are the young adults, born between 1980 and 1995 (give or take). I hear us called “Generation Y,” “Echo Boomers,” “the Digital Generation,” and “the iPod Generation,” but none of these names strike a chord with me. But there’s another possibility – are we “Generation Debt?”

My generation: do we have a name? We are the young adults, born between 1980 and 1995 (give or take). I hear us called “Generation Y,” “Echo Boomers,” “the Digital Generation,” and “the iPod Generation,” but none of these names strike a chord with me. But there’s another possibility – are we “Generation Debt?”

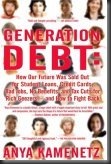

One of our own, columnist Anya Kamentez, gives us this label in her book Generation Debt: Why Now is a Terrible Time to be Young. I picked this book up at the library after having read several of Anya’s articles on Yahoo! Finance – and I have to say, it was one of the most enjoyable and eye-opening books that I’ve ever put my hands on.

The book is a mishmash of relevant statistics and commentary on the economics of our generation, and how social and political factors play into those economics. It’s hard to write up a review, or even an overview, since no page is to be missed. It’s all startling and staggering.

In short, I knew our generation was in trouble, but I had no idea how much trouble we are in until I read this book.

There’s a large focus throughout the book, most especially at the beginning, on the problems in paying for college. This is obviously something I know a great deal about, living through it every day. But Anya has pulled together all of the factors feeding into it, which brought new light to the problem for me. The government’s shift from providing grants to guaranteeing loans. Schools raising their tuition prices faster than inflation and faster than the growth of the average income. The FAFSA (Free Application for Federal Student Aid) being a poor system for calculating aid, since it doesn’t take many factors into account, including recent changes in family status (such as unemployment, disability, or emergencies).

Although there’s a strong focus on college and the enormous debt it brings so many of us, there’s also a good deal on low-wage earners: both those who forgo college (for any number of reasons) and those who get a degree that doesn’t end up being any help.

Our benefits are shrinking. Social security won’t be there for us. The entire economic system is taking a shift, and we’re going to be the ones caught up in it. The baby boomers are beginning to retire right now – and over the next 30 years or so, we’ll be picking up the bill for a lot of them.

As I said, this review is difficult to write. The copy of the book I have is full of post-it notes – item after item of things I would like to go on about in great detail. But here it is: you should really just read the book. Whoever you are. If you’re a member of Generation Debt, like I am, do not miss this opportunity to pick up the book and start to understand the world that you’re entering.

If you’re a parent of one of us “G-Debters” (I just made that term up – Anya, you can thank me later), please read this book. Please, please. I’m very much hoping to get this book into my parents’ hands, so that they can better understand what world they’ve sent me and my siblings into.

If you’re a high schooler, I also encourage this book. But be warned, a lot of it will seem like doom and gloom, and you may even be tempted to put the book down and never look at it again, halfway through. Do not fall into this trap – you really want to read the whole thing and especially get to the last chapter: “Waking Up and Taking Charge.”

Get Generation Debt from Bookshop today!

And you forgot to mention, that with women being paid even less now than their male counterparts (78% on average I think), it will take them proportionally longer to pay off debt. The salary gap is now a double whammy…

I haven’t read her book, but I was following her blog for a bit and read some of the yahoo stuff. It’s been a while, but mostly everything I see reads much like this:

“Waaah, our parents had it easy, our lives are hard because the world is against us, Waaah. You 40 year olds have no freakin clue,like oh my god, like wow life’s Haaaaaaard”.

That pretty much sums up everything I’ve read from her. Less blaming others and more self control is what the G-Debters need. (I’m a ’79er, so I’m borderline there . . . )

@Traciatim –

I can see how Anya would definitely come off as whiny without the context. If I had to name a weakness of Anya’s, it’s that without all the information in the book, she just looks like a big complainer. But she’s really looked into the troubles that this generation is having and the future troubles we’ll have (because of the way our economy is built, etc).

I definitely recommend you check out the book – she really has done her research.

I read this book about a year ago, and I really liked it, too. Unfortunately, most of the anecdotes really do come across as purposeless whining rather than vivid illustrations. Are we of “Generation Debt” responsible for our own debt? Of course! But there is truth in the statement that it’s nearly impossible to get through your 20s without significant debt today.

I do think Boomers and Silent Generation (pre-Boomer) folks don’t realize how drastic this situation really is. The system is stacked against us so that we CAN’T do as well as our parents did, unless we have a lot of help or a lot of luck. In the late 1950s, a year of tuition could be feasibly be earned at a summer job. I don’t know anyone who can do that now.

Hey Anitra, I think they do realize how drastic it is. That’s why they think the ‘G-Debtors’ are a bunch of whiny babies like I look at Anya.

In your comment you mention that you can either get through your 20’s with either “significant debt . . . a lot of help, or a lot of luck”. I think you missed the other three ways: Hard Work, Patience, and Saving.

Why said every student on the planet has to go from high school and get sucked in to a college or university? Why not work for 2 – 3 years and save.

I realize not every high school student can get a part time job, but I would bet that most can. After that work full time for a few years and save and/or invest. Also, if possible, work through your college/University years for your spending money. If you can’t afford it without debt, wait. Either that, or go in to debt; It’s a choice.

@Traciatim,

It certainly is a good point that not everyone should attempt to keep themselves on the “highschool, college, job, promotion, etc.” treadmill, because they just aren’t suited for it.

However, a lot of what Generation Debt is about IS those people that fall between the cracks. I’m going to use an example from my own life, just because I know it well: I had trouble saving up money in high school because my family lived out in the boonies, and was too poor to afford a separate car for me to drive anywhere to work (there was literally no employment within walking distance), and my parents worked a lot and worked odd schedules, so it was difficult to rely on them for transportation.

I accept that a lot of it was my own fault – with some ingenuity I could have worked from home, or found a way to get to a job, but I didn’t necessarily see it as important enough. A book like Generation Debt would have gotten my teenage self thinking about such things.

” . . . but I didn’t necessarily see it as important enough.”

Interesting point you bring up. This stuff should be drilled in to us from birth that in order to buy things, you need to have the money. If you don’t have the money you don’t buy things. It really just common sense when you step back and look at it. That’s also the way things pretty much worked 50 years ago. Imagine telling your great grand parents that you took out a loan to buy you and your friends lunch.

Now don’t get me wrong, I’m still paying off the computer that I purchased with my student loan money from my college education. I lived in a different city for a while and had a spout with no job and lived off peanut butter and bread for almost a month until giving up moving back in with my parents for a few months. I ended up taking something in school that I found out later I didn’t want to do as a career and it was more of a hobby at the time.

Looking back, if I just had have worked a few years to figure things out, and saved my money for a course that I really wanted I would be in much better shape now. This is not only because i would have more relevant training, but also far less debt.

You just won’t see me whining on my local representatives doorstep asking for handouts because life is too hard. You also won’t see me complaining that I took out a loan and now have to pay it back.

Seems like an interesting book, but I didn’t have time to check out the whole review. Can you sum up a rating for the book?

Anyway, seems like it had a big impact on you. I’ll look for it on amazon as I have a gift card ready. 🙂

@traciatim

Wow you are such a stupid idiot. I read 3 of your posts and they had nothing to contribute but trollery. AND then I read that you say you lived with your mommy and daddy. WOW man get a fucking clue. Everything you posted was about you. You are just as lazy as everyone else and I think you just got really lucky.

Sure, if you want to use lies to attempt to make a point then I can see where your coming from. Otherwise your just a fool. Sure I fell back on my parents for a few months when I was just out of college. I don’t live with my parents. If you could learn to read past a grade 3 level you may be able to distinguish the difference.