We’re into the real heat of summer now! I’ve pretty much sequestered myself entirely inside the air-conditioned apartment until that big burning orb in the sky goes away. Except, I did spend a week hanging out at -gasp!- the beach, which is basically a first for me. I don’t think I’d ever been to the beach more than 2 days in a row before in my entire life.

How did taking a week off to frolic in the ocean waves affect my money? Let’s have a look at this month’s numbers!

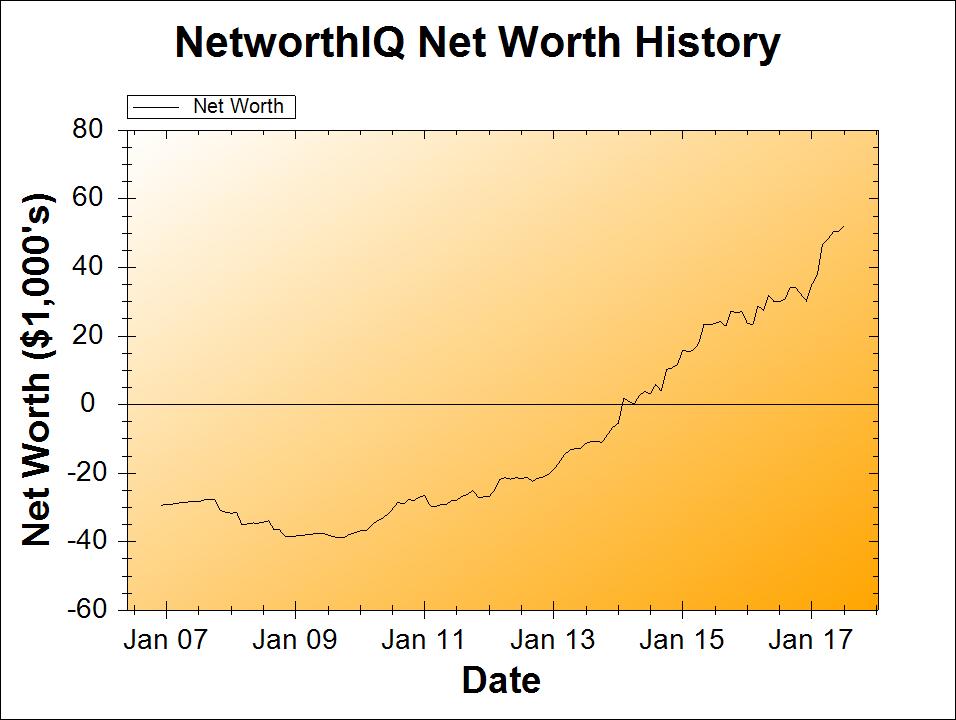

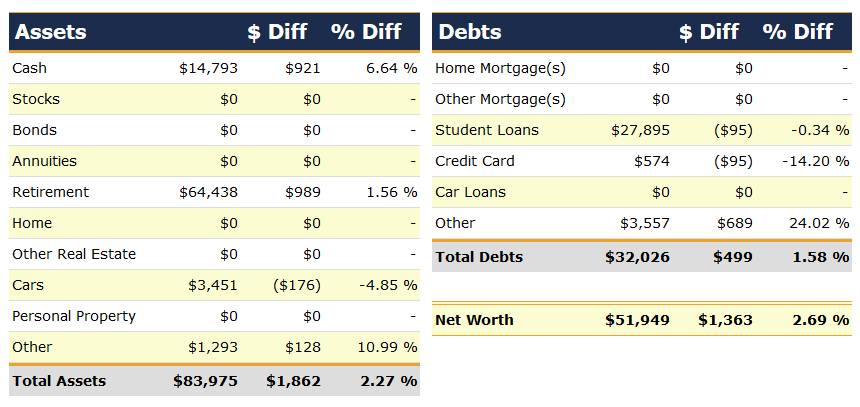

Change: +$1,363 or +2.69%

July Net Worth TOTAL: $51,949

Okay, so, first? I want to talk about that Retirement number. Went up by $989 – nice, right? But wait… I didn’t contribute to retirement this month! Not a red cent. We’re in a lull right now for my retirement contributions, focusing on my funding my husband’s accounts instead. So that nearly-$1000 was all gains, baby!

Except… I can’t actually get excited about that. Well, not too excited anyway. I’m in my “wealth accumulation” years, which is a fancy way of saying “I’m buying right now, not selling.” And when you’re buying something, you want the price to go down, not up! So those on paper gains may be exciting to look at, but I’m actually hoping that number will go down some, so I can buy “on sale.” Just a thought.

Vacation Spending

Cash is up this month, despite the fact that we took a week of vacation (unpaid time off). We kept our spending for the trip pretty light – the shared cost of a beach house with my parents, siblings, and their broods; we bought a round of groceries and beer for the whole group; we stopped at a McDonald’s for lunch on the way back and used a gift card (which we got from our coworkers last year as a “Congrats on the baby!” gift), and that was it for vacation expenses (well, plus a few sundries such as sunscreen, inflatable pool for the baby, adorable baby sun hat, etc.).

The real cost of the trip is in lost wages, since my husband and I both lack any paid time off benefits. That cost won’t be reflected anywhere until next month, since it affected the last paycheck of the month and we haven’t had that come through yet. But we had enough saved up in our “Time Off” savings account (our self-funded “paid time off” savings) and our “Travel” savings account to cover the lost hours. Also, I worked through the trip, which ended up being more than a little interesting when the internet at the beach house was out due to a fried modem from a lightning storm. O_O

But I survived the multi-day lack of internet and still managed to get my work done. Working on vacation isn’t exactly ideal, but if you’ve got to work, you can’t really beat doing so while sitting in a porch swing, enjoying cool ocean breezes!

The baby thought sand was awesome and waves were scary, in case you were wondering. Also, we stuffed ourselves on donuts.

Vacation was the “big news” this month, but again, we won’t see the full effects of it until next month.

Milestone Progress

$51,949 out of $61,099 by January 2018, $1,525 per month to go! That seems very doable, considering the $1,363 gain during what was a “down” month (no retirement contributions and travel spending). Of course, that just makes me want to run to the finish line on this – quick, where can I get a spare $9,000 right now?

If you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on the Rockstar Finance directory!