Prepare yourself for a lot of exclamation points, bold text, italics, and maybe even some ALL CAPS… because this is the most exciting Net Worth update in Poorer Than You history, and I’m super stoked about it. So forget about this intro… LET’S GET TO IT!!!

Change: +$7,456 or +136.33%

February Net Worth: $1,987

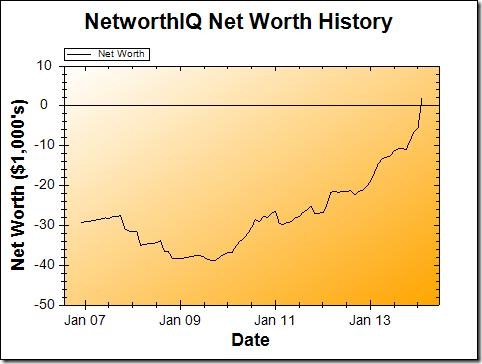

YOU GUYS. LOOK AT IT! There’s a new line! A line that indicates the difference between negative and positive! AND MY NET WORTH LINE CROSSED THAT LINE! What, what, WHAT is this, I don’t even?!?

Stephanie, WHERE DID ALL THIS MONEY COME FROM?!?

The obvious one: the cash increase of over $8,000. Unfortunately I can’t actually provide much insight into this, as all I really feel comfortable saying is that some checks that were owed to me came in. And I cashed them. This filled up my Emergency Fund, most of my Wedding Fund, and even my regular savings goals for the time I’m expecting to be unemployed/underemployed.

I won $500 in Capital One 360’s “What are you #SAVING4” contest, just by tweeting a picture of my fiancé and myself, telling them I was saving up for our wedding. Haven’t I said that Capital One 360 is my favorite bank? LOVE IT. And that $500 will certainly be helpful for our wedding, so I’m quite a happy camper.

My car increased in value again. This is just one of those fluke things — some times of year, a 2004 Toyota Camry is just worth more than other times. I get the value from Kelley Blue Book every month, not from any “depreciation” method or anything like that — so it’s helpful to think of my car’s value like stock values: it goes up and down with the market.

Speaking of the stock market: I had a pretty good month there, in my retirement accounts anyway. Also bolstering that value is some cash that I put aside in a savings account. Remember when I used to put all my retirement savings in a savings account? (Yeah, that’s a link to a Net Worth Update from 2008. Old school.)

For the time being, that practice is back. With the whole “unemployment/underemployment” thing I’ve got going on right now, it seems too risky to put money directly into my Roth IRA, where it’ll be locked up. Putting it in a savings account “holding pattern” means I can get at it if I completely drain my emergency fund, or I can move it to my Roth once I get a job.

So you might be wondering why I keep writing it as “unemployed/underemployed.” The truth is, I’m actually not completely unemployed at the moment — just “underemployed” (working less than full time). I picked up a freelance project just last week (one that I’m super excited about, by the by), and I’m hunting some leads on more freelance work. All while interviewing and job hunting for full-time work. Not really a surprise, as I’m just not a person that can sit still without a project to work on for more than, uh, 2 seconds.

So about that “Positive Net Worth by September 2014” goal…

Yeah, so, back in October of 2012, I set a goal for myself to have a positive net worth by September 16th, 2014. I guess this update means that I, technically, have achieved that goal. Woohoo! Dance party!

But, you know, it probably only really counts if I can keep it positive through September. Or, if it does dip back down in the negatives (I am underemployed, after all), get it back up into the positive numbers again by that day in September. But whatever — this is a really good milestone on my financial journey, and I intend to continue my dance party.

Feel free to dance with me in the comments!

Also, if you’d like to see how I stack up against other personal finance bloggers, be sure to check out The Ultimate List of Blogger Net Worths over on Rockstar Finance!