During my pregnancy last year, I made it a point not to read too many pregnancy and baby books, thinking that the information overload and the contradictions between books would be good for no one. Instead, I read a choice few prenatal and parenting tomes that I thought would give me the most bang for my reading buck. For the huge financial implications that came with this major life change, I turned to Kimberly Palmer’s recent 2016 release, Smart Mom, Rich Mom: How to Build Wealth While Raising a Family.

During my pregnancy last year, I made it a point not to read too many pregnancy and baby books, thinking that the information overload and the contradictions between books would be good for no one. Instead, I read a choice few prenatal and parenting tomes that I thought would give me the most bang for my reading buck. For the huge financial implications that came with this major life change, I turned to Kimberly Palmer’s recent 2016 release, Smart Mom, Rich Mom: How to Build Wealth While Raising a Family.

The mom of two young children herself, Palmer is a U.S. News & World Report money writer. In this book, she shares what she’s learned from nine years of interviewing “Smart Moms” who are tackling the family finances and decision-making process. That’s the overarching question for this entire book: What is it that these Smart Moms have done to make good decisions and take care of their families to create a rich life?

Chapter by Chapter

Introduction: Into Motherhood

The book starts off strong by pointing out how many personal finance books have failed moms and women in general. Citing several different studies, Palmer points out that “being a mom is the single best predictor of financial ruin,” and yet, most personal finance books are targeted at men. And many of the ones that are targeted at women fall short of teaching the truly meaningful, useful tactics of finance, and instead get caught in a superficial trap. As Palmer puts it:

In most investing and personal finance books, moms get nary a shout-out, and in the books that are written for us, which you can spot from their gleaming pink colors, the focus tends to be on how to shop less or coupon harder. It’s insulting, really, when you start to think about it. Why do men get magazines and books on investing and getting rich while women get lectured on pinching pennies at the grocery store and cutting back on our shoe collections? (page 2)

This introduction had me singing Hallelujah, as Palmer promised to share secret strategies, tips, and advice gathered from numerous interviews with “smart moms who make financial decisions that lead to security and wealth for their families” in the chapters to follow.

Chapter 1: Save (And Spend) Like a Mother

As much as I appreciated the pun in the chapter title, this chapter rubbed me the wrong way. After all that talk in the introduction about how personal finance books for women talk down to us by pointing out how we can spend less and coupon better… the very first chapter is about how to spend less and coupon better?

Which is not to say there isn’t some good advice in this chapter. There’s a focus on cost-cutting measures that don’t waste a bunch of time (a losing proposition), and pointing out some smart budget-slashing tips to rein in the family finances. But the chapter really feels out of place right after the introduction that rails against this sort of thing. With sub-sections like “Smarter Shopping” and “Spending Bootcamp,” this chapter flirted with the same feel that other personal finance books for women give off: if only you would control your crazy shoe habit, estrogen queen!

It’s not that I disagree with advice like “maintain an ongoing shopping list of all the items you actually need to buy,” using RetailMeNot and Unroll.me, contacting customer service or writing a review when a company has failed to deliver, using credit responsibly, and making sure you save your savings in a high-yield FDIC-insured saving account. I’m pretty big into all of those things, in fact. It’s just that after going out of her way to make a point in the introduction about how this is the only type advice that most personal finance books seem to have for moms… this makes for a very surreal first chapter.

I wouldn’t throw this chapter out – not at all. I just wish I had time to go into the Amazon warehouses, rip this chapter out of each book, and staple it into the back as an appendix. I just don’t think it belongs front and center as Chapter #1, especially after the introduction that this book has.

Chapter 2: Owning It

This chapter is all about setting goals, making a game plan, and embracing your role as “chief financial officer” for your household. I really enjoyed doing the goal-setting exercise, and later talking over those goals with my husband. This was the first of many conversation starters in the book, which is definitely the real strength of this book: tactical activities that get the brain juices flowing and family conversations started.

Chapter 3: Timing is Everything

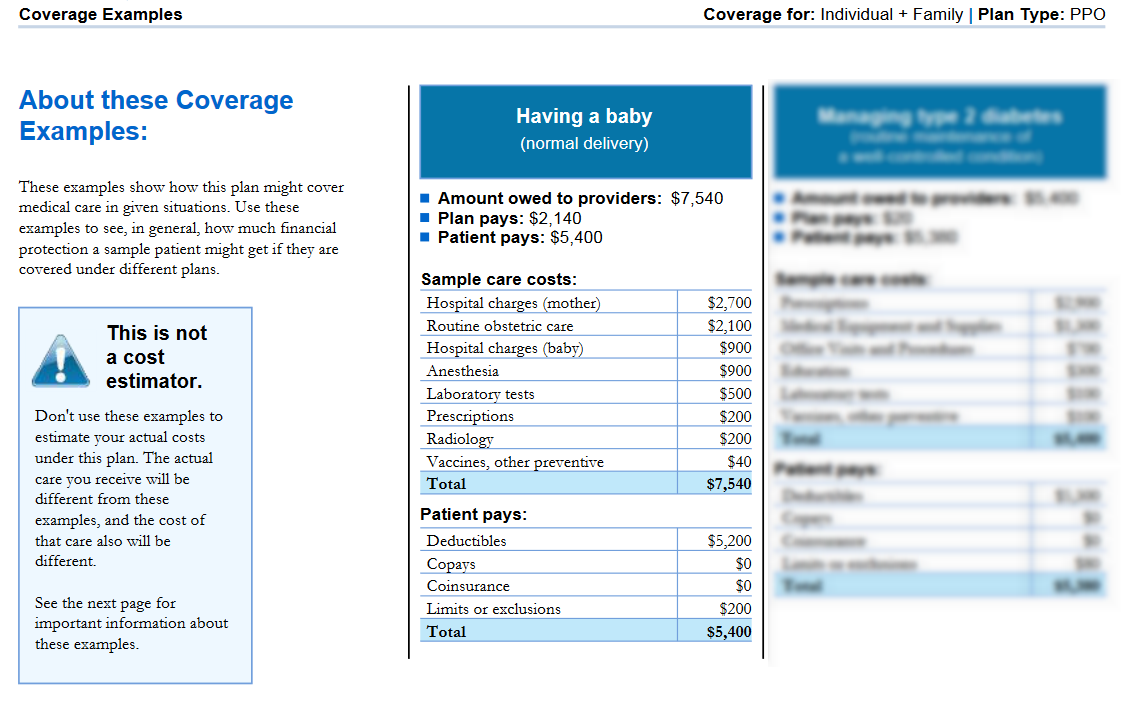

Kids are expensive, yo. And this chapter tackles the somewhat-sticky subject of putting off having children until we’re “financially ready” (which is a hard thing to determine – I don’t think anyone ever really feels financially ready for kids). This chapter mainly deals with the direct costs of having kids: housing, child care, furniture, clothing, etc. etc.. This chapter was of particular interest to me at the time I read the book (while pregnant), because it goes into how to estimate and prepare yourself for these costs.

Chapter 4: Like a Boss

The less-talked-about, but perhaps more impactful, cost of having children: lost wages. While Palmer dives into the harsh realities of being a working parent (or giving up work upon becoming a parent), she also serves up a treasure trove of tips and strategies from the Smart Moms she interviewed. The biggest takeaway from this chapter is that you need to find flexibility: either from your employer, from a new employer or career path, or through forging your own path (freelancing). Palmer goes a little bit into each of these things to help you figure out how to navigate this treacherous terrain.

This was another chapter that struck a real chord with me, as I was sitting there pregnant, about to take several months of unpaid maternity leave and then start working part-time/freelancing, and try to maintain a flexible schedule while taking care of my kiddo. I really appreciated this look into the months that lay ahead for me, and it gave me a few ideas and points to ponder. There’s not a lot of information out there from other sources – I feel like there’s a big “all-or-nothing” approach most of the time (ie. you either have a full time job with paid maternity leave and then you go back to work, or you become a stay-at-home mom), but here Palmer does a great job of displaying the whole spectrum and showing that really, most women adopt some degree of flexibility in their work in order to make it all work.

Chapter 5: Investing Mamas

A lot of people feel intimidated by investing – women especially, in my experience (and Palmer’s research, as well!). Honestly, I think that’s a product of the financial industry: they have an incentive to make investing seem daunting and complicated, so that everyone feels like they couldn’t possibly do it by themselves, and that you need to hire a professional.

This is one of the longer chapters in the book (but don’t worry – it’s not too long), and with good reason. Palmer gets into the benefits of investing for our families (and the risks of not doing so), how to get started if you’ve never done it before, how much to save/invest, the different types of investment accounts available (retirement accounts such as 401(k)s and IRAs, college savings accounts like 529s, etc.), and a little bit about choosing investments. The book is pretty light on that last part, though that’s common for personal finance books because once you start getting into the weeds on which investments to pick, you start making it a much longer book. (The Bogleheads’ Guide to Investing is a good book that does go there, if you’re looking for that.)

There’s also a section in this chapter on “Love and Money,” which helpfully includes some questions to sit down and noodle over with your spouse or partner. These exercises are really my favorite parts of the book – my husband and I had a long discussion that was kicked off by these questions. It really made for an interesting Sunday afternoon conversation!

Chapter 6: Playing Defense

There’s a lot that can happen to a family, but the big two “D”s are perhaps the worst: death, and divorce. Not happy subjects, of course, but worse than these things happening is these things happening and you being completely unprepared for them.

We don’t have to dwell on it or be maudlin for long, but consider this: Women are far more likely than men to outlive their spouse by a factor of four to one. (page 111)

This is the chapter of the book that I’m the most grateful for, personally – because I’ve been slacking in this area. I haven’t been particularly prepared for this sort of total catastrophe, including my own inevitable death (cheery!). Especially with a baby on the way (and the major medical event that encompasses all that), I needed to make sure that my husband would be able to handle and access everything if something were to happen to me.

Plenty of tips and ideas in this chapter for how to organize paperwork and essential documents, review insurance policies, protect your digital legacy, learn from someone in your life who has gone through a death/divorce situation, and cultivate your own financial resilience.

Chapter 7: Stuck in the Middle

If you’ve heard of the “Sandwich Generation,” which describes people who are in a position to have to care for both children and aging parents at the same time, that’s what this chapter deals with. Though one of the shorter chapters of the book, this spurred the longest (ongoing) conversation in my household. It’s something we may well have to deal with in the future (with six parents between the two of us, thanks to divorces and remarriages). Out of everything in this book, this is the chapter that we’ll be going back to again and again for years to come.

Chapter 8: Model Moms

What sort of financial lessons are our children learning from us? Palmer refers to our kids as “little spies:”

Like highly trained CIA agents, our kids are studying us all the time – even when we think they’re distracted. Sometimes it’s shocking to hear them repeat our words back to us; sometimes it’s adorable. … For better or for worse, they are basing their own budding identities on what they see us do. (page 150)

Included in this chapter are 12 possible talking points to start discussions with your children in order to pass on smart money lessons to the next generation. Things like mistakes that you’ve personally made with money, how to use credit cards and bank accounts, and getting comfortable with retirement and investment concepts.

Right now my kid is still trying to grasp the concept of consonant sounds, but I enjoyed this chapter nonetheless – both as a look forward into how I might teach my own kids, and also as a bit of nostalgia about conversations with my own mother growing up. This chapter brought up some great memories of how my mom found those teachable moments while I was a kid, and often had me execute certain financial tasks in order to teach me: working the ATM to get cash for her, swiping her card at the grocery checkout, and completing shopping cart transactions when she would buy things online. Thanks for helping me learn to do these things myself, Mom!

There’s also a bit about allowances in this chapter, which started yet another conversation with my husband, about the money lessons we learned growing up, and how allowances were handled.

Chapter 9: Back to You

With kids in the house, everything seems very immediate. Where did that missing sock go? What’s for dinner? Oh crap, the laundry! But things will change, and there’s life after the kids grow up and become independent. This chapter gets into the “what to do next,” how to figure out what that is for you, and how to prepare yourself for it.

Obviously the “empty nest” stage is a long ways off for me, and for any other millennial readers, but there’s plenty in this chapter that can be done now, in order to be better prepared for that time. For example, there’s an entire section on cultivating your social media accounts and online presence so that they support your long-term goals.

Chapter 10: Returning to the Nest

Oh those pesky boomerang kids, coming back to the nest after they’d left it! Oh wait. I was one of those (briefly, during college and for a few months after). 26% of millennials now live with their parents, in fact. There are benefits and drawbacks to this situation, of course, and this chapter briefly deals with that, and with the general concept of how to help adult children find their footing.

In going through the book, my husband called out this section with a resounding “THIS!”:

Knowing that we are the templates by which our children and grandchildren start to shape their own lives raises the stakes – and makes it even more important that we are taking care of ourselves, the way we hope they take care of themselves one day. We’re setting up patterns that could last for generations. (page 196)

Epilogue: More Than Money

Palmer shares a very cute anecdote about her five-year-old daughter seeming to hold some strangely traditional views about bread-winning that sent her down a rabbit hole, researching how traditional gender roles and money have changed in the recent past. It’s a short and sweet epilogue, but of course as a feminist who minored in gender studies in college, I loved it.

Smart Mom, Rich Mom Handbook

In the back of the book, there is this series of templates, checklists, and to-do lists for implementing the ideas in the book. This is the section I spent the most time with, going through the conversation exercises with my husband, such as the family money goals questions.

There’s also a really nice nine-month plan that breaks down pretty much all of the action steps from the book chapters into manageable monthly tasks.

Good for Smart Dads, Too?

I thought that this was such a rich, tactical book that perhaps it might not just be for smart moms, but that dads might get a lot out of it, too. So as soon as I finished the book, I handed it off to my husband to give a read-through, as well.

This didn’t start out so well. My husband was even more put off by Chapter 1 than I was, finding some of the women-targeted analogies insulting (“Credit cards are like high school boyfriends” – page 23). I agreed that I found Chapter 1 to be the weakest chapter of the book, amounting to a roundup of good advice from frugality blogs, but I didn’t remember the rest of the book being written that way. At my urging, he continued on and quite liked most of the rest of the book. “Those analogies really tapered off after Chapter 1, and I enjoyed the book a lot after that. But, you have to get past that first chapter!” he says.

Yet another reason why I’d love to just take Chapter 1 and move it to the “Handbook” section at the end. It just doesn’t fit with the style or the “meatiness” of the following chapters, and that could put off some readers (you wouldn’t naturally realize that Chapter 1 is not representative of Chapters 2-10!).

Recommendations by Life Stage

Normally I sort out my recommendations for a book based on age (good for college students? 20-somethings? etc.), but for this book, it makes more sense to sort them based on your “mom” stage:

No kids yet but planning on having them, or currently pregnant: This book has a lot for you, including passages about planning for kids that only apply to you! Some of the later chapters about money conversations with your kids, planning for grandkids, what to do in retirement, and your kids returning to the nest – obviously those things won’t apply. Yet. But it would make for a good book to read now and keep on the shelf to reference back to, throughout your “mom lifetime.” Highly recommended.

No kids yet, not sure about having them: This book might be helpful to you, in that it goes over a lot of the challenges and planning you would face if you decide to have kids. However, there’s not a whole lot you can act on here if you aren’t sure that kids are actually in your future. Skip this book for now.

Mom with young kids: This book is meant for you! Especially if you are thinking of adding more kiddos to your brood, in which case, pretty much the entire book is relevant to your situation, now and later. (Which makes sense, as Palmer herself was in a position of having two young children at the time she wrote this.) Highly recommended.

Mom of teenagers: The second half of the book or so is meant for you, so there’s a lot here to work with. Obviously there are several chapters you might as well just skip over, since you’re past those stages. (Or just give ’em a good skimming.) Recommended.

Empty-nesters and grandmothers: Not sure how many of you are looking for book recommendations on a blog for millennials, but hi there! This book only has a tiny amount for you. But it might be a good thing to read and then pass along to your adult daughters. Not really recommended.

Dudes and Dads: My husband liked the book well enough, after he got past Chapter 1 (see above). Like me, his favorite part of it was all of the talking points for discussion between the two of us. But honestly, that happened without both of us reading the book. For better or for worse, this book is for ladies and doesn’t really reach across the gender aisle. Not that it claims to, of course.

Smart Mom, Rich Mom by Kimberly Palmer is available from:

Bookshop (support indie bookshops!): Paperback, E-Book, and Audiobook

Amazon: [Paperback] [Kindle] [Audible] [Audio CD]

or check your local library!